Spotting large-scale institutional trading activity before it unfolds can be a game-changer for any trader. What if you had a tool that could read the tape in real time and alert you to potential market reversals driven by powerful non-retail participants? The Double Delta Shift Reversal (DDSR) strategy, developed by AlgoBox for NinjaTrader, does exactly that.

In this comprehensive guide, I will walk you through everything you need to know about the DDSR strategy, how to recognize it, the key signals to watch for, and how to integrate it into your trading routine. This method is designed to help you identify high-probability reversal points by analyzing delta shifts within accumulation zones and aligning them with structural market elements and order flow events.

Whether you are a day trader focused on futures or forex, mastering DDSR can add a powerful tool to your trading arsenal. Let’s dive in.

Table of Contents

- Step 1: Understanding Delta Shifts and Their Importance

- Step 2: Identifying the Double Delta Shift Reversal (DDSR) Setup

- Step 3: Adding Confluence with Structural Market Elements

- Step 4: Reinforcing the Setup with Order Flow Events

- Step 5: Executing the Trade – Entry, Stops, and Targets

- Step 6: Building Confidence Through Practice

- Step 7: Accelerate Your Learning with AlgoBox Resources

- Frequently Asked Questions (FAQ) About the DDSR Strategy

- Conclusion: Harnessing the Power of DDSR for Smarter Trading

Step 1: Understanding Delta Shifts and Their Importance

The foundation of the DDSR strategy lies in the concept of a delta shift. But what exactly is a delta shift, and why does it matter?

Delta, in the context of order flow trading, represents the difference between aggressive buying and selling volume at the bid and ask prices. When a new prominent delta flag emerges in the opposite direction of the previous delta flag, it signals a shift in market sentiment. This is what I call a delta shift.

For example, if the market has been showing strong positive delta (more aggressive buying), and suddenly a significant negative delta flag appears, it can mean that large players—institutions or other non-retail participants—are starting to push the market the other way.

This shift is important because it often precedes a potential reversal in market direction. Recognizing these shifts early can give you an edge in timing your trades.

Why Institutional Activity Matters

Retail traders usually follow price action and indicators without direct insight into order flow. However, institutions trade with massive volume and often influence price direction significantly. When these large players start to reverse their positioning, the delta shift flags it first through order flow changes.

By identifying these delta shifts, you are essentially gaining a glimpse into the “footprints” of the big players, allowing you to anticipate moves that retail traders might miss.

Step 2: Identifying the Double Delta Shift Reversal (DDSR) Setup

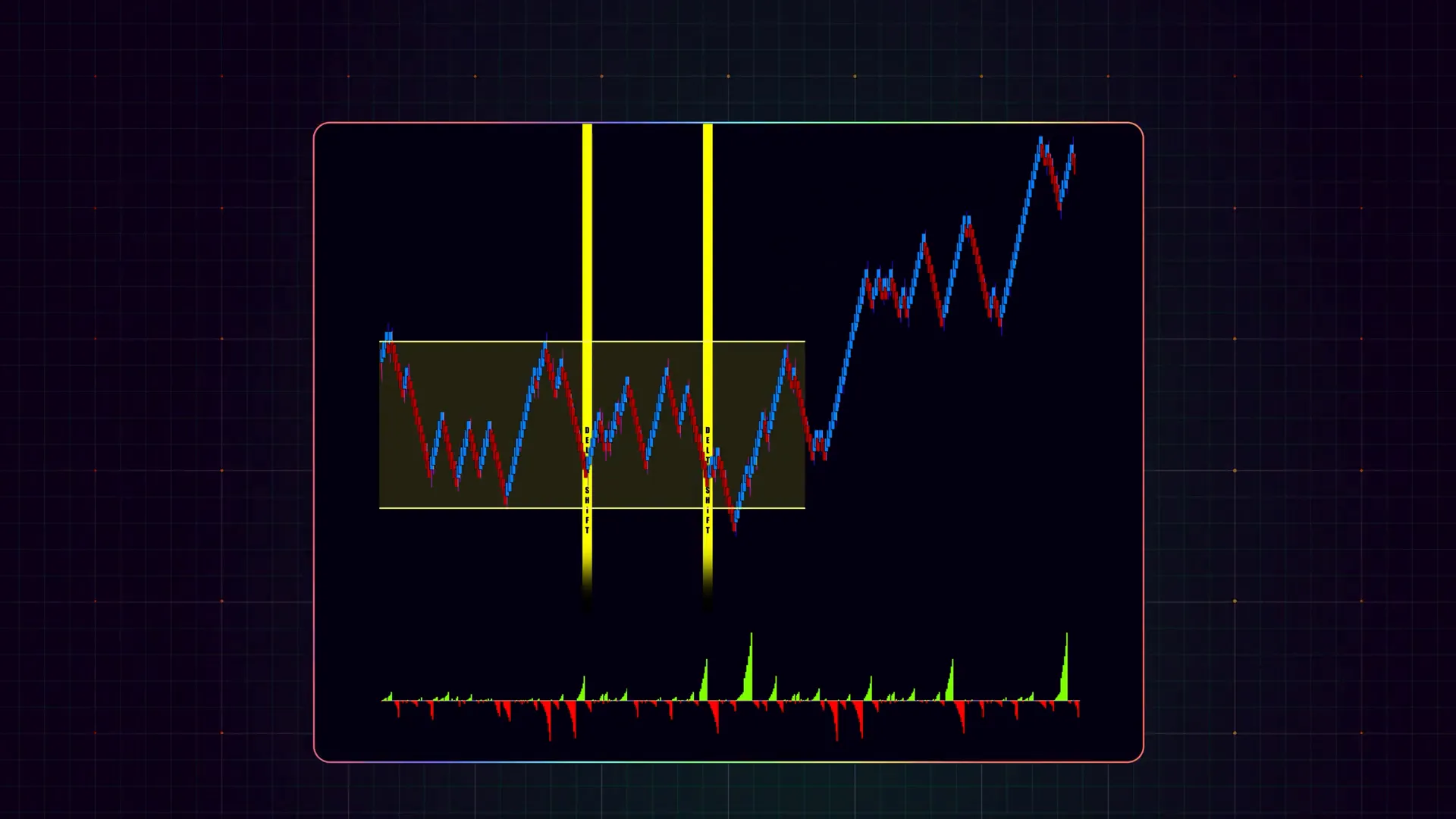

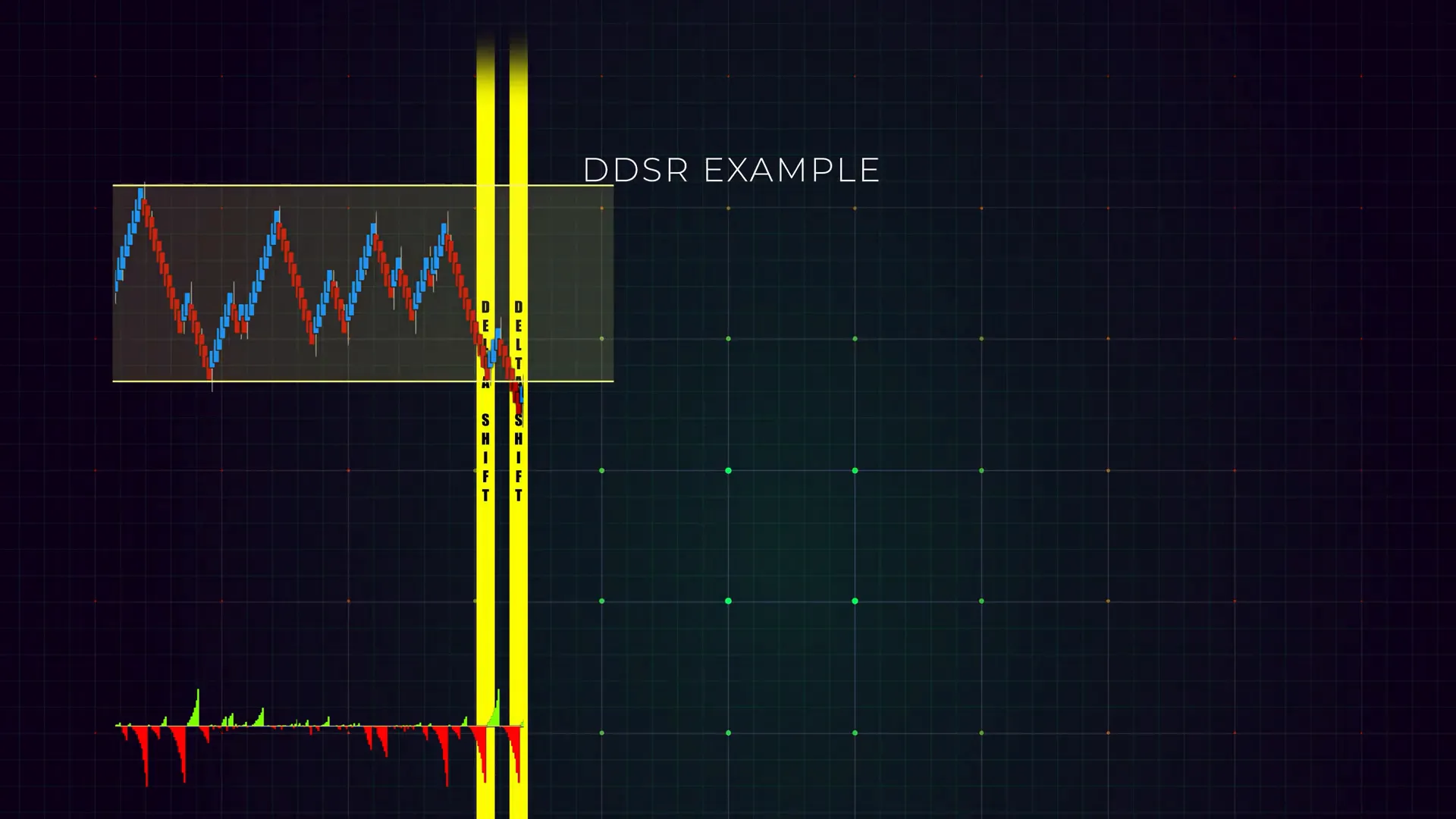

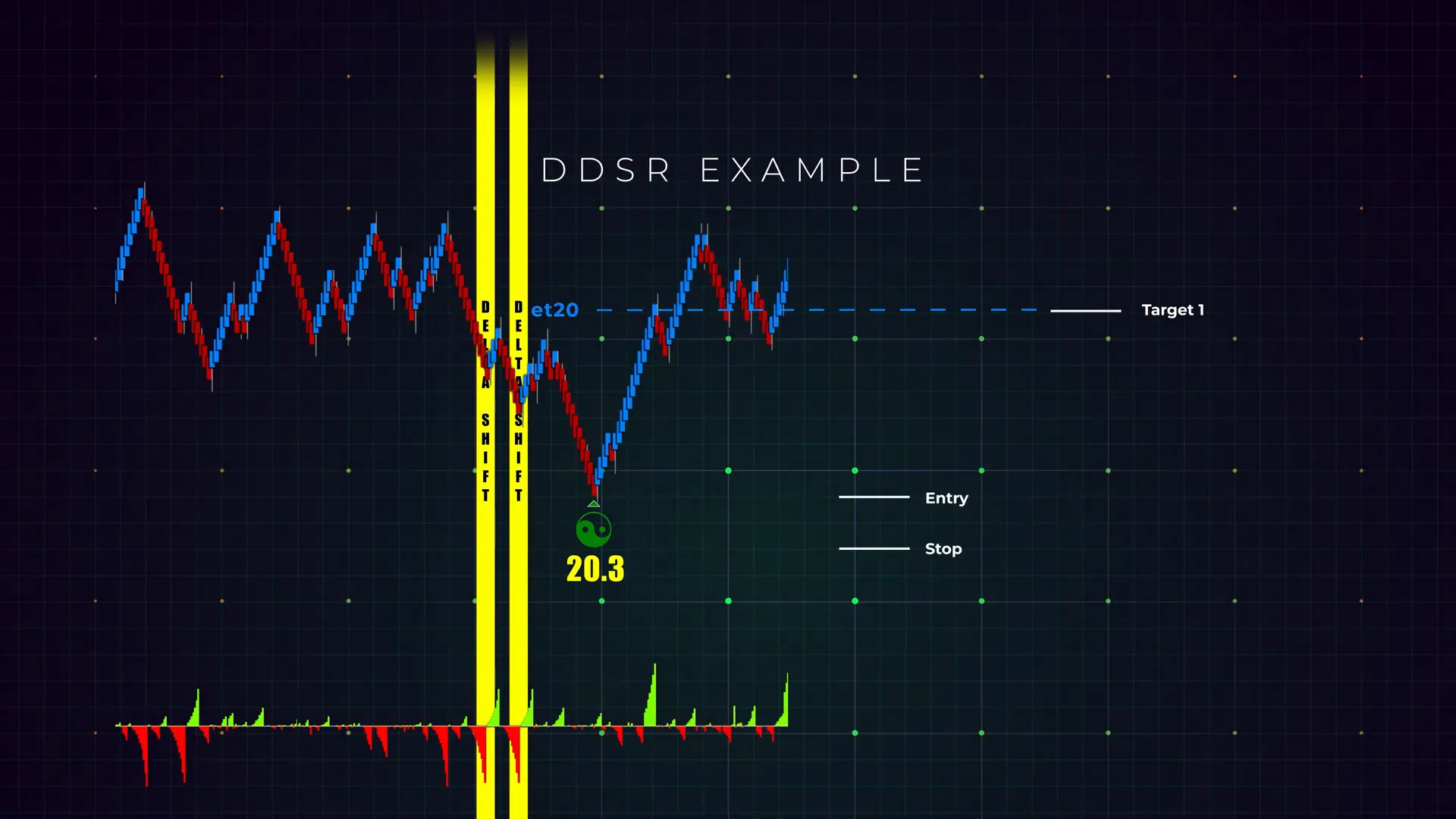

While a single delta shift can signal a potential reversal, the DDSR strategy looks for two delta shifts appearing in close succession within a specific price area called an accumulation zone. This dual occurrence strengthens the likelihood of a meaningful market turn.

An accumulation zone is a range where the market consolidates and builds up buying or selling pressure before breaking out or reversing. When two delta shifts happen here, it suggests that strong institutional order flow is building up for a reversal.

Think of the DDSR as a double confirmation: the market tries to change direction once, then tries again quickly, indicating that the big players are actively engaged and likely to influence the next move.

How Close is Close? Understanding Timing and Proximity

For the DDSR to be valid, the two delta shifts must occur within a tight time frame and price proximity. If they are too far apart, the signal loses strength. The idea is to catch a rapid change in order flow sentiment before the market breaks out.

In practice, this means monitoring your charts closely and looking for two delta shift bars or vertical bars that stand out next to each other within a consolidation range.

Step 3: Adding Confluence with Structural Market Elements

Confirming the DDSR setup with additional technical elements increases confidence and the probability of success. The DDSR gains strength when it aligns with:

- Harmonics: Price patterns like Gartley, Bat, or Butterfly that indicate potential reversal zones.

- Trend Channel Highs or Lows: Areas where price has historically reversed or stalled.

- Fibonacci Dots: Key retracement or extension levels based on Fibonacci ratios.

When you see the DDSR setup coincide with these structural elements, it adds a powerful layer of confluence. This means multiple independent signals point to the same market behavior, making your trade setup more robust.

Why Confluence Matters in Trading

Trading is about managing probabilities, not certainties. The more signals or confirmations you have pointing to the same outcome, the higher your chances of success. By combining DDSR with structural analysis, you avoid relying solely on order flow and instead build a multi-dimensional view of the market.

Step 4: Reinforcing the Setup with Order Flow Events

Beyond delta shifts and structural elements, AlgoBox provides specialized order flow signals that further reinforce the DDSR setup. Two key events to watch for are:

- Enigma Cross: A signal that captures complex order flow interactions indicating potential reversals or continuation.

- Alpha Omega Cross: Another order flow event that highlights shifts in market aggressiveness and momentum.

When one of these signals appears alongside the double delta shifts, it adds significant confluence and suggests a higher probability trade setup.

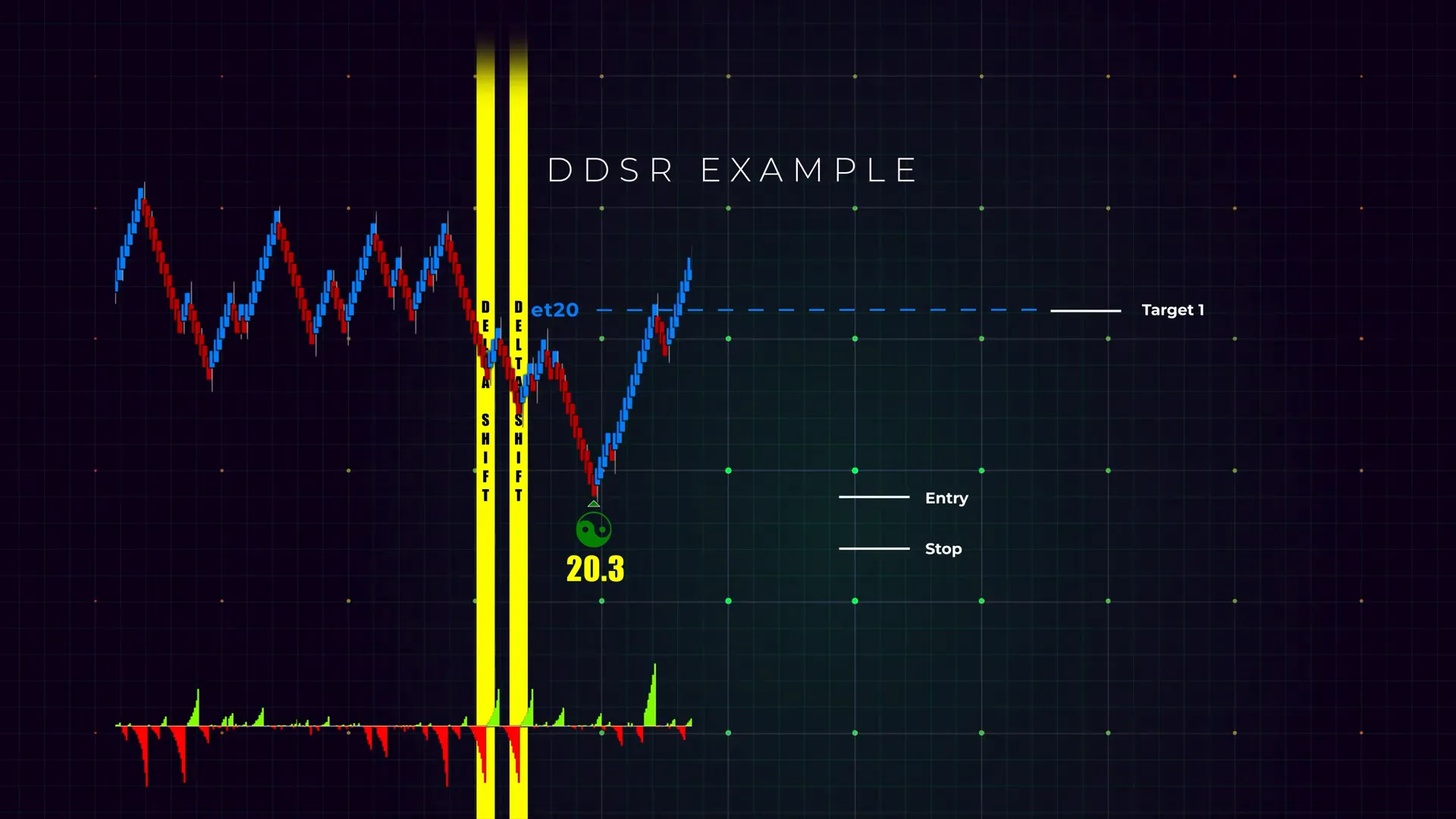

For example, imagine spotting two yellow delta shift vertical bars close together within a consolidation range, then seeing an Enigma signal emerge. This combination suggests that institutional players are actively setting up a reversal, and the market is primed to move.

Step 5: Executing the Trade – Entry, Stops, and Targets

Once the DDSR setup is identified with the necessary confluence, the next step is to execute your trade following your pre-defined strategy rules. This means:

- Entry: Enter the trade based on your preferred method, whether it’s a market order, limit order, or a specific trigger.

- Stop Loss: Place your stop loss according to your risk management rules, typically beyond key structure levels or volatility thresholds.

- Targets: Set profit targets using logical resistance/support zones, Fibonacci levels, or measured moves.

- Trade Management: Use trailing stops, partial exits, or scaling in/out strategies as needed.

Following a disciplined plan ensures that you manage risk effectively and maximize the potential of your DDSR trades.

Why Sticking to Your Rules is Critical

Even the best setups can fail. The DDSR strategy is no exception. That’s why it’s crucial to stick to your entry and exit rules. Consistency and discipline are the cornerstones of profitable trading.

Step 6: Building Confidence Through Practice

Like any trading strategy, mastering DDSR takes practice. One of the best ways to build confidence is to practice identifying and trading DDSR setups in a simulated environment.

I highly recommend using NinjaTrader’s market replay feature. This allows you to replay historical market data in real time, giving you the opportunity to:

- Spot delta shifts and DDSR setups without the pressure of live trading.

- Test different entry and exit strategies to find what works best for you.

- Understand how additional AlgoBox signals integrate with DDSR.

By practicing regularly, you’ll become quicker and more confident at recognizing valid DDSR setups and executing trades effectively.

Step 7: Accelerate Your Learning with AlgoBox Resources

To fully unlock the power of the DDSR strategy and AlgoBox tools, consider enrolling in AlgoBox’s comprehensive training programs. Here are some valuable resources:

- Free Two-Week Trial: Experience the full AlgoBox system firsthand and explore all the signals, including DDSR.

- Eight-Session Bootcamp: A structured training course designed to accelerate your learning curve and deepen your understanding of order flow trading.

- Live Streams: Tune in for live market analysis, strategy breakdowns, and Q&A sessions to see DDSR and other signals in action.

These resources are designed to help traders at all levels integrate DDSR into their trading workflow and improve their edge in the markets.

Frequently Asked Questions (FAQ) About the DDSR Strategy

What is the Double Delta Shift Reversal (DDSR) strategy?

The DDSR strategy identifies potential market reversals by spotting two prominent delta shifts in opposite directions occurring closely together within an accumulation zone, reinforced by structural market elements and order flow events.

How does AlgoBox help with the DDSR strategy?

AlgoBox automates the detection of delta shifts and provides additional order flow signals like Enigma and Alpha Omega crosses, making it easier to spot DDSR setups in real time without manually reading the tape.

What markets can I use DDSR on?

The DDSR strategy is primarily designed for futures and forex markets where order flow data is available, but it can be adapted to any liquid market that provides delta information.

How do I know if a DDSR setup is valid?

A valid DDSR setup includes two delta shifts appearing in close succession within an accumulation zone, aligned with structural elements like harmonics or fib dots, and preferably confirmed by AlgoBox order flow signals like Enigma crosses.

Is the DDSR strategy suitable for beginners?

While DDSR can be learned by traders of all levels, it requires understanding of delta, order flow, and price structure. Beginners should consider practicing with NinjaTrader’s market replay and enrolling in AlgoBox’s training programs for better results.

How do I manage risk when trading DDSR setups?

Risk management is crucial. Use stop losses beyond key levels, define profit targets, and follow your trading plan strictly. Never risk more than you can afford to lose on any single trade.

Can DDSR be used for scalping or longer-term trading?

DDSR is versatile and can be adapted to different timeframes. It is often used for day trading and scalping futures but can also be applied to longer intraday or swing trades with appropriate adjustments.

Conclusion: Harnessing the Power of DDSR for Smarter Trading

The Double Delta Shift Reversal (DDSR) strategy offers traders a unique window into the activities of large institutional players by analyzing delta shifts and order flow in real time. By spotting two delta shifts in close succession within accumulation zones and confirming these with structural market elements and specialized AlgoBox signals, you can identify high-probability reversal setups.

Incorporating DDSR into your trading requires discipline, practice, and a solid understanding of order flow dynamics. Using NinjaTrader’s market replay and AlgoBox’s comprehensive training resources can accelerate your mastery of this strategy.

Remember, no strategy guarantees success, but combining DDSR with sound risk management and consistent execution can significantly enhance your trading edge. I encourage you to explore this powerful approach and see how it can transform your futures or forex trading.

Happy trading, and see you on the next setup!

This article was created from the video DOUBLE DELTA SHIFT REVERSAL (DDSR) Strategy 🟪 NinjaTrader Futures | AlgoBox Training with the help of AI.