I’m ALGOBOX PRO, and in this article I’ll walk you through the Split Cross Reversal (SCR) strategy I teach in my AlgoBox system training. This piece expands on the concept I presented in my video, giving you a step‑by‑step tutorial you can practice in NinjaTrader’s Market Replay or in a simulated environment. I’ll explain the indicators, what to look for, how to manage risk, and how to integrate the SCR into a robust trading playbook.

Table of Contents

- Outline

- Step 1: Understand the Split Cross Reversal (SCR) concept

- Step 2: Identify the Flowmaster cross and the white crosses

- Step 3: Recognize when two Flowmaster crosses are a true split cross

- Step 4: Build confluence—combine SCR with structure and order flow tools

- Step 5: Entry triggers, target selection, and stop placement

- Step 6: Practice SCR in NinjaTrader Market Replay

- Step 7: Integrate SCR into a playbook and risk plan

- Step 8: Walkthrough examples and annotated trade scenarios

- Step 9: Common pitfalls, false signals, and troubleshooting

- Step 10: Backtesting, journaling, and measuring edge

- Conclusion and next steps

Outline

- Step 1: Understand the Split Cross Reversal (SCR) concept

- Step 2: Identify the Flowmaster cross and the white crosses

- Step 3: Recognize when two Flowmaster crosses are a true split cross

- Step 4: Build confluence—combine SCR with structure and order flow tools

- Step 5: Entry triggers, target selection, and stop placement

- Step 6: Practice SCR in NinjaTrader Market Replay

- Step 7: Integrate SCR into a playbook and risk plan

- Step 8: Walkthrough examples and annotated trade scenarios

- Step 9: Common pitfalls, false signals, and troubleshooting

- Step 10: Backtesting, journaling, and measuring edge

- Conclusion and next steps (trial, boot camp, live sessions)

Step 1: Understand the Split Cross Reversal (SCR) concept

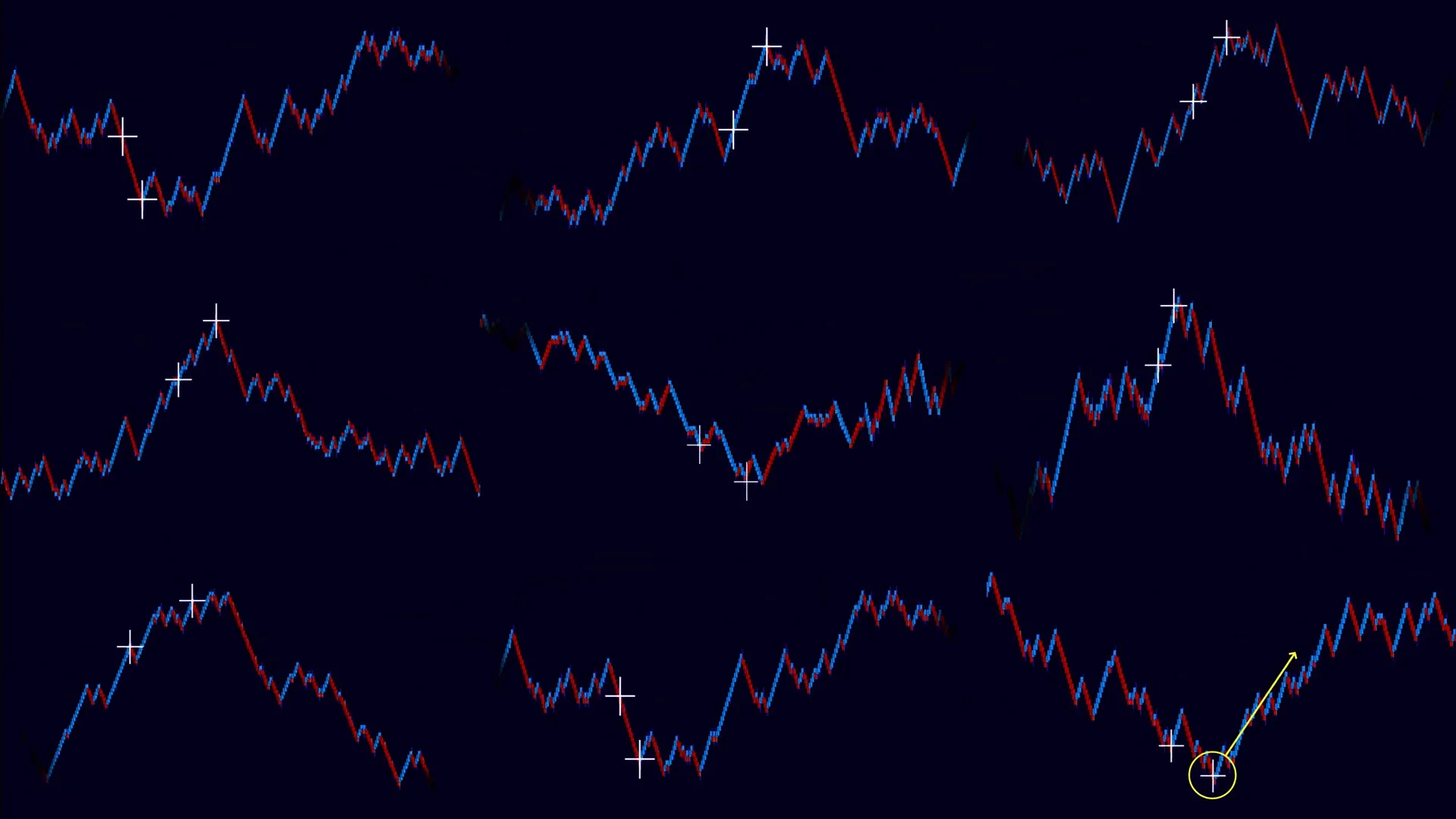

The Split Cross Reversal (SCR) is a pattern I use inside the AlgoBox framework to anticipate short‑term reversals that often catch retail traders off guard. At its core the SCR relies on the Flowmaster cross indicator—the AlgoBox tool that highlights meaningful order flow shifts. The SCR is a nuanced version of the “late night” signal with a small but powerful twist: it’s not one isolated cross, it’s a pair of Flowmaster crosses that appear separated in time and spaced apart within the same impulse leg.

Why does this matter? Because those two spaced white crosses often represent two separate retail bait moments during a strong momentum move. The market sucks in late traders on multiple occasions, and when the second group shows up the move can quickly exhaust. The separation (or “split”) between the two crosses is what differentiates SCR from other simple cross signals such as DCDM or DCR.

SCR is an observational clue, not a standalone entry. I always seek confluence with other AlgoBox tools like structural patterns or order flow signals before trading.

Key takeaways from Step 1:

- SCR = Split Cross Reversal: two Flowmaster crosses separated within the same impulse leg.

- The crosses indicate retail involvement and potential exhaustion.

- SCR alone is a hint—it needs confirmation from other tools.

Step 2: Identify the Flowmaster cross and the white crosses

The first practical skill is recognizing the Flowmaster cross on your chart. In AlgoBox, the Flowmaster cross is a visual marker that appears when there’s a surge in order flow activity indicating a meaningful shift. Most SCR setups involve two white Flowmaster crosses. These white crosses are not just decorations—they mark moments when retail traders are piling in, usually chasing the continuation of a move.

Here’s how I interpret a single Flowmaster cross:

- White cross: a surge in order flow aligned with retail buying or selling momentum.

- Color and context matter: white crosses in the direction of the trend are often bait attempts.

- Look to see if the cross follows a strong impulse leg—this increases the significance.

When the first white cross forms, many retail participants may still be early or on time. When a second white cross forms later in the same impulse leg, that’s the signal that late traders are jumping in. Two spaced white crosses are exactly what I look for when I’m tracking Split Cross Reversals.

Step 3: Recognize when two Flowmaster crosses are a true split cross

Not every pair of crosses qualifies as a Split Cross Reversal. The spacing, the context in the impulse leg, and the presence of a strong preceding momentum all matter. Here’s the checklist I use to validate whether I have a legitimate SCR observation:

- Two white Flowmaster crosses appear within the same directional impulse leg.

- The two crosses are spaced apart—there is meaningful time and/or price between them (not back to back).

- The setup occurs after a strong or extended impulse—meaning the market already displayed momentum in that direction.

- Retail bait characteristics: the crosses show deep retail involvement, where price action pulls in late entrants.

What I’m watching for in real time

- After the first white cross, price often continues for a while as momentum retains strength.

- At the second white cross, momentum often persists again but the character of buying/selling changes—this is where exhaustion can begin.

- I want separation between crosses: think of two distinct attempts to push price further that create two separate retail participation peaks.

When those conditions align I call this an SCR observation. I don’t jump in automatically—SCR is an observational clue. The next step is to find reinforcing signals to trade against the exhausted retail move.

Step 4: Build confluence—combine SCR with structure and order flow tools

Confluence is everything. A single signal by itself rarely provides a durable edge. I always combine the SCR observation with other AlgoBox and market structure tools: support/resistance zones, structure breaks, order flow patterns, and AlgoBox specific signals such as enigmas. When these tools align, the probability of a successful reversal trade improves materially.

Here’s how I layer confluence:

- Structural context: is price at a prior support/resistance level, a structural swing, or a significant market profile boundary? If yes, this raises the trade’s probability.

- Order flow confirmation: look for footprint or tape evidence that aggressive buying/selling is waning or that contra liquidity is stepping in.

- AlgoBox signals like enigma: an enigma forming in the opposite direction provides a strong confirmation of retail exhaustion. When a blue enigma forms at the location of the split crosses, that’s significant.

- Session context: know what session you’re trading—certain sessions amplify retail participation (e.g., overlap, economic releases).

Example of confluence I use:

- Two spaced white Flowmaster crosses within a strong up impulse leg.

- Price at a prior supply zone or the top of a structural range.

- Order flow footprint showing fewer aggressive buyers at the second cross.

- Blue enigma appears in the same zone, signaling an AlgoBox counter‑move.

When all or most of the above line up, I’ll consider entering a short against the momentum. If some elements are missing, I either pass or reduce position size and widen stops.

Step 5: Entry triggers, target selection, and stop placement

Once I’ve observed an SCR and built confluence, I need clear rules for entry, target(s), and stop placement. I treat the SCR as a signal that retail traders are likely late; my goal is to trade the contra move with a clear risk plan.

Entry strategies

- Enigma-triggered entry: if a blue enigma forms in the same zone as the two white crosses (opposite direction), I use the enigma as a primary entry trigger—entering when its directional criteria is met.

- Break of structure entry: if price breaks a structure level after the enigma or shows a clear rejection, I may enter on the break or on a retest.

- Order flow trigger: enter when footprint or tape shows absorption of aggressive orders or a surge in contra buying/selling consistent with reversal.

- Patience entry: wait for a small pullback or a clear microstructure reversal candle that indicates the impulsive move has been rejected.

Stop placement

- Primary stop behind the enigma marker: I often place stops just beyond the enigma marker because the enigma defines an algo‑identified reference point for the counter move.

- Alternate: place stop beyond the swing high/low of the impulse that produced the second cross, adjusting for ATR and volatility.

- Position sizing: determine position size so that the dollar risk to the stop does not exceed your predefined risk per trade (e.g., 0.25%–1% of account).

Target selection

- Enigma projected line: the AlgoBox enigma often gives a projected line or target area that I use as the primary take profit.

- Structure levels: second target at the nearest structural level, such as support for shorts or resistance for longs.

- Partial profit scaling: scale out at the enigma target and hold a smaller swing portion to an additional structure target to maximize reward/risk.

Practical entry example

- I observe two spaced white Flowmaster crosses during an extended up impulse (SCR observation).

- A blue enigma forms in the same price area, signaling a possible counter move.

- I wait for either the enigma’s condition or a structure break and enter short at the confirmation candle.

- I place my stop just above the enigma marker and size my position for a 0.5% account risk.

- I take partial profits at the enigma projected line and the remainder at the prior support level.

This process keeps the trade disciplined: I’m trading against late retail momentum with clearly defined risk and a reasonable target area provided by AlgoBox tools.

Step 6: Practice SCR in NinjaTrader Market Replay

I cannot stress enough the value of practicing SCR in a simulated environment like NinjaTrader’s Market Replay. Observational skills—learning to recognize the spacing, the impulse characteristics, and the enigma timing—develop through repetition. Market Replay lets you speed up, slow down, and review the interaction between Flowmaster crosses, enigma formation, and order flow details.

How I structure my practice sessions

- Session selection: pick days with clear impulsive moves and days with choppy ranges to see both success and failure modes.

- Speed control: use Market Replay to slow the session down and focus on how the crosses and enigma markers arrive relative to tape and footprint changes.

- Document observations: log each instance where two white crosses appear and note whether an enigma later confirmed the reversal.

- Test entries: simulate entries at the enigma or on structure breaks and record outcomes (win/loss, R:R, edge metrics).

- Edge refinement: over many sessions, identify which contexts (time of day, instrument, impulse length) produce a higher win rate.

Practice creates pattern recognition muscle memory. Over time you’ll intuitively sense when two spaced white crosses are likely to herald a short term reversal and when they are not.

Step 7: Integrate SCR into a playbook and risk plan

To trade SCR professionally you must integrate it into your overarching playbook and strict risk plan. SCR is a useful addition to a trader’s toolkit but it must fit within rules that cover position sizing, maximum daily drawdown, acceptable R:R, and trade management protocols.

Elements of a robust SCR playbook

- Pre‑market checklist: define instruments, volatility expectations, and session segments to focus on.

- Signal checklist: require the SCR observation plus at least one additional confluence tool (enigma, structure, footprint pattern).

- Position sizing matrix: scale position size based on stop distance and probability—smaller size in lower confidence contexts.

- Trade management: rules for partial exits, trailing stops, and re‑entry (if any).

- Daily maximum risk: cap the total account risk per day to prevent ruin from a string of losses.

- Replay schedule: weekly review of SCR trades to refine filter rules (e.g., avoid certain sessions or instrument behaviors).

Risk examples

- If my stop is 8 ticks on ES and I risk 0.5% of account, I calculate contract quantity accordingly.

- I prefer scaling out—lock in partial profit at first enigma target to reduce the psychological pressure and then trail the rest.

- I set rules to not average into a losing SCR trade unless a new confluence forms and the edge recalculates positively.

Step 8: Walkthrough examples and annotated trade scenarios

Walking through examples builds intuition faster than abstract rules. Below I give two annotated scenarios—one ideal SCR trade and one failing SCR trade—so you can see characteristics of success and failure.

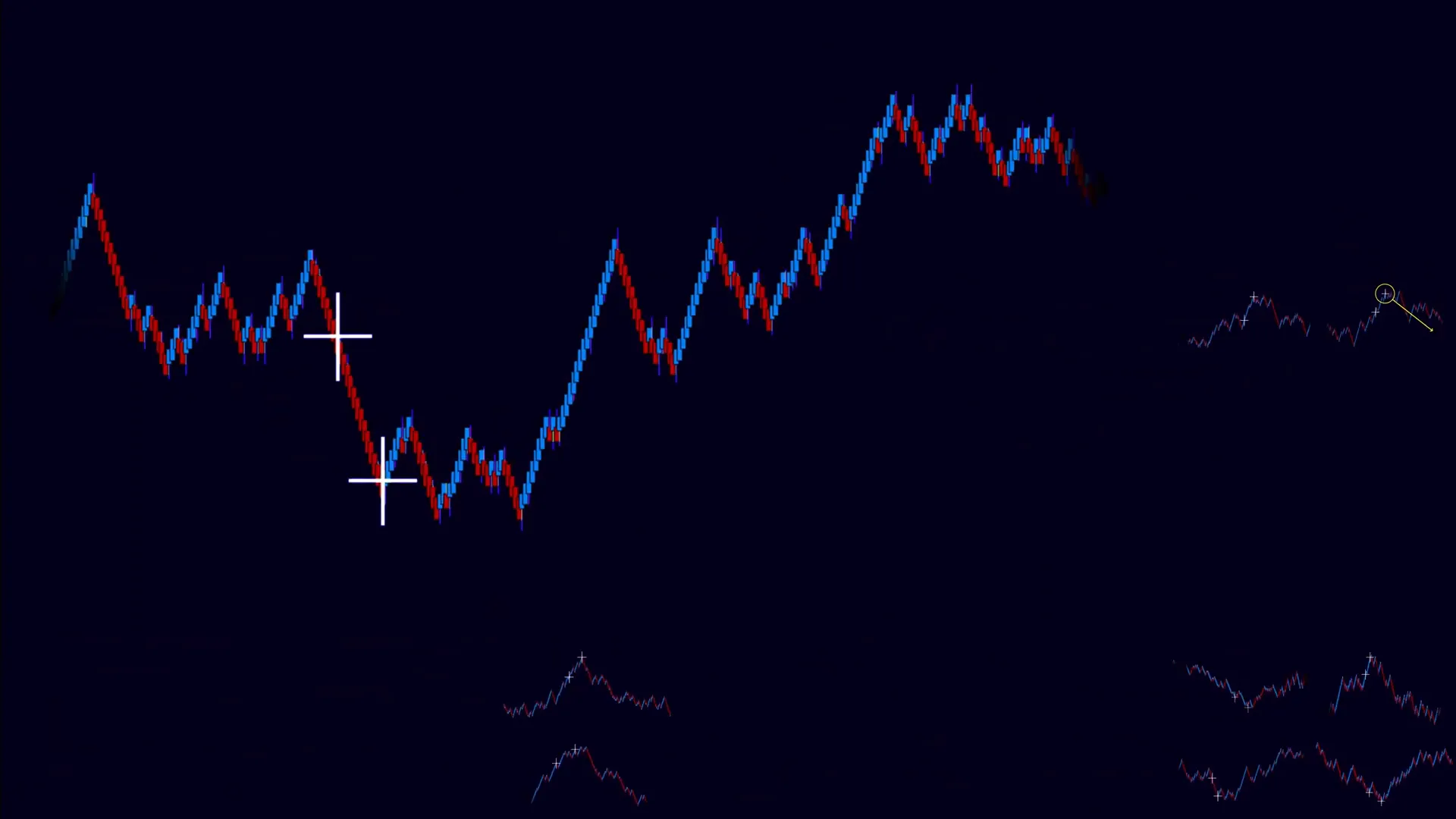

Example A: Ideal SCR short against extended up impulse

Context:

- Instrument: ES futures during a high‑volume session.

- Price action: strong up impulse starting from session open, pushing through a well‑defined resistance area.

- Observation: a Flowmaster white cross forms near the resistance. Price continues, then another white cross forms 30–45 minutes later within the same impulse leg.

- Confluence: a blue enigma forms in approximately the same zone as the second cross, and footprint shows decreased aggressive buying at the highs.

My trade plan:

- Wait for enigma confirmation and a bearish rejection candle or a structure break down.

- Enter short on confirmation with a stop just above the enigma marker.

- Take partial profit at enigma projected target; trail the rest to prior support.

- Record trade: entry, stop, target, R:R, notes on order flow and retail participation.

Outcome and reasoning:

The trade hits the first target quickly because the late retail participants were indeed exhausted. The enigma target aligns well with a microstructural support zone, reinforcing the exit. This highlights the power of combining SCR observation with AlgoBox signals.

Example B: Failed SCR—why it failed and what I learned

Context:

- Instrument: Small‑cap futures contract with low liquidity.

- Price action: choppy range with several shallow impulses.

- Observation: two white crosses appeared but they were only minutes apart and occurred during thin liquidity hours.

- Confluence: no enigma and no strong structure at the cross zone—just random volatility spikes.

My trade plan (what I did wrong):

- I entered based solely on the two crosses without waiting for enigma or order flow confirmation.

- I placed a narrow stop and expected a quick reversal.

Outcome and lesson:

Price telescoped through the stop as the instrument’s low liquidity and market noise created more false signals. The lesson: avoid SCR entries in low‑volume instruments and insist on confluence. Spacing matters—crosses that are too close may simply be noise rather than distinct retail bait moments.

Step 9: Common pitfalls, false signals, and troubleshooting

Trading SCR is not without pitfalls. I want you to be aware of the most common failure modes so you can filter them out or mitigate them.

Top pitfalls and my fixes

- False positives from clustered crosses: If crosses are too close in time, treat them as part of the same event rather than a split. Fix: require minimum time/price separation.

- Low liquidity & noise: Thinly traded instruments create spurious crosses and enigmatic markings that don’t have follow‑through. Fix: trade SCR primarily in high‑liquidity futures and instruments you’ve tested.

- No enigma confirmation: SCR without an enigma or structure confirmation is weak. Fix: make enigma or structure mandatory unless you have another high‑confidence order flow confirmation.

- Session context ignorance: Trading SCR during major news events or very low liquidity sessions increases risk. Fix: be selective about sessions or increase stop distance and reduce size.

- Overtrading SCR: Seeing SCR everywhere and forcing trades reduces expectancy. Fix: keep a strict signal checklist and pass when the checklist isn’t met.

How I troubleshoot a questionable SCR signal

- Rewind in Market Replay and observe the footprint for 10–20 bars prior to the crosses to see if consistent absorption or delta divergence exists.

- Check session volume profile—did the cross occur during a spike in participation or during a quiet period?

- Examine related instruments (e.g., micro spreads) to see if the move is isolated or part of a broader market move.

Step 10: Backtesting, journaling, and measuring edge

To convert SCR from a concept into an edge you must quantify results. That means disciplined backtesting, consistent journaling, and tracking meaningful metrics.

Backtesting tips

- Start with a fixed template: instrument (ES/NQ), session hours, and timeframe (I prefer 1–5 minute for SCR observation but test multiple).

- Log each instance of two white crosses and whether enigma formed, then record trade entry, stop, and target if you would have taken the trade.

- Use out‑of‑sample testing: reserve recent months to validate the model after tuning.

- Calculate expectancy: (Winning % * average win) – (Losing % * average loss).

Journal fields I recommend

- Date/time

- Instrument and tick/point value

- Session (e.g., US open, Asian)

- Price action context (impulse length, structure)

- Flowmaster cross timestamps and spacing

- Enigma presence and timestamp

- Entry rationale and trigger

- Stop and target levels

- Result and notes on order flow dynamics

- Self‑review: what I did well or poorly

How I measure edge

- Win rate and average R:R: don’t focus on win rate alone—combine with average R:R to see real edge.

- Expectancy per trade and per day: the number that tells you average dollars to expect per trade.

- Max drawdown and worst streak: ensure your position sizing tolerates observed losing streaks from backtesting.

- Confidence intervals: treat your edge as probabilistic and track how sample size increases confidence.

Conclusion and next steps

Split Cross Reversal is one of those nuanced observations that can provide an edge when combined with disciplined confluence criteria, robust risk rules, and deliberate practice. I use the Flowmaster crosses as the initial sensor of retail bait, and then I wait for enigma or structure confirmation before committing capital. Practicing in NinjaTrader Market Replay, logging trades, and tuning filters turns this observation into an actionable, repeatable strategy.

If you want to go deeper, I’ve structured a training route that takes you from concept to execution: start with a two‑week trial of AlgoBox to get the tools on your platform, then join the eight‑session AlgoBox boot camp where I walk through live examples, diagnostics, and how to integrate SCR into a complete trading plan. Attend live sessions and replays to continue honing your pattern recognition and trade management skill set.

Final checklist before you trade SCR:

- Confirmed two spaced white Flowmaster crosses in the same impulse leg.

- Clear spacing between the crosses (time/price), not noise cluster.

- Confluence: blue enigma or strong structural/order flow confirmation.

- Defined entry trigger, stop placement (usually behind enigma), and targets (enigma projected line & structure).

- Position sizing aligned with your risk limit and stop distance.

- Practice and log the trade in Market Replay before trading live.

Thanks for reading. I’ll see you in the next live session where I break down live SCR setups and answer questions in real time.