Welcome to the final step in mastering algorithmic futures trading with the comprehensive AlgoBox system. Developed by Vinny Emini, a seasoned futures trader and NinjaTrader expert, this guide distills essential tips and techniques to elevate your trading game. Whether you’re just completing the seven-day bootcamp or diving straight into advanced strategies, this article will walk you through the crucial concepts, from stop loss placement to advanced entry tactics like the Doctor Seuss entry and the two try rule. Ready to combine human intuition with algorithmic precision? Let’s get started.

Table of Contents

- Step 1: Understanding Stop Loss Placement – The Four Key Types

- Step 2: Mastering the Two Try Rule – Re-Entry with Confidence

- Step 3: Trading Against Retail – Understanding Supply and Demand Colors

- Step 4: Applying “Recency is Key” in Your Trading Decisions

- Step 5: Understanding the Gold Line Reversal (GLR) and Holding to Opposing Signals

- Step 6: Managing Small Accounts and Growing Your Trading Capital

- Step 7: Differentiating Between Flowmaster Crosses, DCDM, and SCR Crosses

- Step 8: The Ten X Rule – Practice Trading at Your Desired Size

- Step 9: Use Checklists and the “No List” to Improve Trading Discipline

- Step 10: Master the Doctor Seuss Entry Technique for Better Trade Entries

- Step 11: Manage Windfall Wins and Avoid the “Day After” Trap

- Step 12: Optimize Your Trading Setup – Tools, PC Performance, and Recording

- Step 13: Commission Management and Licensing

- Step 14: Staying Connected and Engaged with the AlgoBox Community

- Step 15: Final Reminders and Encouragement

Step 1: Understanding Stop Loss Placement – The Four Key Types

Stop losses are a critical element in managing your risk and protecting your capital. AlgoBox provides four primary types of stop loss markers to help you place stops strategically: the Box, the Dot, the Cross, and occasionally, the Triangle. Each corresponds to specific chart patterns or indicators, and knowing how to use them effectively can make a significant difference in your trading results.

The Box Stop

Boxes represent Potential Reversal Zones (PRZs) in harmonic patterns. These are auto-drawn rectangular areas on your charts, marking zones where price reversals are likely.

For bullish setups, place your stop loss just below the box; for bearish setups, just above. For example, if you identify a red Gartley pattern signaling a short opportunity, your stop would be set just above the red PRZ box. This way, if price moves beyond this zone, your position is automatically protected.

The Dot Stop

Dots can take multiple forms, such as Fib Dots or Flowmaster Enigmas, represented visually as circles on the chart. These dots signal potential reversal points with varying degrees of strength.

For instance, when trading off a pink dot on the chart, a short position’s stop loss is placed just behind the dot, ensuring a tight risk zone. The entry is ideally triggered on a “Doctor Seuss” bar color shift (blue to red or vice versa), which we’ll discuss shortly.

Enigmas are larger dots that often imply a wider stop due to their size. Stop losses should be placed just behind these, accounting for the variability in bar sizes and timeframes.

The Cross Stop

Crosses come in two main types: white crosses and colored crosses (red or green). When crosses cluster together, the stop placement depends on the closest confluence point, usually the nearest dot or cross, to minimise risk.

For example, in a DCR (Double Cross Reversal) event, if you’re entering a short trade, place your stop just above the first cross. If price retraces and triggers that stop, the “two try rule” allows for a re-entry with adjusted size.

The Triangle Stop

Triangles are rare and typically appear only on MACV charts as divergence indicators. If your strategy incorporates triangles, place your stop just behind the triangle marker as part of your risk management.

In all cases, the goal is to place stops behind logical market structure points to avoid premature stop-outs while limiting losses.

Step 2: Mastering the Two Try Rule – Re-Entry with Confidence

One of the most powerful concepts in AlgoBox trading is the two try rule. This is less a strict rule and more a standard operating procedure that allows you to re-enter a trade that has hit your stop loss, but with a larger position size.

Here’s how it works:

- You enter a trade (trade one) and it hits your stop loss.

- Instead of giving up, you take a second attempt (trade two) at the same setup but increase your contract size by at least one contract (plus one).

- This re-entry should be based on additional confluence factors like Flowmaster AudioBox alerts, delta flushes, cluster reversals, etc.

- Trade the second attempt with logic and discipline, avoiding emotional decisions.

For example, during a recent live stream on April 29, 2025, Vinny demonstrated this rule effectively by re-entering a shark harmonic trade after the first stop out, resulting in a $700 profit on the retry.

Remember, the two try rule is strategy-specific. A double cross double move (DCDM) will have a different re-entry approach than a dot-based strategy. Study your chosen strategies carefully and practice applying this rule in simulated environments.

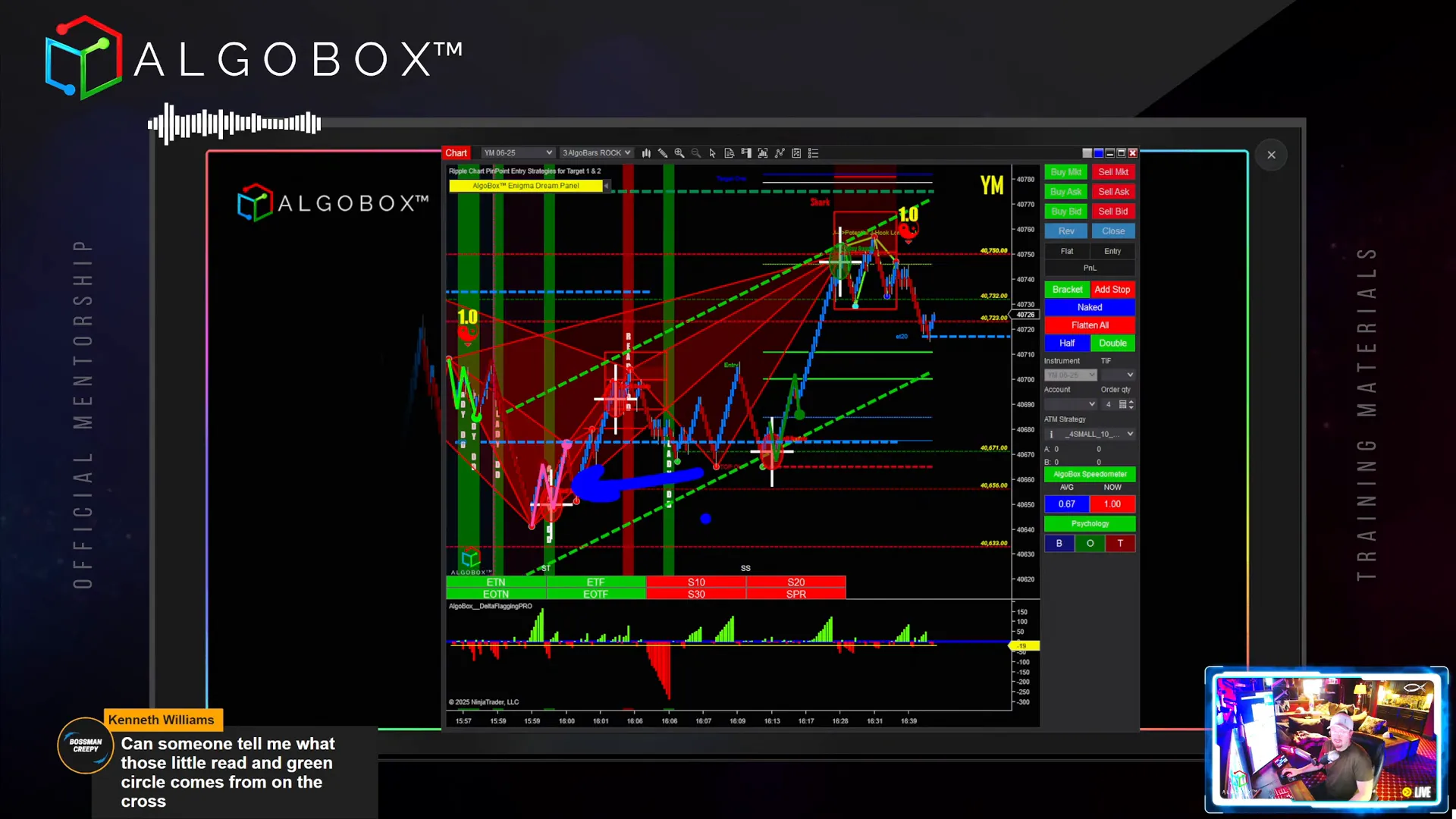

Step 3: Trading Against Retail – Understanding Supply and Demand Colors

AlgoBox’s Flowmaster crosses come with an option to show “buy supply” and “sell supply” colors and texts (red and green circles). These colors represent the best guess of retail trader positions, which is crucial because roughly 90% of retail traders lose money within 90 days.

Therefore, the smart approach is often to trade against retail sentiment. For instance, when the crosses show green (retail buying), consider shorting; when red (retail selling), consider going long. This contrarian approach can improve your edge.

Vinny usually turns off these colors during live streams to avoid confusion for newcomers, but advanced traders can enable them for additional insights, especially when trading the AB two’s strategy.

Keep in mind that these signals are not perfect. They are an artistic interpretation of time and sales data, and should be used alongside other confluences.

Step 4: Applying “Recency is Key” in Your Trading Decisions

One of the most repeated mantras in AlgoBox trading is “Recency is Key.” When conflicting signals appear, prioritize the most recent one to guide your trading decision.

For example, if a green Fibeli dot appears followed by a red Fibeli dot, the price will generally react according to the red (most recent) signal. This principle applies across all AlgoBox signals, including Flowmaster Alpha Omega, Enigmas, and harmonic patterns.

By focusing on the latest signals, you avoid confusion and reduce the risk of being caught in whipsaws or conflicting market information. Combine this with confirmation tools like the nerd and arrow indicators for added bias confirmation.

Step 5: Understanding the Gold Line Reversal (GLR) and Holding to Opposing Signals

The Gold Line Reversal (GLR) is a key concept when trading double move projections, especially in double cross double move (DCDM) strategies. It is a projected reversal level drawn with the F8 tool or auto-drawn on DCDM setups.

GLRs are generally used to identify quick reversal points, often targeting a minimum 10-tick profit. Learning to recognize and trade the GLR can significantly improve your entries and exits.

Another important concept is holding to the opposing signal. If you entered long on a green enigma, for example, you hold your position until an opposing red signal (dot, cross, cipher, etc.) appears. This approach helps you maximize your gains by riding the trend until a clear reversal signal emerges.

Remember, the opposing signal does not have to be the same type as your entry signal, just the opposite color and direction.

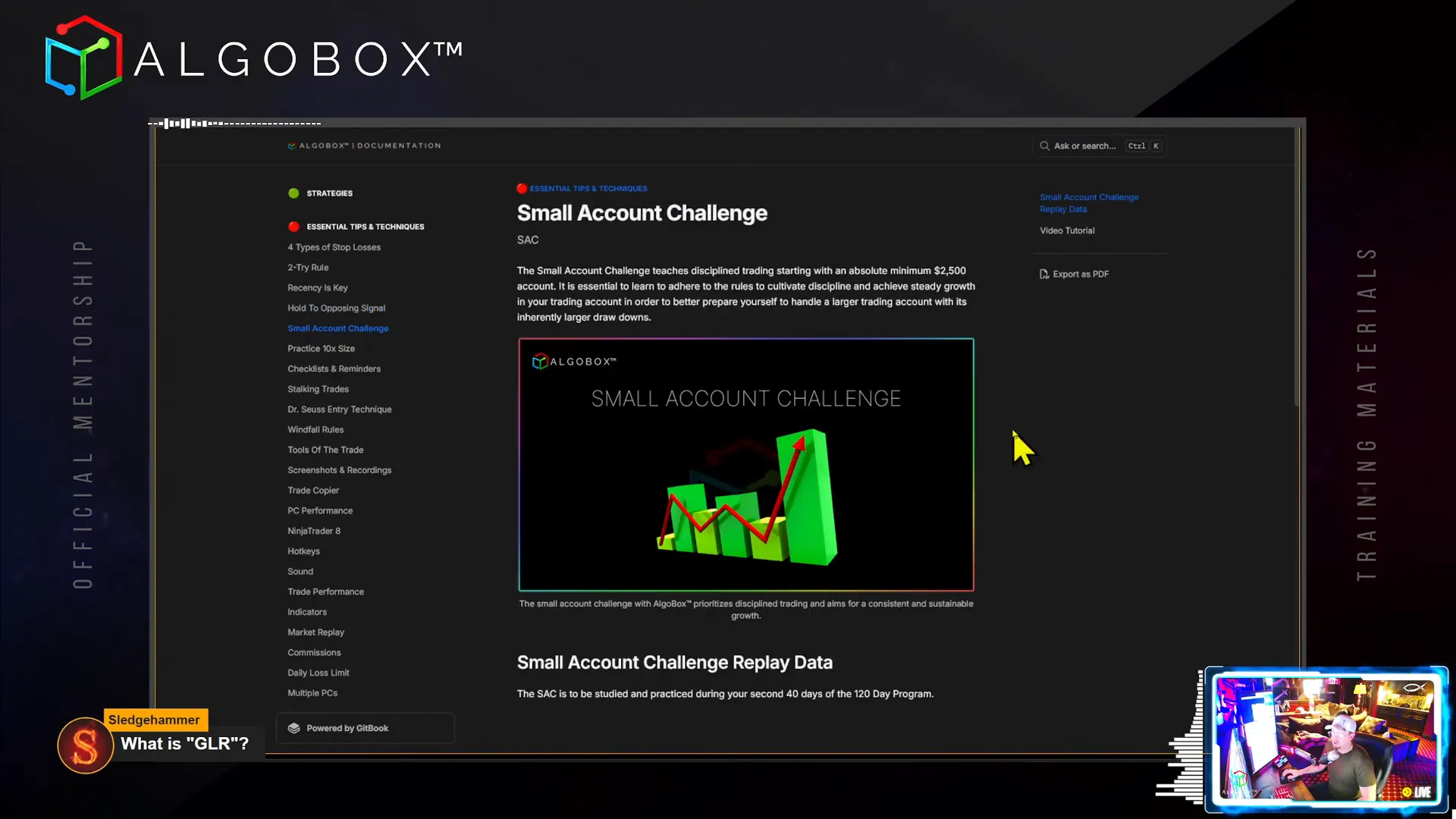

Step 6: Managing Small Accounts and Growing Your Trading Capital

Trading with a small account presents unique challenges, especially when margin requirements limit your position sizing. Vinny’s famous Small Account Challenge started with $2,500, which allowed him to trade up to five contracts on discount brokers with $500 margin per contract.

Key takeaways for small accounts:

- Margin requirements differ per instrument; e.g., Nasdaq requires $1,000 per contract, limiting contract counts.

- Start conservatively; Vinny began with two to three contracts and scaled up as the account grew.

- Psychological discipline is critical; you must protect your limited capital and avoid early large losses.

- Use confluence and strong setups like double cross double move to increase your win probability.

Vinny advises against trading the absolute smallest size just to say you can. Like buying the cheapest car, it might work but comes with many disadvantages. Instead, focus on building a solid foundation and growing your account responsibly.

The Small Account Challenge video series is a great resource for those wanting to see real-time examples of how to manage and grow a small trading account.

Step 7: Differentiating Between Flowmaster Crosses, DCDM, and SCR Crosses

Understanding the nuances between different types of crosses is essential for precise entries and exits.

- Double Cross Double Move (DCDM): Crosses appear close together near a trap pivot, targeting a double distance move from the pivot.

- Split Cross Reversal (SCR): Crosses appear separated by a straight leg price movement. The SCR signals a reversal on the second cross, often hitting targets around 15-20 ticks.

SCRs often interact with an invisible “barrier” near the prior cross, acting like a force field that price rarely penetrates on the first attempt. This creates reliable reversal zones.

Recognizing these patterns helps you anticipate price moves and set realistic profit targets.

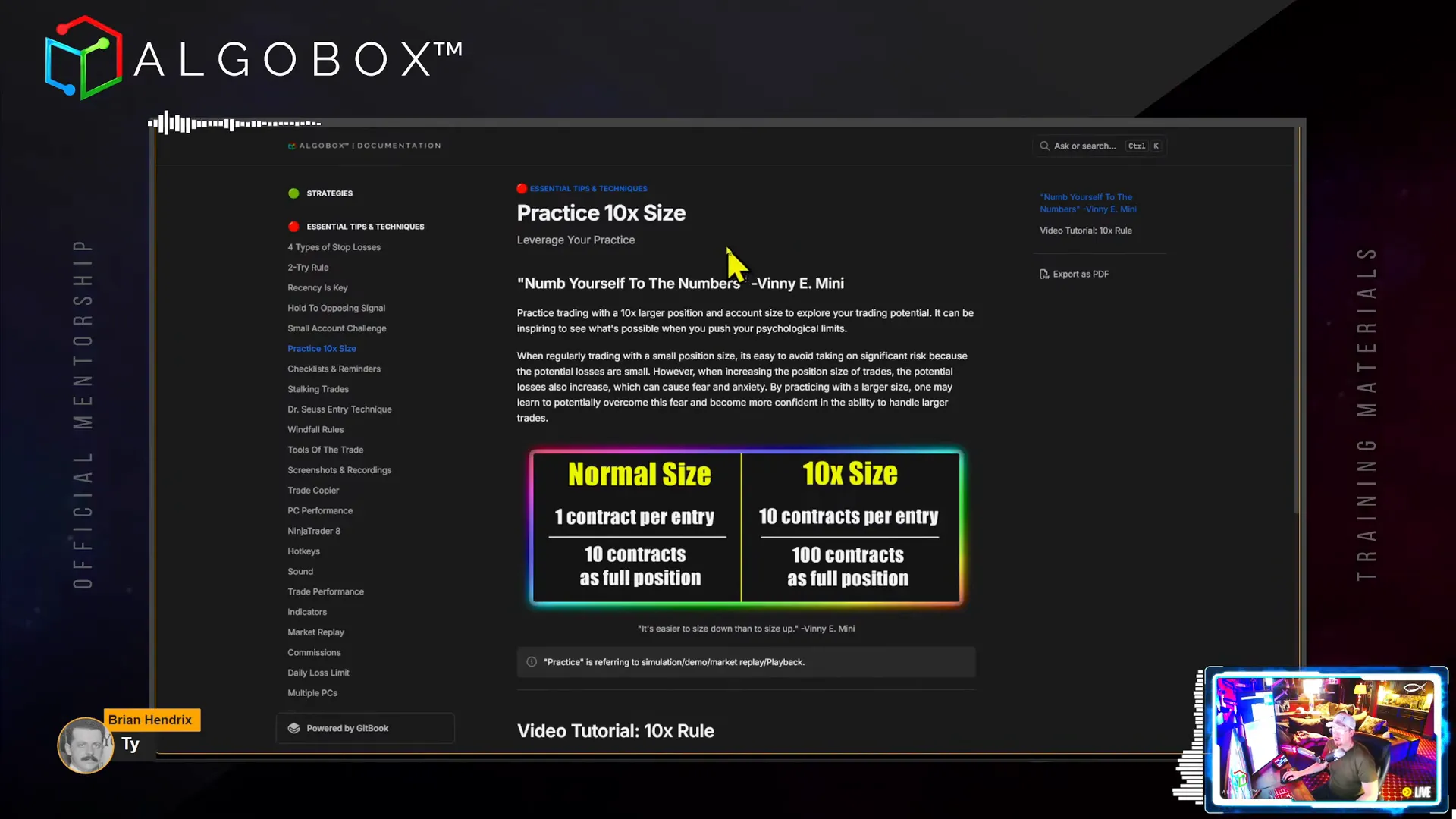

Step 8: The Ten X Rule – Practice Trading at Your Desired Size

The Ten X Rule is a psychological training technique that encourages traders to practice trading with position sizes ten times larger than their current real trading size, but in simulated environments (SIM or market replay).

This method helps you:

- Become numb to the emotional impact of large losses and gains.

- Build confidence to scale up your real trading size.

- Prepare your mindset for handling bigger swings and rapid decision-making.

Vinny stresses that practicing with pennies won’t prepare you for the realities of trading larger accounts. If you want to make $10,000 a day, start by practicing making $10,000 days. This mindset shift is crucial for growth.

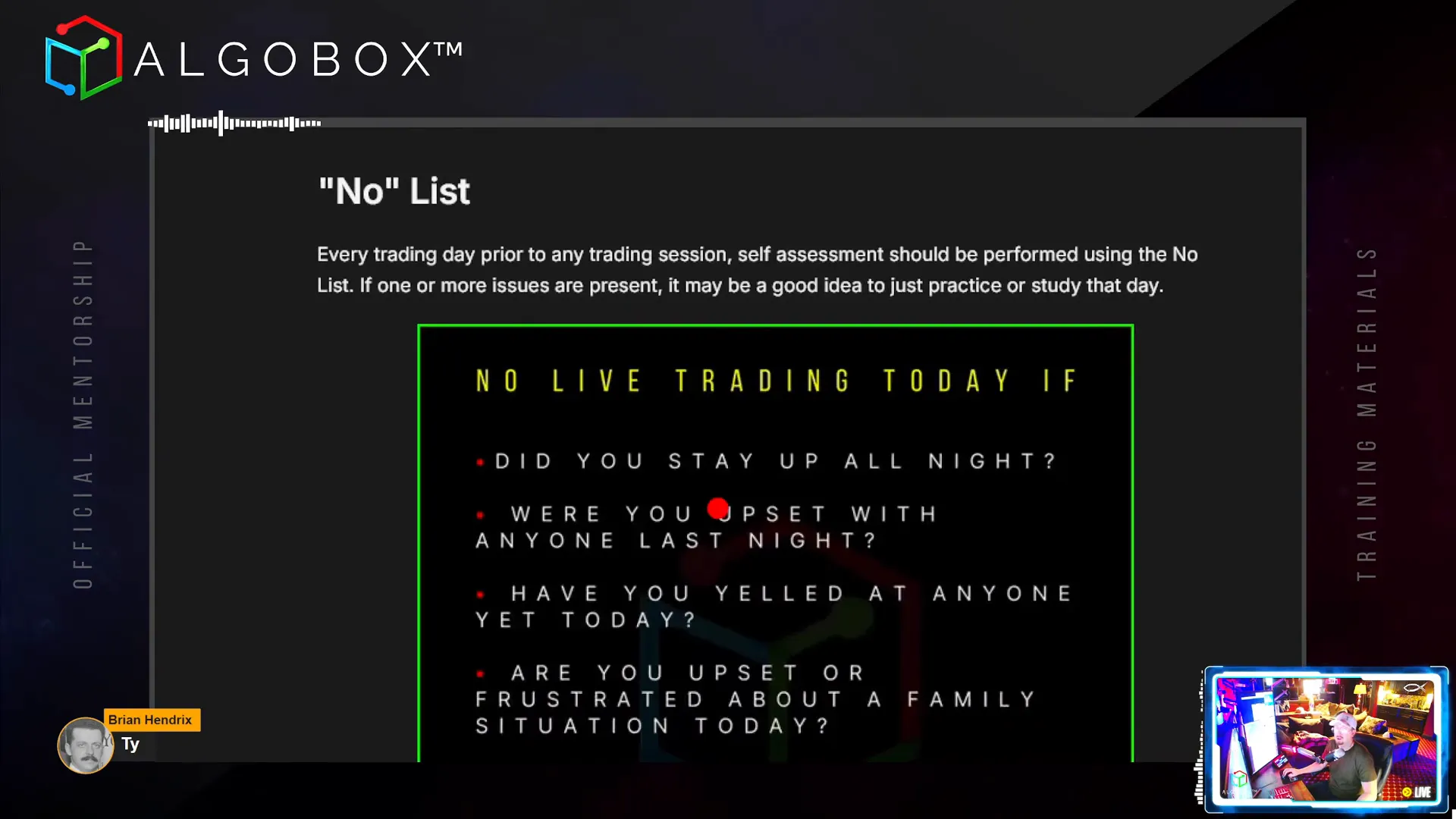

Step 9: Use Checklists and the “No List” to Improve Trading Discipline

Professional traders like pilots and doctors use checklists to maintain consistency and avoid mistakes. You should adopt the same approach in trading.

Before every trading session, perform a self-assessment using a “No List” – conditions under which you should avoid live trading, such as:

- Did you stay up late or are you tired?

- Are you upset or frustrated with someone?

- Are you dealing with family issues or personal stress?

- Are you feeling sick or unwell?

- Do you have meetings or distractions planned during trading hours?

If any of these apply, consider practicing or studying instead of live trading. Emotional and physical clarity is essential for making sound decisions.

Step 10: Master the Doctor Seuss Entry Technique for Better Trade Entries

The Doctor Seuss entry is a simple yet effective bar color confirmation technique inspired by the book One Fish, Two Fish, Red Fish, Blue Fish. It leverages the color change of bars (red and blue in Vinny’s setup) to time entries more precisely.

Here’s how it works:

- Identify your signal, such as an Enigma dot appearing.

- Wait for the first bar that changes color opposite to the recent bars (e.g., from blue to red).

- Enter the trade on this “Doctor Seuss” bar color shift for a better price and confirmation.

This method helps avoid premature entries and can improve risk-reward ratios. Sometimes you may miss the initial move, but you can still enter on a retracement using the same technique.

Additionally, you can use Doctor Seuss entries to add to winning positions, especially during strong trending moves or “Titanic zones” where multiple ready DDs align.

Step 11: Manage Windfall Wins and Avoid the “Day After” Trap

After a big winning day (a windfall), many traders experience psychological and market challenges on the following day. This phenomenon is common and can lead to losses if not managed properly.

Vinny’s advice for the day after a windfall:

- Consider not trading at all to avoid emotional overconfidence or fatigue.

- Adopt a mindset of “owing the market” – the market often wants to reclaim profits with interest.

- Trade cautiously and with fear, or focus on scalping small profits rather than big swings.

Understanding and preparing for this psychological pattern can protect your capital and preserve your gains.

Step 12: Optimize Your Trading Setup – Tools, PC Performance, and Recording

Successful trading requires a reliable technical setup. Here are some essentials:

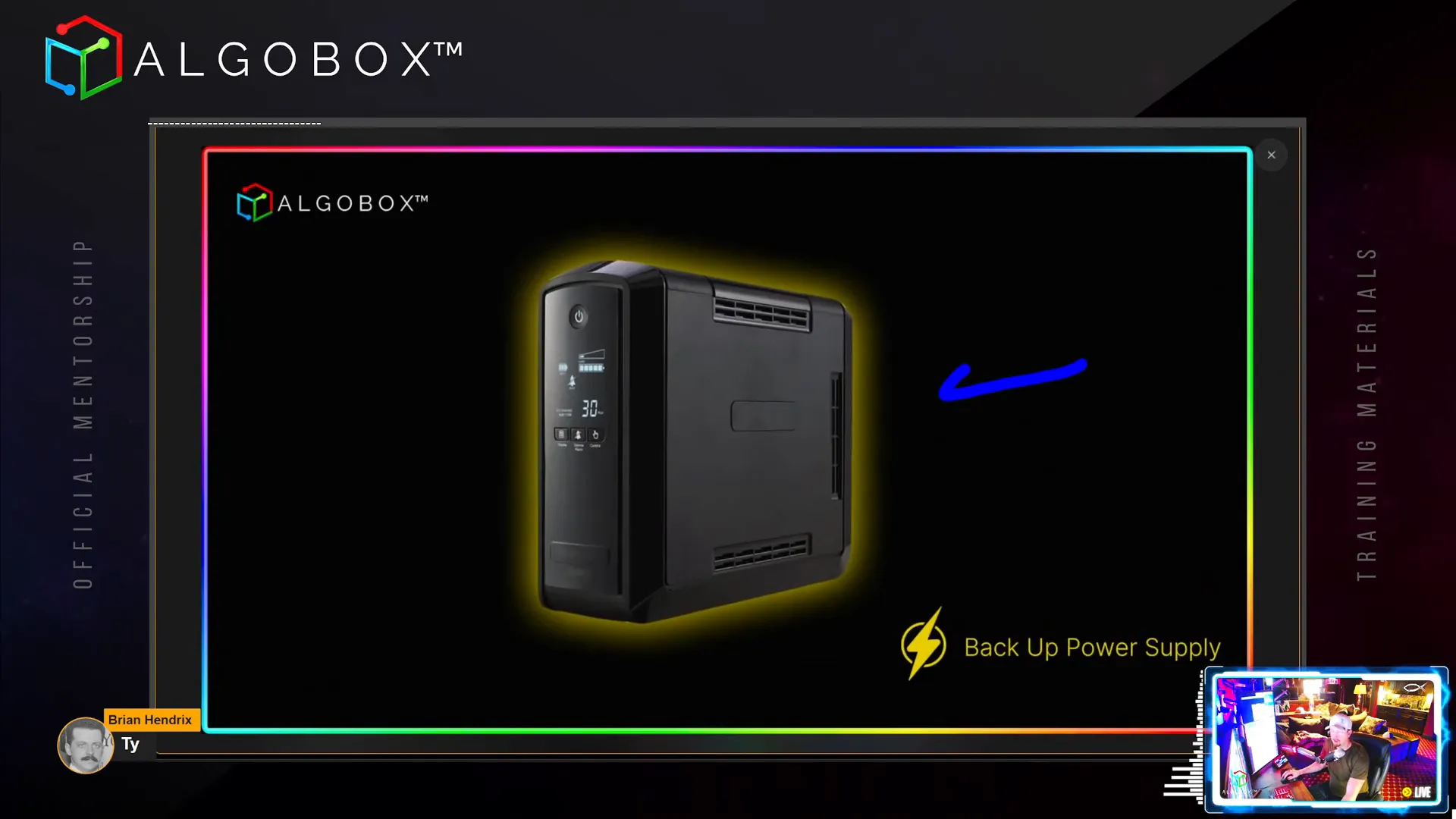

Uninterruptible Power Supply (UPS)

A UPS smooths out power fluctuations and protects your PC from outages or spikes that can disrupt trading software.

Screenshot and Recording Utilities

Use third-party tools for screenshots and screen recordings. Avoid built-in OS utilities which are often insufficient. OBS Studio is recommended for screen recording, with a buffer feature to capture recent minutes automatically.

PC Performance Optimization

- Turn off antivirus, bloatware, and OneDrive syncing during trading.

- Enable “Ultimate Performance” mode in Windows to maximize CPU power.

- Consider overclocking if you’re comfortable, as AlgoBox’s load is spiky and well suited for it.

- Use utilities like Process Lasso to assign NinjaTrader and OBS to different CPU cores.

Trade Copier for Multiple Accounts

If you trade funded accounts or multiple accounts, AlgoBox’s native trade copier is efficient and lightweight, allowing you to copy trades from a leader account to up to 20 follower accounts seamlessly.

Market Replay for Practice

Market replay in NinjaTrader allows you to practice past trading days repeatedly. Vinny recommends playing setups multiple times (five or more) to build muscle memory and confidence. Use the “right click → go to” feature to jump to specific times quickly.

Step 13: Commission Management and Licensing

Understanding NinjaTrader’s commission structure is essential for accurate trade performance analysis. The free version has higher commissions, while monthly and lifetime licenses reduce costs.

You can add your specific commission templates in NinjaTrader’s settings for precise reporting, including for market replay sessions.

For professional traders or those managing other people’s money, a different licensing agreement is required. Contact AlgoBox for details on professional licensing and secondary licenses, with discounts available for gold or lifetime members.

Step 14: Staying Connected and Engaged with the AlgoBox Community

AlgoBox’s Discord is an invaluable resource for announcements, support, sharing screenshots, and accountability. It’s recommended to install Discord on your phone for real-time connectivity.

Stay engaged with live streams, mentorship Mondays, and full auto Fridays to continue learning and growing as a trader.

Step 15: Final Reminders and Encouragement

As you complete your AlgoBox training, remember to:

- Answer the forty key questions in the quiz section to solidify your knowledge.

- Practice consistently using market replay and the two try rule.

- Implement risk management and trading discipline through checklists and the no list.

- Use confluence and never trade signals alone.

- Prepare your technical setup for optimal performance and reliability.

AlgoBox empowers individual traders with cutting-edge technology that levels the playing field against institutional investors. With dedication, discipline, and these essential tips and techniques, you can confidently navigate the futures markets and grow your trading success.

Thank you for being part of this journey. Keep practicing, stay disciplined, and trade smart!

Start your AlgoBox journey now and take control of your trading future!