In my journey trading futures with NinjaTrader, I’ve discovered that spotting potential market turning points can dramatically improve both entries and exits. One of the most powerful techniques I’ve integrated into my trading toolkit is the HEADSHOT strategy from AlgoBox. This approach combines sophisticated order flow analysis with Fibonacci-based reversal signals to pinpoint high-probability trade setups.

In this comprehensive guide, I’ll walk you through the HEADSHOT strategy step-by-step — breaking down each component, how to apply it in real-time, and how to manage your trades with precise risk and target rules. Whether you’re a beginner or an experienced trader looking to refine your approach, this method offers a clear framework to trade smarter and more confidently.

Let’s dive into what makes the HEADSHOT strategy so effective and how you can master it using NinjaTrader’s powerful market replay feature along with AlgoBox tools.

Table of Contents

- Step 1: Understanding the HEADSHOT Strategy Components

- Step 2: Recognizing the HEADSHOT Setup

- Step 3: Executing the HEADSHOT Trade

- Step 4: Managing Risk and Trade Validation

- Step 5: Practicing the HEADSHOT Strategy

- Step 6: Expanding Your Knowledge with AlgoBox Training

- Step 7: Staying Connected for Continuous Learning

- Frequently Asked Questions (FAQ)

- Conclusion

Step 1: Understanding the HEADSHOT Strategy Components

The HEADSHOT strategy is a technical trading setup that hinges on the convergence of two key AlgoBox indicators:

- Fibelli Dot

- Flow Master Event

Each of these elements provides unique insights into price action and market behavior. When they appear in close proximity, they form a “headshot” setup — a signal with enhanced reliability indicating a potential market reversal or turning point.

Fibelli Dot: Pinpointing Potential Reversals

The Fibelli Dot is a specialized indicator designed to identify potential reversal points by using Fibonacci levels within Elliott Wave patterns. Elliott Wave theory helps traders understand the natural rhythm and fractal nature of markets, and Fibonacci retracements are widely respected tools for spotting support and resistance levels.

The Fibelli Dot highlights where price may stall or reverse based on these Fibonacci retracement zones aligned with Elliott Wave counts. This makes it a powerful tool for timing entries near potential market pivots.

Flow Master Event: Analyzing Real-Time Order Flow

The Flow Master Event is an advanced order flow-based indicator that identifies significant shifts in market activity. It includes several components such as:

- Bubbles

- Alpha Omega crosses

- Other cross signals

These elements analyze real-time order flow — the actual buying and selling pressure behind price moves — to pinpoint moments of heightened activity and potential directional shifts.

By observing these flow master events, traders can gain insight into the strength or weakness of a move, often before traditional price-based indicators react.

Step 2: Recognizing the HEADSHOT Setup

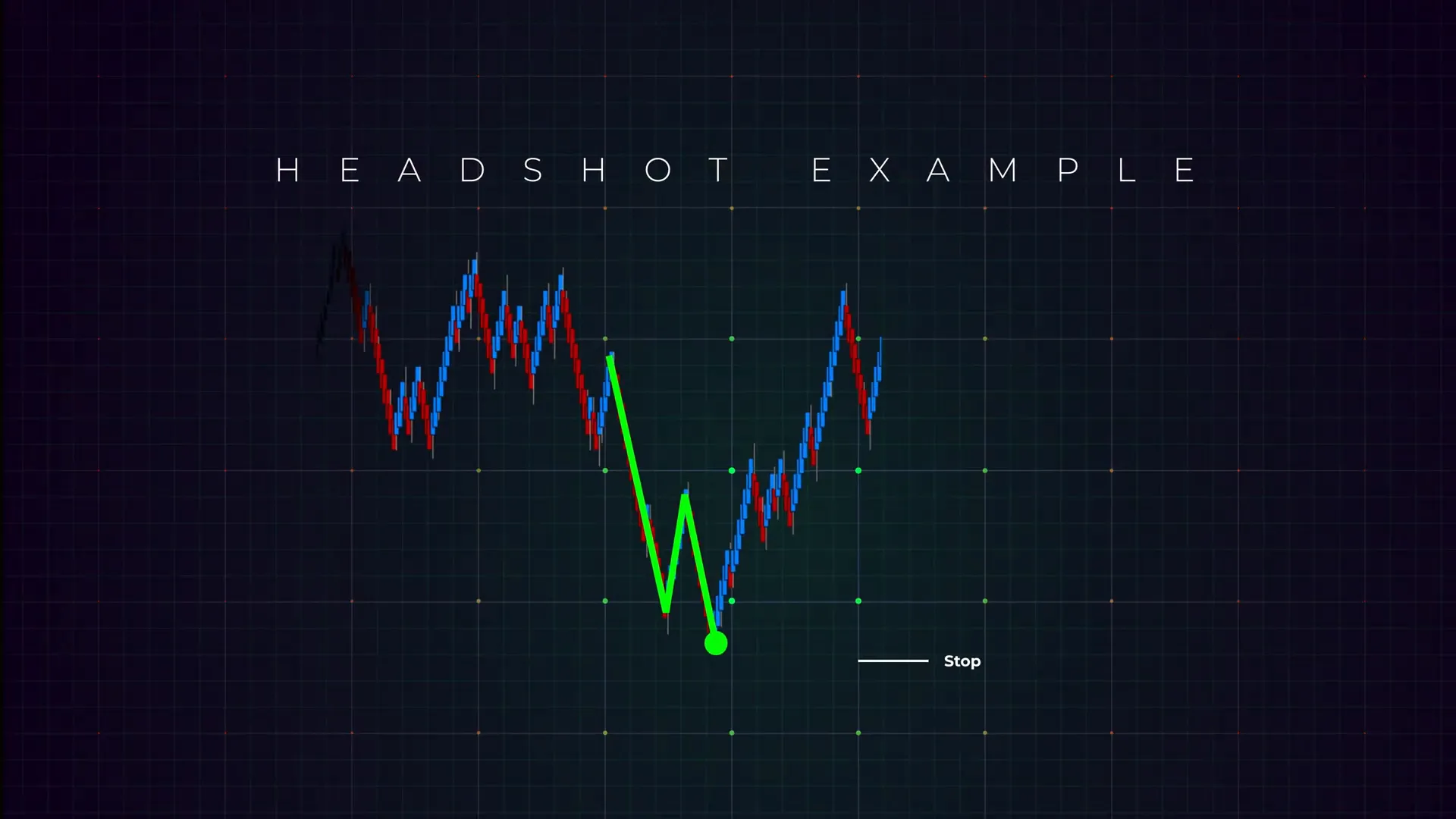

To qualify as a valid HEADSHOT setup, the Fibelli Dot and Flow Master Event signals must appear within a narrow window of ten to fifteen AlgoBars of each other. This proximity ensures the signals are related and reinforces the likelihood of a meaningful market turning point.

Why is this important? When two independent indicators—one based on Fibonacci Elliott Wave analysis and the other on real-time order flow—converge, the combined signal has a higher probability of success. It’s like having two different experts agree on the same forecast.

What Are AlgoBars?

AlgoBars are a type of price bar used in AlgoBox, which can be configured based on volume, range, or time. They offer a cleaner and more adaptive way to visualize price action compared to traditional candlesticks. Understanding how to read and interpret signals on AlgoBars is crucial for applying the HEADSHOT strategy effectively.

Step 3: Executing the HEADSHOT Trade

Once the HEADSHOT setup is identified, here’s how I approach execution:

- Entry: When the Flow Master Cross appears on the AlgoBox chart, wait for the Fibelli Dot to confirm the potential reversal. For example, a green Fibelli Dot suggests a potential long (buy) opportunity.

- Entry Zone: Ideally, enter your trade as close to the Fibelli Dot as possible. This increases the chance of catching the move early and maximizing potential reward.

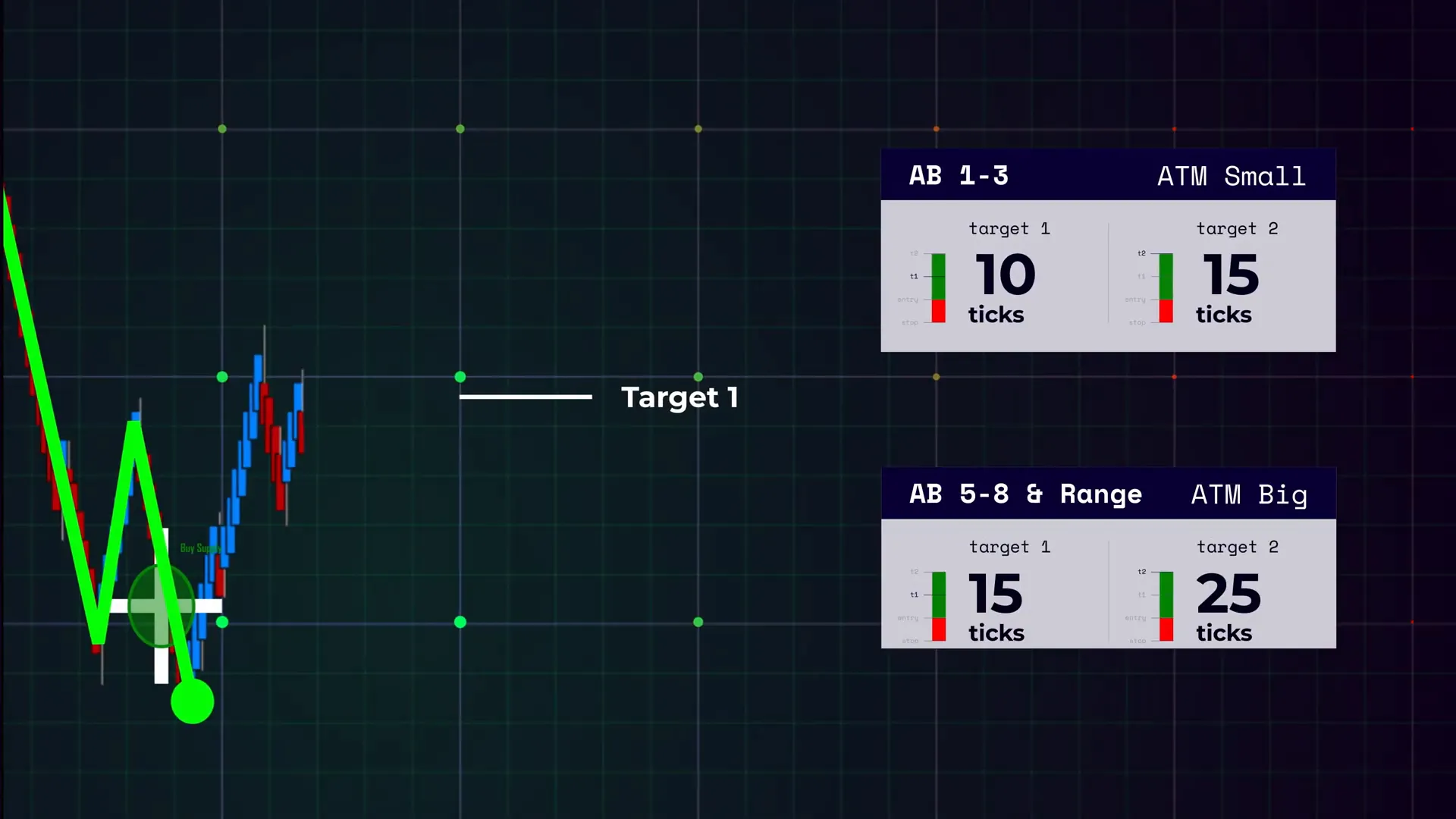

- Targets: For trades using smaller AlgoBars (1 to 3), I usually aim for smaller ATM (At The Money) targets to capture quick profits.

- For larger bars (5 AlgoBars and range bars), I target around 15 ticks for the first target and scale out for runners based on the strength of order flow and market conditions.

- Stop Loss: Place your stop just behind the Fibelli Dot or the Flow Master Cross. If price breaks this level, it invalidates the setup and signals it’s time to exit.

Why Scale Out?

Scaling out means taking partial profits at predefined targets and letting the remaining position run to maximize gains when the trade strongly moves in your favor. This approach balances risk management with the opportunity for larger profits on strong trends.

Step 4: Managing Risk and Trade Validation

Risk management is fundamental. The HEADSHOT strategy recommends placing a stop loss behind the Fibelli Dot or Flow Master Cross. This critical level acts as a “line in the sand.”

If price moves against you and breaks this stop, it’s a clear sign the setup is no longer valid. Exiting quickly protects your capital and keeps you in the game for future trades.

The Importance of Setup Validation

Not every signal will result in a winning trade. The key is to respect your stop and avoid emotional trading. The HEADSHOT strategy’s built-in validation through these two independent indicators helps filter out weaker signals, but discipline remains crucial.

Step 5: Practicing the HEADSHOT Strategy

Mastery comes with repetition and experience. I highly recommend practicing the HEADSHOT strategy using NinjaTrader’s market replay feature. This tool allows you to replay historical market data in real-time and simulate trades without risking actual capital.

By practicing in a controlled environment, you can:

- Gain confidence in recognizing HEADSHOT setups

- Refine your entry and exit timing

- Test different target and stop loss levels

- Understand how the strategy performs in various market conditions

Step 6: Expanding Your Knowledge with AlgoBox Training

To deepen your understanding, I encourage you to enroll in the AlgoBox 8-session bootcamp. This comprehensive training covers the full AlgoBox system, including advanced order flow concepts and additional strategies to complement the HEADSHOT setup.

Starting with a free two-week trial, you can explore the tools and training materials that have helped me become a more consistent trader.

Step 7: Staying Connected for Continuous Learning

Trading is a journey that requires constant learning and adaptation. I recommend subscribing to AlgoBox’s live sessions and newsletters for ongoing strategy insights, updates, and real-time market analysis.

Engaging with a community of traders and educators helps you stay sharp and informed about evolving market dynamics.

Frequently Asked Questions (FAQ)

What makes the HEADSHOT strategy different from other setups?

The HEADSHOT strategy uniquely combines Fibonacci Elliott Wave reversal signals (Fibelli Dot) with real-time order flow analysis (Flow Master Event). This dual confirmation increases the reliability of trade signals compared to relying on a single indicator.

Can the HEADSHOT strategy be used on any futures market?

Yes. While the strategy was demonstrated using NinjaTrader futures charts, the principles of Fibonacci retracements and order flow analysis apply broadly. However, always test and adjust based on the specific market’s behavior and liquidity.

How do I choose the right AlgoBar settings?

AlgoBars can be customized based on your trading style and the market’s volatility. For quick scalping, smaller AlgoBars (1 to 3) work well, while larger bars (5 or range bars) suit swing or trend trades. Experiment with settings during practice sessions to find what fits you best.

What is the best way to manage risk using the HEADSHOT strategy?

Placing your stop loss behind the Fibelli Dot or Flow Master Cross is critical. This protects your capital if the setup fails. Additionally, scale out of winning trades to lock in profits while letting a portion run for larger gains.

Is prior knowledge of Elliott Wave theory required?

While a basic understanding of Elliott Wave helps in grasping the Fibelli Dot’s logic, the indicator itself handles much of the complex calculations. Beginners can still use the strategy effectively by learning to interpret the signals as presented.

Conclusion

The HEADSHOT strategy from AlgoBox offers a powerful, data-driven approach to identifying market turning points by blending Fibonacci Elliott Wave analysis with real-time order flow insights. By focusing on the convergence of Fibelli Dot and Flow Master Event signals within a tight timeframe, traders gain a high-probability setup that enhances both entry precision and risk management.

Mastering this strategy takes practice, but with tools like NinjaTrader’s market replay and the comprehensive AlgoBox training bootcamp, you can accelerate your learning curve and trade with greater confidence.

Remember, no strategy guarantees success, but disciplined application of the HEADSHOT setup can significantly improve your edge in the futures markets. Start practicing today, manage your risk wisely, and stay connected to ongoing education to evolve as a trader.

Here’s to your trading success!

This article was created from the video HEADSHOT Strategy 🟪 NinjaTrader Futures | AlgoBox Training with the help of AI.