Trading futures and forex markets requires precision, confidence, and reliable signals to spot high-probability setups. Among the many strategies I’ve explored and refined, the Super Alpha Omega (AO) strategy stands out for its powerful integration of order flow and momentum signals, providing clear, actionable trading cues. Developed within the AlgoBox system for NinjaTrader, this strategy combines unique components that help traders identify potential market reversals with high confluence, improving entry timing and risk management.

In this comprehensive guide, I will walk you through the Super Alpha Omega strategy step-by-step. I’ll explain the key elements—the Flowmaster™ Alpha Omega crosses and the Double Delta Ready DD signal—how to interpret them, set targets, manage risk, and practice the approach effectively. Whether you are new to AlgoBox or looking to enhance your day trading tactics, this tutorial will equip you with the insights you need to apply this strategy confidently.

Table of Contents

- Step 1: Understanding the Core Components of the Super Alpha Omega Strategy

- Step 2: Identifying a Super Alpha Omega Setup in Action

- Step 3: Setting Targets Based on Bar Types and Momentum

- Step 4: Managing Risk with Stops Behind the Alpha Omega Cross

- Step 5: Practicing the Super Alpha Omega Strategy in NinjaTrader’s Market Replay

- Step 6: Accessing Additional Resources and Training

- Frequently Asked Questions (FAQ)

- Conclusion

Step 1: Understanding the Core Components of the Super Alpha Omega Strategy

The foundation of the Super Alpha Omega strategy lies in the convergence of two distinct yet complementary signals. These components work together to highlight potential shifts in market momentum with greater accuracy than using either alone.

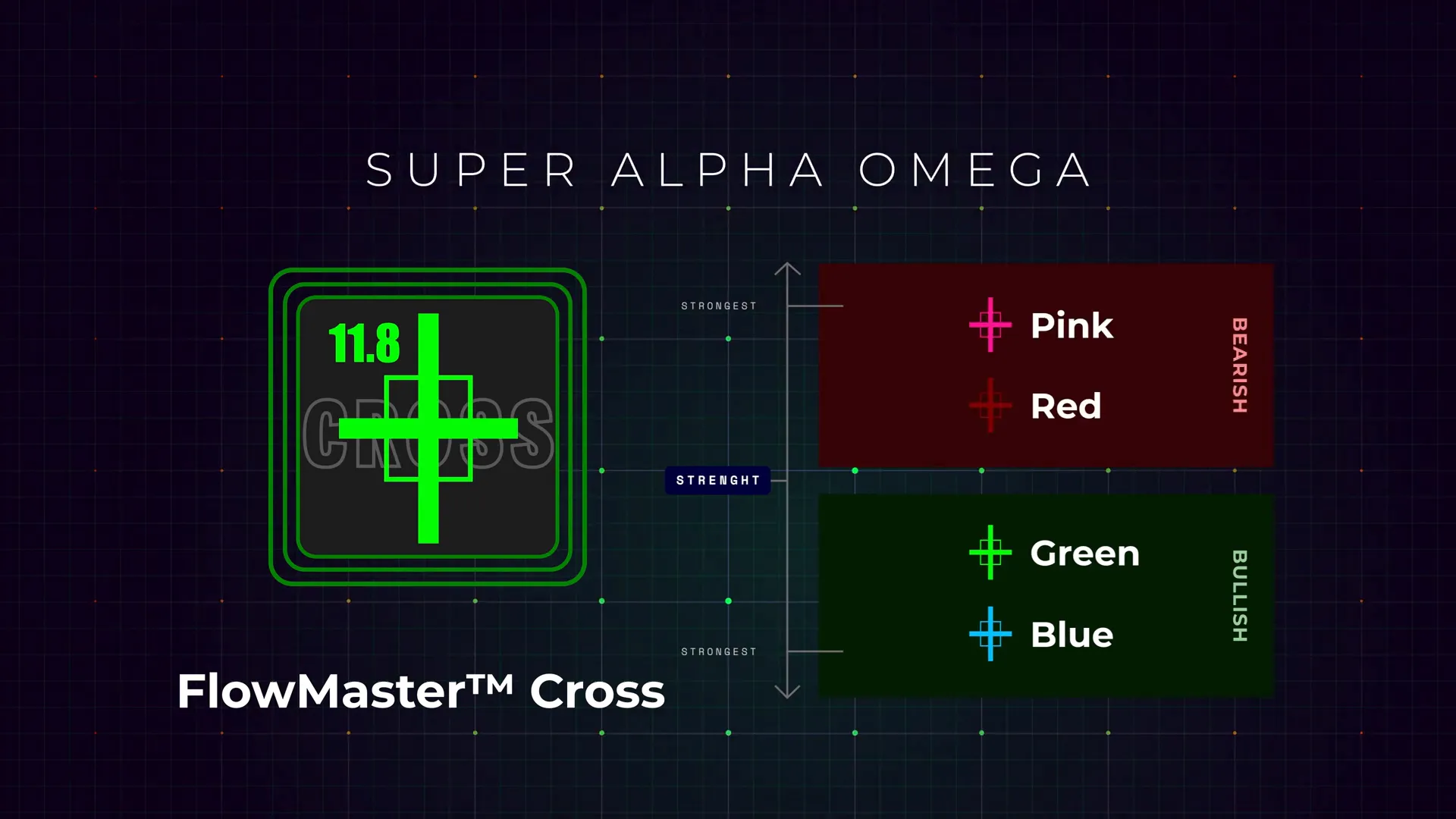

The Flowmaster™ Alpha Omega Crosses

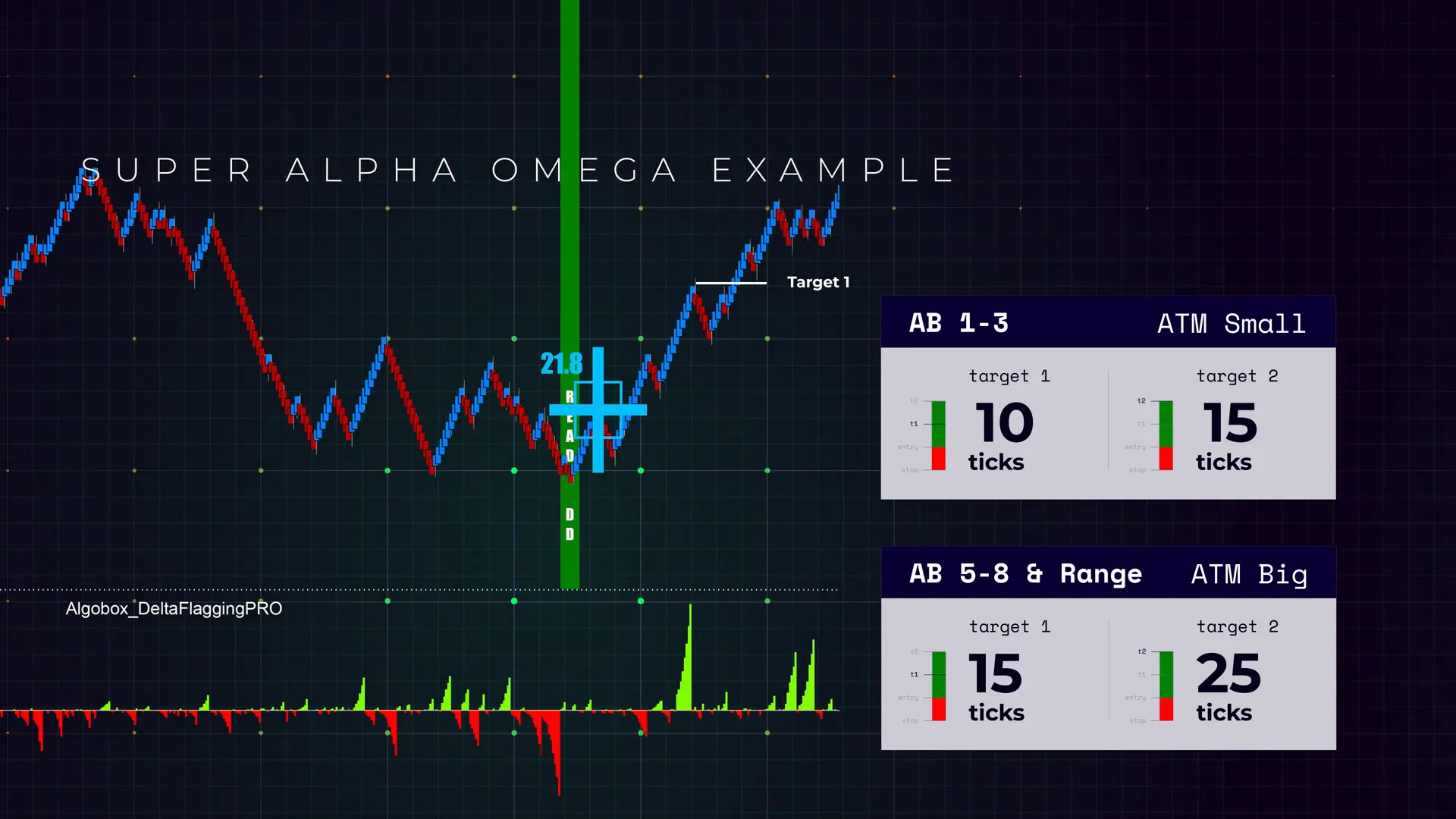

The Flowmaster™ Alpha Omega crosses are proprietary indicators within the AlgoBox system, designed to pinpoint when price reaches significant prior auction zone highs or lows combined with strong algorithmic order flow activity. They visually represent these moments as colored crosses plotted on your chart, each signaling potential reversals or continuation points.

- Bullish signals: Displayed as green or blue “Alpha” crosses.

- Bearish signals: Displayed as red or pink “Omega” crosses.

Each cross is accompanied by a “power number,” which quantifies the strength of the market’s buy or sell imbalance. A higher power number suggests a stronger potential reversal or significant market move, giving you an extra layer of confidence in your trade decisions.

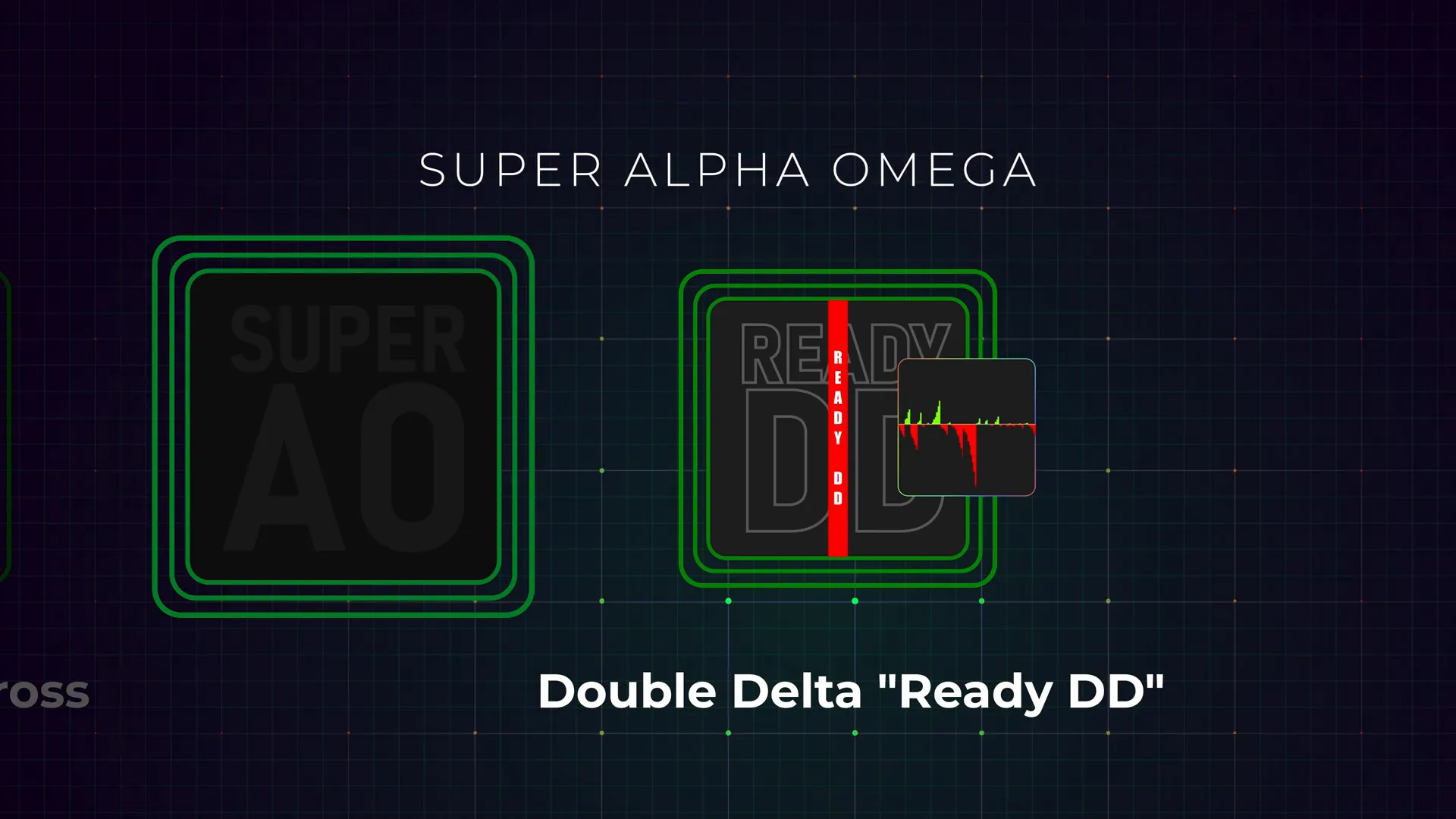

The Double Delta Ready DD Signal

The second critical component is the Double Delta Ready (DD) signal. This signal appears as a vertical text label on your chart and indicates a potential shift in market momentum. It is triggered when two delta flags align, signaling that a change in buying or selling pressure may be imminent.

In practice, the DD signal acts as an early warning system, alerting you to watch for a possible upcoming move. It’s particularly powerful when it appears in conjunction with an Alpha Omega cross, creating a high confluence setup that increases the odds of a successful trade.

Step 2: Identifying a Super Alpha Omega Setup in Action

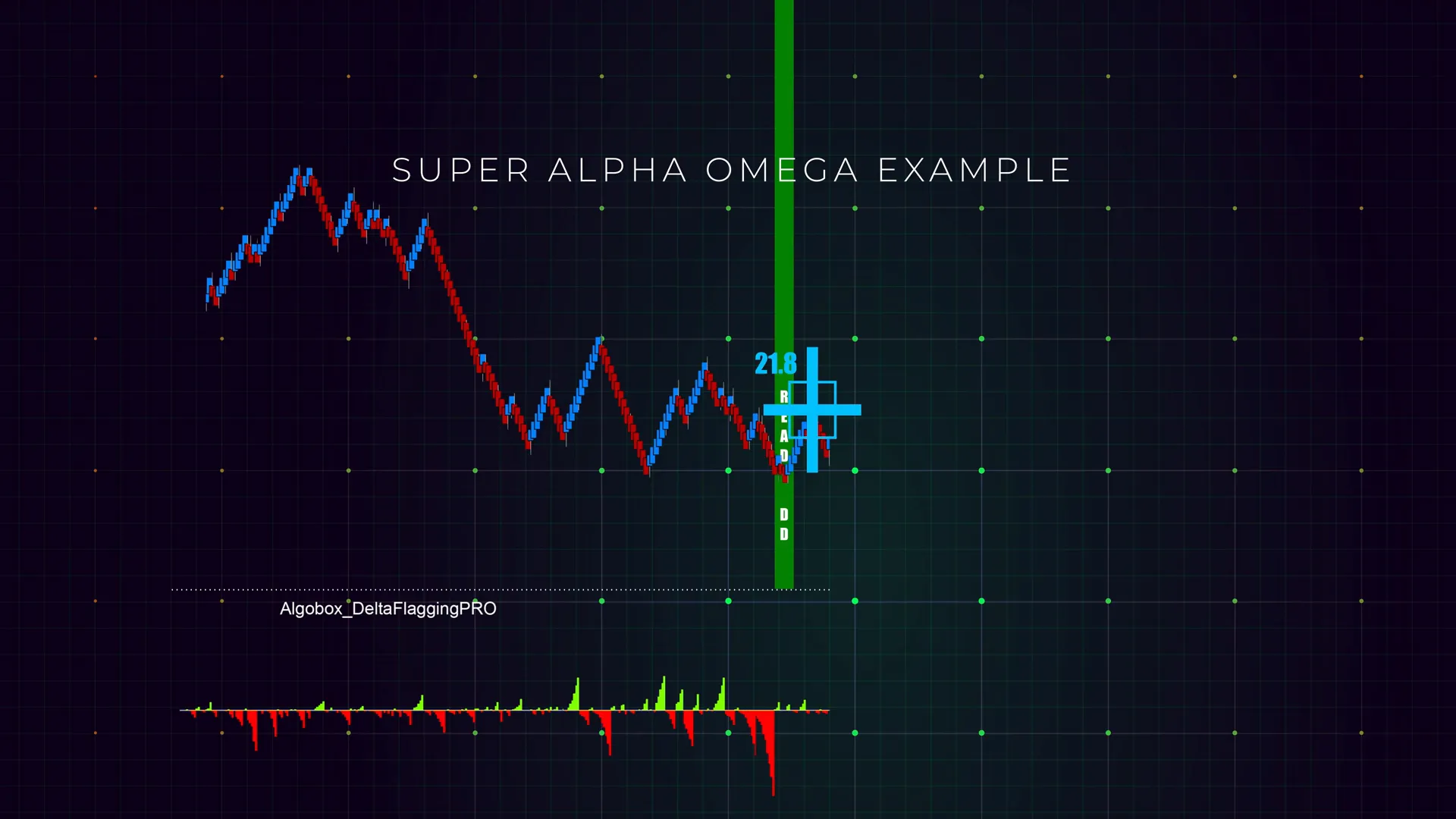

Recognizing a Super Alpha Omega setup involves looking for the alignment of the Double Delta Ready DD signal and the Flowmaster™ Alpha Omega crosses within close proximity on your chart. This convergence serves as a confirmation that a market reversal or momentum shift is likely underway.

Here’s how a typical setup unfolds:

- Appearance of the Double Delta Ready DD label: For example, a green DD label appears vertically on the chart, signaling a potential bullish momentum shift.

- Proximity of an Alpha Omega cross: Shortly after, a blue Alpha cross appears nearby, indicating strong buying activity backed by a high power number.

- Reinforcement of reversal bias: The combination of the DD label and the Alpha cross heightens the probability of a bullish reversal or move upward.

Traders can interpret this sequence as a strong cue to consider entering a long position aligned with the signals.

Step 3: Setting Targets Based on Bar Types and Momentum

Once you have identified a Super Alpha Omega setup and decided to enter a trade, the next crucial step is to define your profit targets. These targets depend on the bar types you are trading and the market’s momentum.

Targets for Algobar 1s to 3s

When using Algobar 1s to 3s, which are smaller time-scale bars, it’s common to aim for smaller ATM (Automated Trade Management) targets. These targets are typically tighter due to the faster price action and smaller bar sizes, allowing for quicker profits but requiring careful trade management.

Targets for Algobar 5s and Range Bars

For Algobar 5s and range bars, which cover a broader price range per bar, you can afford to aim for larger targets. A good rule of thumb is to set your first target around 15 ticks in scale for runners, depending on the momentum you observe.

Runners are partial position sizes you hold after hitting your first target, aiming to capture extended moves. Adjusting your targets based on the bar type and momentum helps you optimize gains while managing risk sensibly.

Step 4: Managing Risk with Stops Behind the Alpha Omega Cross

Risk management is the backbone of any successful trading strategy. With the Super Alpha Omega approach, placing your stop loss appropriately is essential to protect your capital and limit losses.

A practical and effective stop placement is just behind the Alpha Omega cross. Since this cross marks a significant level of order flow imbalance and potential market turning point, positioning your stop beyond it limits your exposure if the trade moves against you.

Setting stops here ensures that if the price breaks through this critical level, your trade thesis is invalidated, and you exit before losses escalate.

Step 5: Practicing the Super Alpha Omega Strategy in NinjaTrader’s Market Replay

Mastering any trading strategy requires deliberate practice. NinjaTrader’s Market Replay feature offers an excellent environment to hone your Super Alpha Omega skills without risking real money.

Market Replay allows you to replay historical market data in real-time, giving you the chance to:

- Identify Double Delta Ready DD signals and Alpha Omega crosses in various market conditions.

- Practice timing your entries and exits based on the strategy’s signals.

- Test different stop placements and target settings to find what works best for you.

- Build confidence and refine your approach before trading live.

Consistent practice with Market Replay accelerates your learning curve and increases your chances of success when you transition to live trading.

Step 6: Accessing Additional Resources and Training

To fully experience the AlgoBox system and deepen your understanding of the Super Alpha Omega strategy, I recommend enrolling in the AlgoBox eight-session boot camp. This training provides comprehensive coverage of the system’s tools, indicators, and strategies, including live sessions and real-time examples.

Moreover, starting a two-week free trial of AlgoBox allows you to explore the software firsthand, test the Super Alpha Omega strategy, and integrate it into your trading workflow.

Subscribing to live sessions and ongoing strategy insights keeps you updated with the latest developments, tips, and real-time trade analysis, fostering continuous growth as a trader.

Frequently Asked Questions (FAQ)

What exactly does the Double Delta Ready (DD) signal represent?

The Double Delta Ready DD signal is a vertical text label that appears when two delta flags align, indicating a potential shift in market momentum. It serves as an early alert for traders to watch for possible upcoming moves in price direction.

How do the Alpha Omega crosses differ from other order flow indicators?

The Alpha Omega crosses are unique because they combine price reaching prior auction zone highs or lows with significant algorithmic order flow activity. They are color-coded to represent bullish or bearish bias and include a power number quantifying the strength of buying or selling imbalance, which adds a quantifiable edge to the signals.

Can I use the Super Alpha Omega strategy on instruments other than futures?

While the strategy is designed with futures trading in mind, especially within NinjaTrader, the concepts of order flow and momentum shifts are applicable across various markets. However, you should test and adapt the strategy to the specific instrument and trading environment before applying it live.

What is the best way to place stops when trading this strategy?

The recommended stop placement is just behind the Alpha Omega cross that signals your entry. This placement helps limit losses if the market moves against your trade, as breaking this level invalidates the trade setup.

How do I determine appropriate profit targets?

Your targets depend on the bar type you are using. For smaller bars (Algobar 1s to 3s), smaller ATM targets are common. For larger bars (Algobar 5s and range bars), aim for around 15 ticks for your first target, adjusting based on momentum and market conditions.

Is the Super Alpha Omega strategy suitable for beginners?

The strategy involves understanding order flow and reading complex signals, so it may not be ideal for absolute beginners. However, with dedication, practice using NinjaTrader’s Market Replay, and structured training like the AlgoBox boot camp, traders of all levels can learn to apply it effectively.

Conclusion

The Super Alpha Omega strategy within the AlgoBox system is a sophisticated yet accessible approach to trading futures with high confluence setups. By combining the Double Delta Ready DD momentum signal with the Flowmaster™ Alpha Omega crosses, traders gain a powerful toolkit for spotting potential reversals and shifts in market dynamics.

Setting appropriate targets based on your bar type, managing risk with well-placed stops, and practicing consistently in Market Replay are critical steps to mastering this strategy. With the added support of AlgoBox’s training resources and live sessions, you can build confidence and precision in your trading decisions.

If you’re serious about elevating your trading game and capturing more consistent profits, I encourage you to explore the Super Alpha Omega strategy in depth and integrate it into your trading plan. Start your journey today with a free trial of AlgoBox, and take advantage of the comprehensive boot camp to unlock the full potential of this system.

Remember, successful trading combines strategy, discipline, and continuous learning. The Super Alpha Omega strategy is a powerful step in that direction.

This article was created from the video SUPER AO (ALPHA OMEGA) 🟪 NinjaTrader Futures | AlgoBox Training with the help of AI.