I’m Vinny from ALGOBOX Trading, and in this guide I’ll walk you through the Split Cross Reversal (SCR) strategy I teach for NinjaTrader using the AlgoBox toolkit. This article expands on the core idea behind SCR, shows how I read the Flowmaster cross signals, explains how I layer confluence and risk controls, and gives step‑by‑step instructions so you can practice and master this strategy in a simulated environment.

Table of Contents

- Outline

- Introduction

- Step 1: Understand the Split Cross Reversal (SCR) concept

- Step 2: How SCR differs from DCDM, DCR and late night signals

- Step 3: Recognizing the SCR sequence in real time

- Step 4: Entry, stop and target rules

- Step 5: Confluence and filters to strengthen the signal

- Step 6: Practical execution and simulated practice

- Step 7: Advanced nuances and common pitfalls

- Step 8: Building a pre‑trade and trade routine

- Step 9: Example trade walkthrough

- Step 10: How to continue learning (trials, bootcamps, live sessions)

- Common trading scenarios and how I handle them

- Performance management and psychology

- Checklist: When to accept an SCR trade (my personal rules)

- FAQ

- Conclusion

Outline

- Step 1: Understand the Split Cross Reversal (SCR) concept

- Step 2: How SCR differs from DCDM, DCR and late night signals

- Step 3: Recognizing the SCR sequence in real time

- Step 4: Entry, stop and target rules

- Step 5: Confluence and filters to strengthen the signal

- Step 6: Practical execution and simulated practice

- Step 7: Advanced nuances and common pitfalls

- Step 8: Building a pre‑trade and trade routine

- Step 9: Example trade walkthrough

- Step 10: How to continue learning (trials, bootcamps, live sessions)

- FAQ

- Conclusion

Introduction

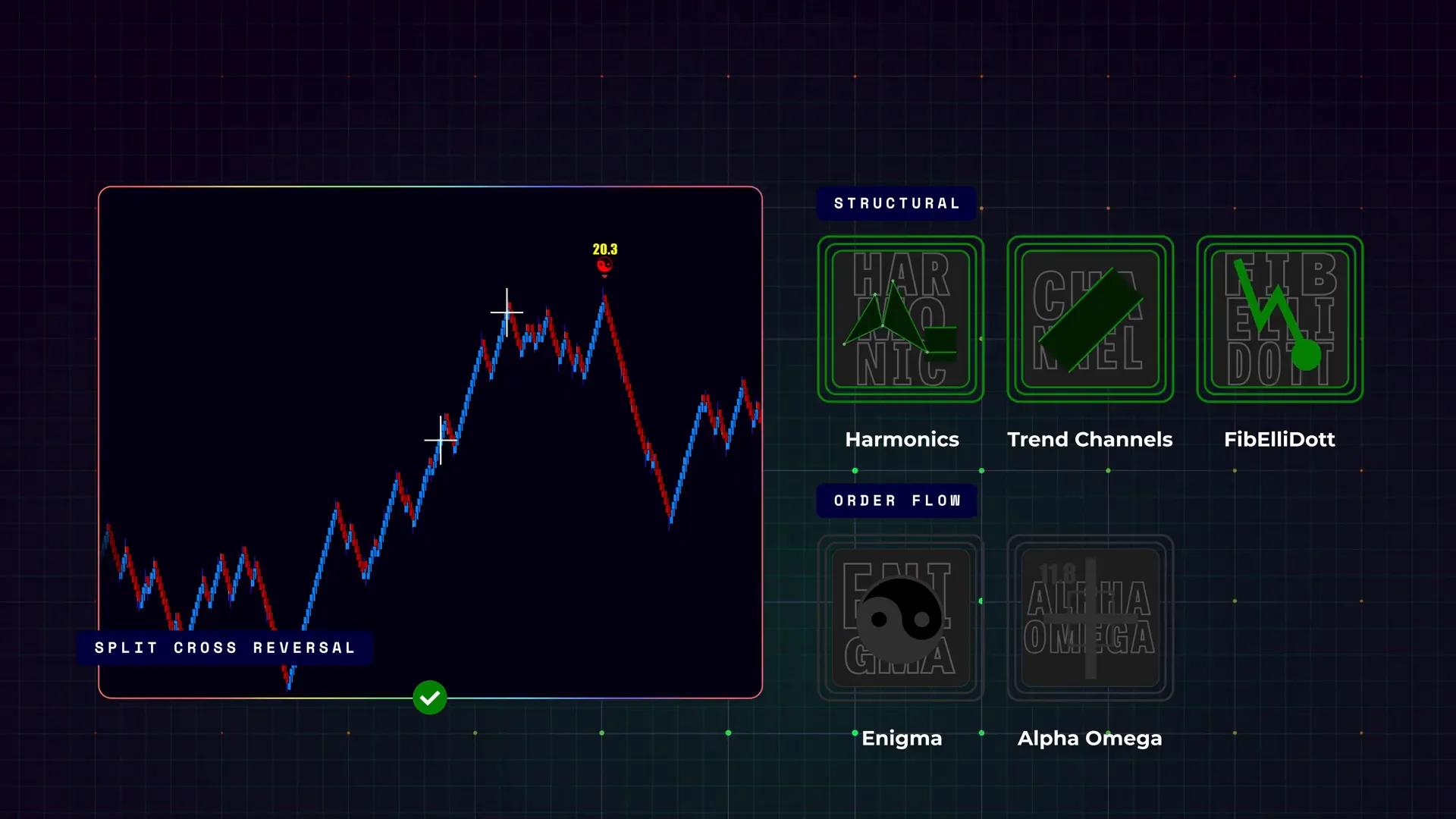

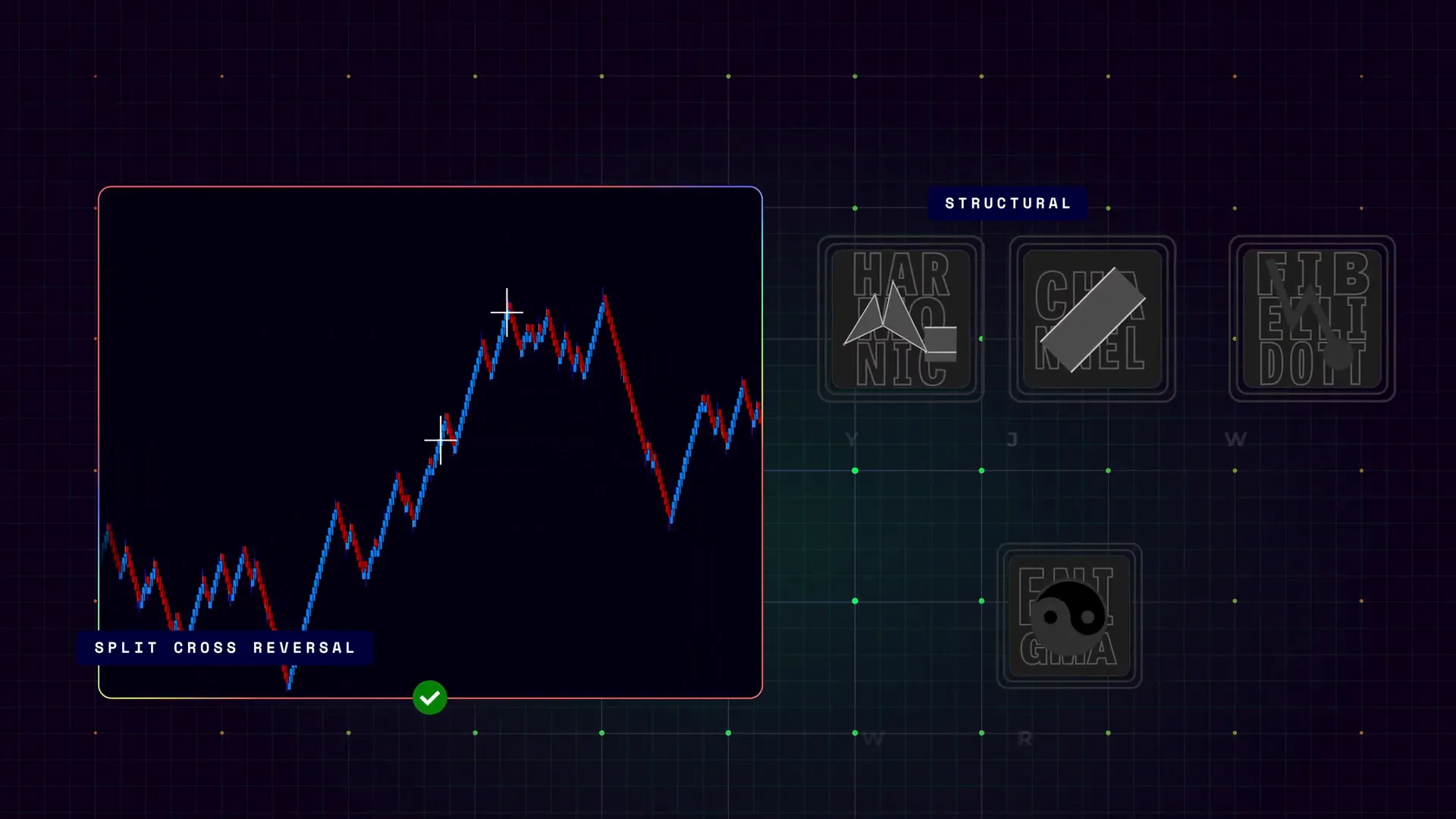

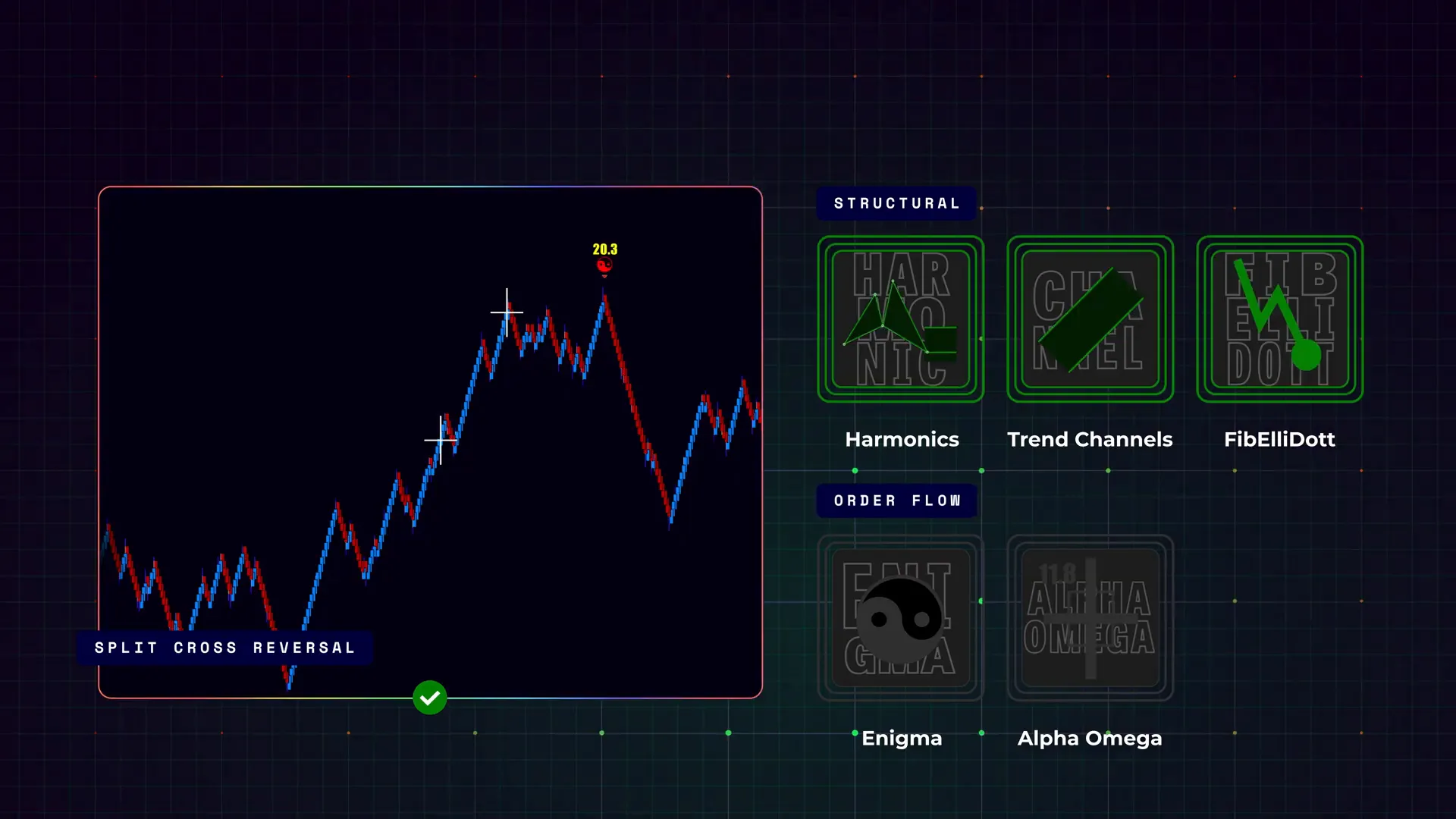

I created the Split Cross Reversal (SCR) strategy to give traders a practical way to anticipate short‑term reversals that tend to catch retail traders off guard. The SCR centers on one of my favorite indicators, the Flowmaster cross, which highlights significant shifts in order flow — moments when liquidity is being hunted and retail participation spikes. When used with other AlgoBox tools like structural patterns and the Enigma signal, SCR becomes a robust observational tool for timing entries and managing risk.

Throughout this guide I’ll quote and expand upon the precise pattern language I use: “two white Flowmaster crosses appearing farther apart than typical DCDM or DCR signals, ideally after a strong impulse leg.” I’ll explain why that spacing matters, what “retail bait” looks like, and how to convert these clues into repeatable trade plans.

Step 1: Understand the Split Cross Reversal (SCR) concept

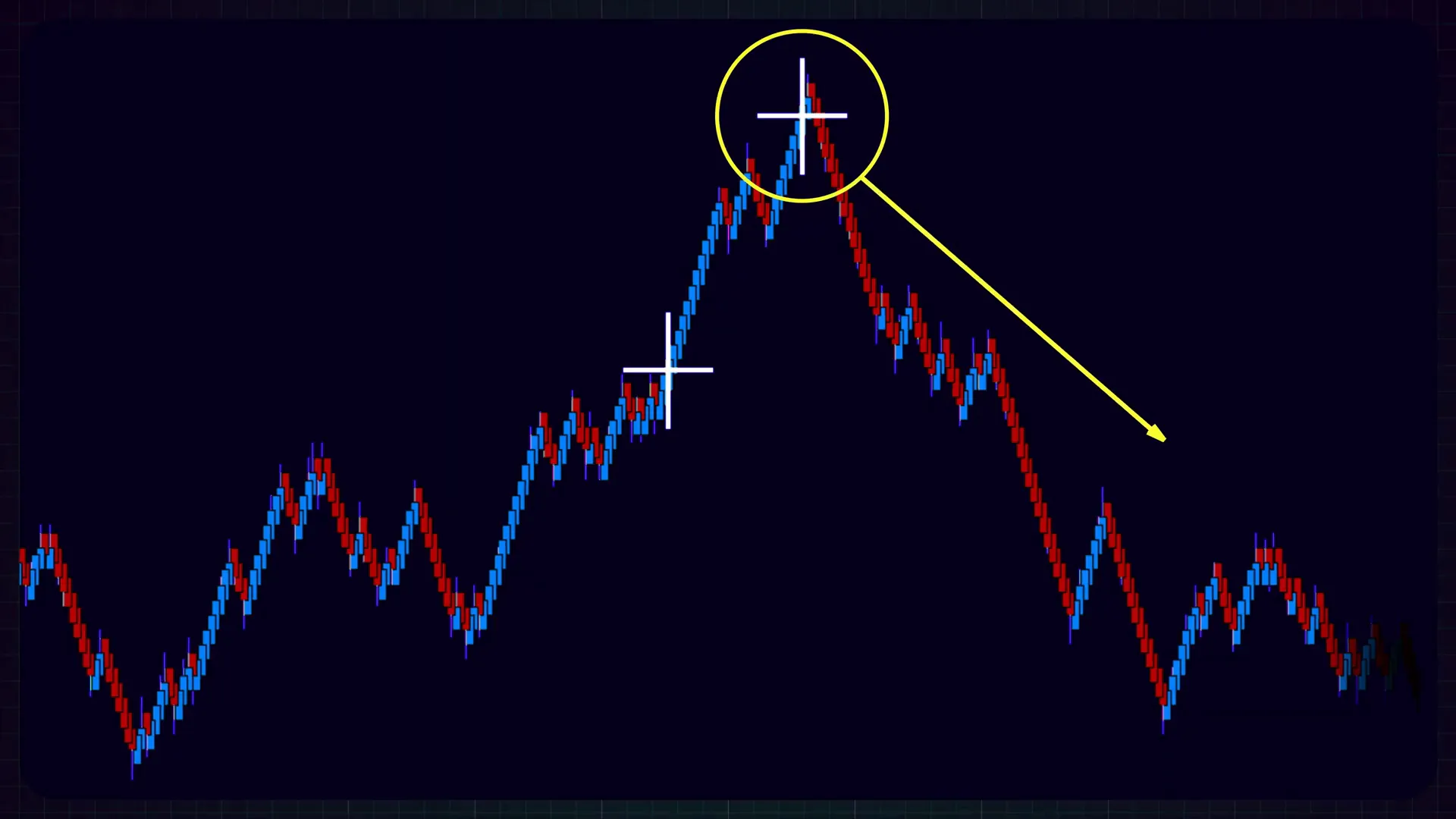

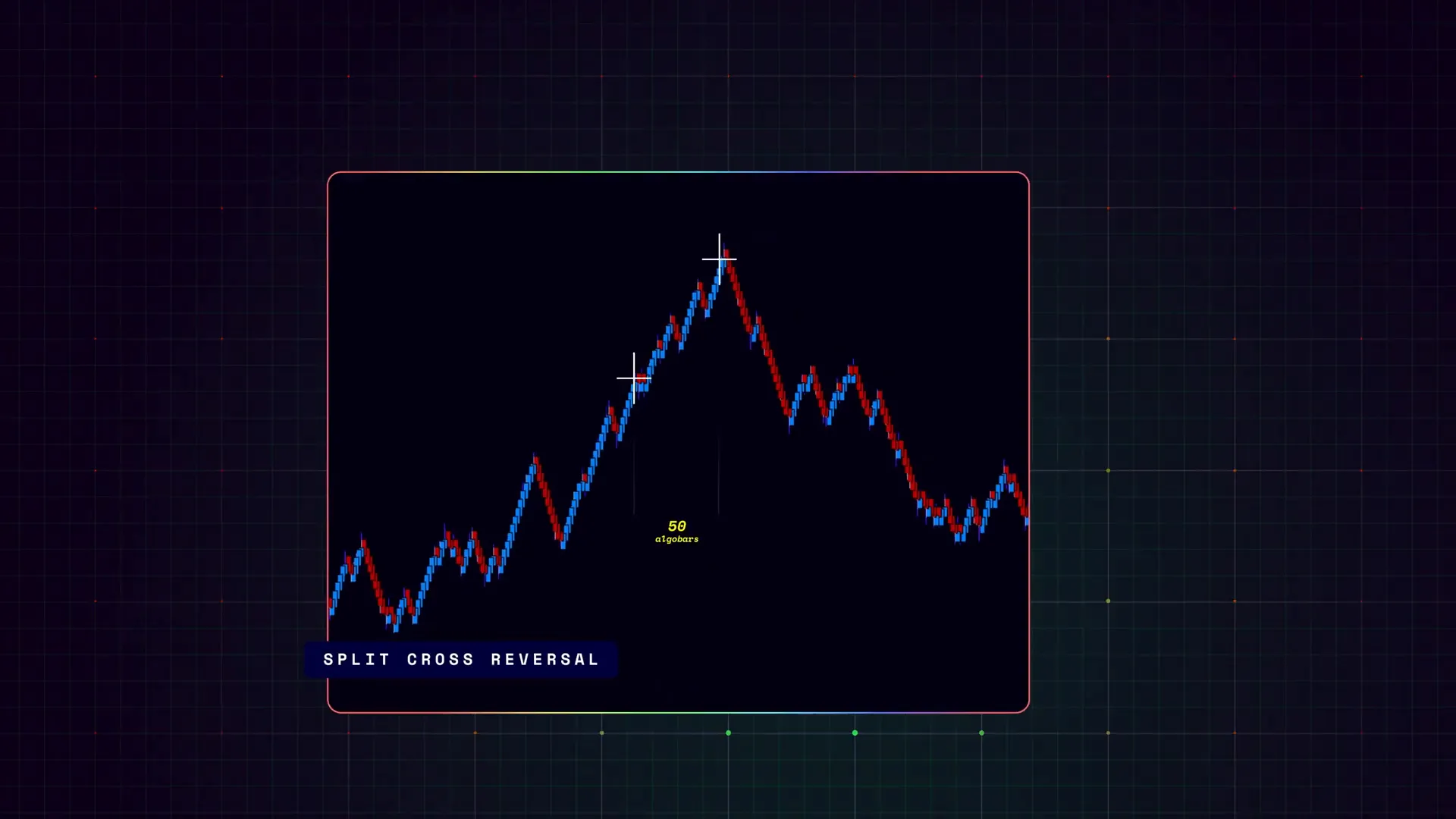

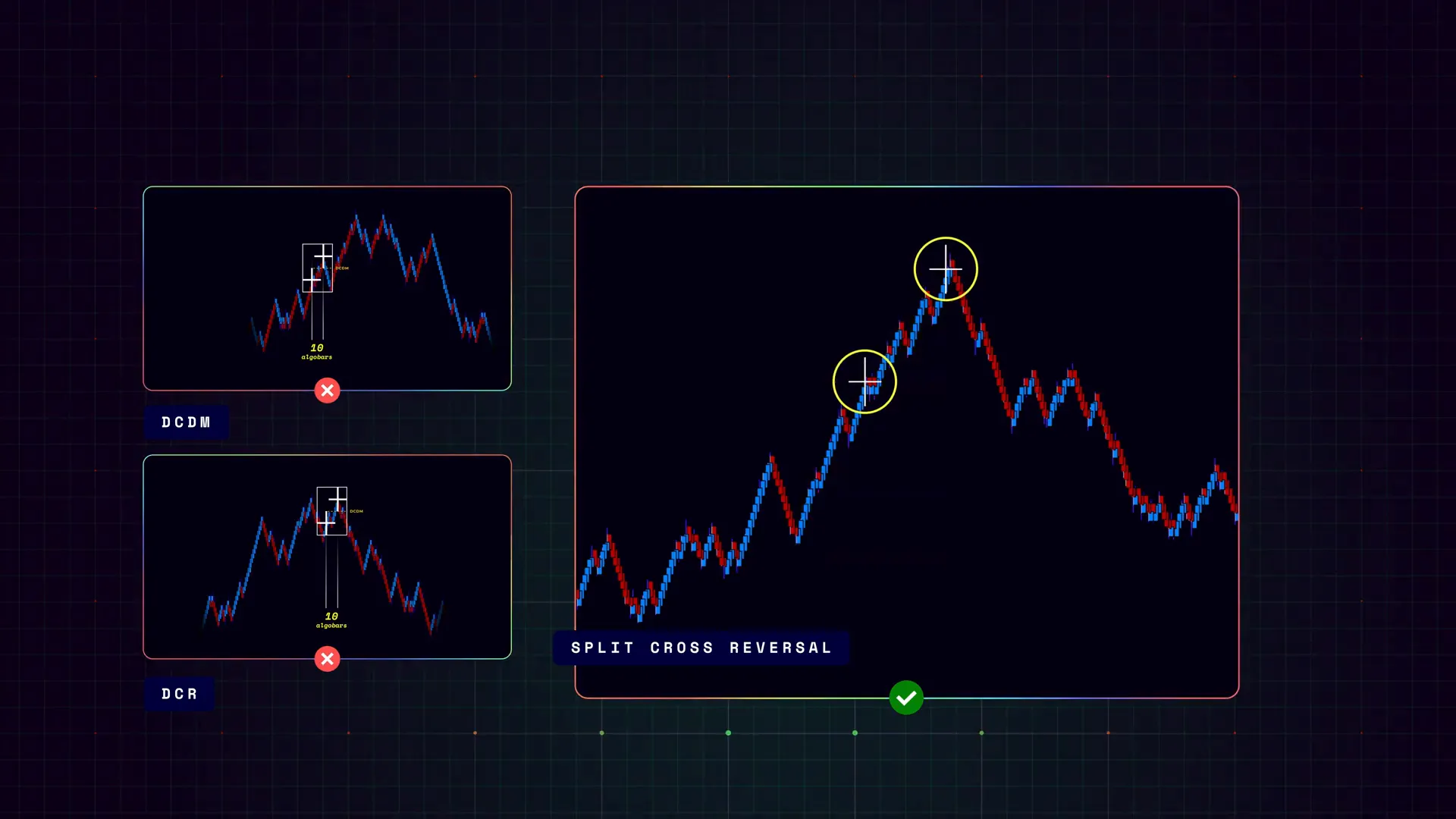

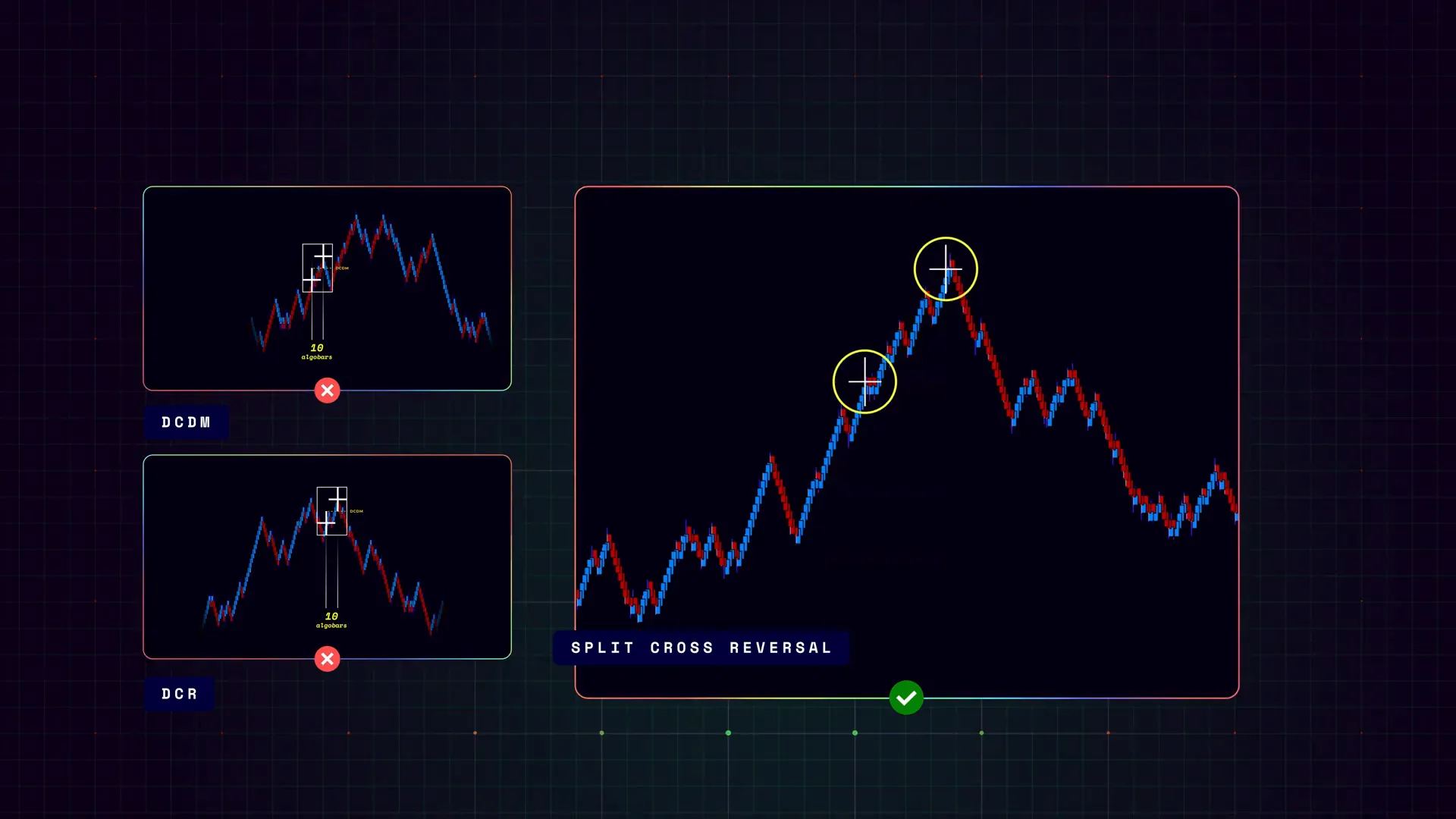

The SCR is an observational strategy based on an order flow shift indicator called the Flowmaster cross. In its simplest form, SCR is identified when you see two white Flowmaster crosses in the same impulse leg, spaced further apart than you would see in a typical DCDM (Double Cross Demand Moment) or DCR (Double Cross Reversal) signal.

Why two crosses? The first cross often represents an initial surge in order flow — sometimes institutional buying or selling starts to hunt liquidity. The second cross, appearing later in the same leg, typically represents late retail traders jumping into the move. That second participation is often the “retail bait” that leads to a short‑term exhaustion and a potential reversal.

Think of the price move like a sprint. The first cross is the initial burst. The second cross is the late, breathless sprint from retail who chased the move. When both occur in the same impulse leg but separated by enough time/price distance, they tell a story: momentum has been strong and retail is still piling in late. That’s where SCR becomes valuable — it provides a clue that the leg might be near a short‑term top or bottom.

Step 2: How SCR differs from DCDM, DCR and late night signals

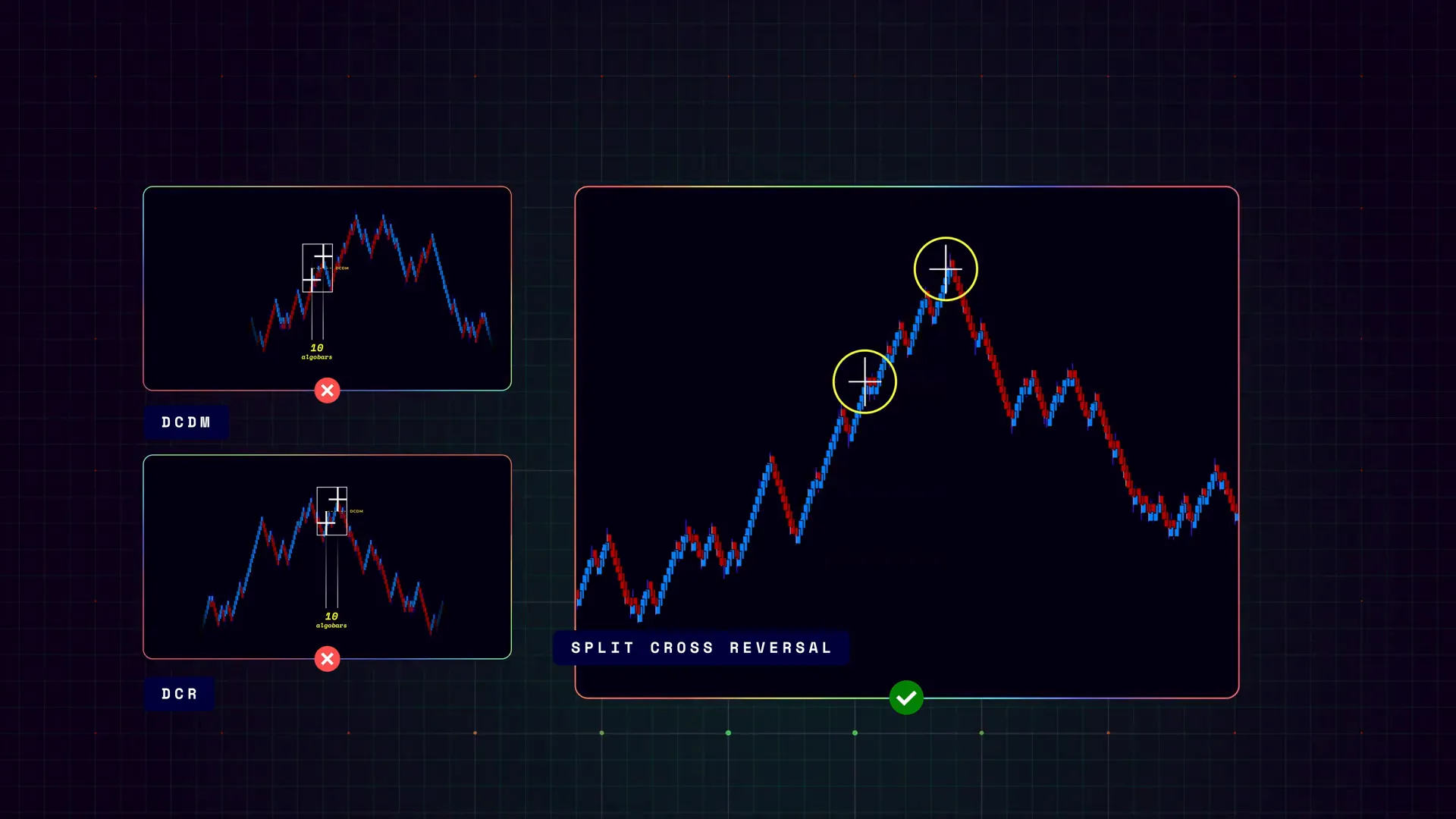

Many traders are familiar with other AlgoBox signals such as DCDM and DCR, or the “late night signal.” SCR is a nuanced variant that borrows concepts from these signals but emphasizes spacing and market context.

Key differences:

- Spacing: DCDM and DCR signals typically appear close together — almost a twin signal. SCR requires the two Flowmaster crosses to be farther apart, showing two separate retail bait moments within the same extended leg.

- Context: SCR is most reliable after a strong impulse leg or extended momentum. The pattern thrives in markets where retail participation is aggressive and follows price action.

- Outcome expectation: DCDM/DCR might indicate immediate structural exhaustion, whereas SCR often precedes a short‑term reversal after a slightly longer retail momentum. The retail momentum “tends to last a bit longer,” which means timing matters.

Understanding these differences helps prevent false expectations. SCR is not a guaranteed reversal — it’s a high‑probability observational clue that needs confirmation from other tools and structure.

Step 3: Recognizing the SCR sequence in real time

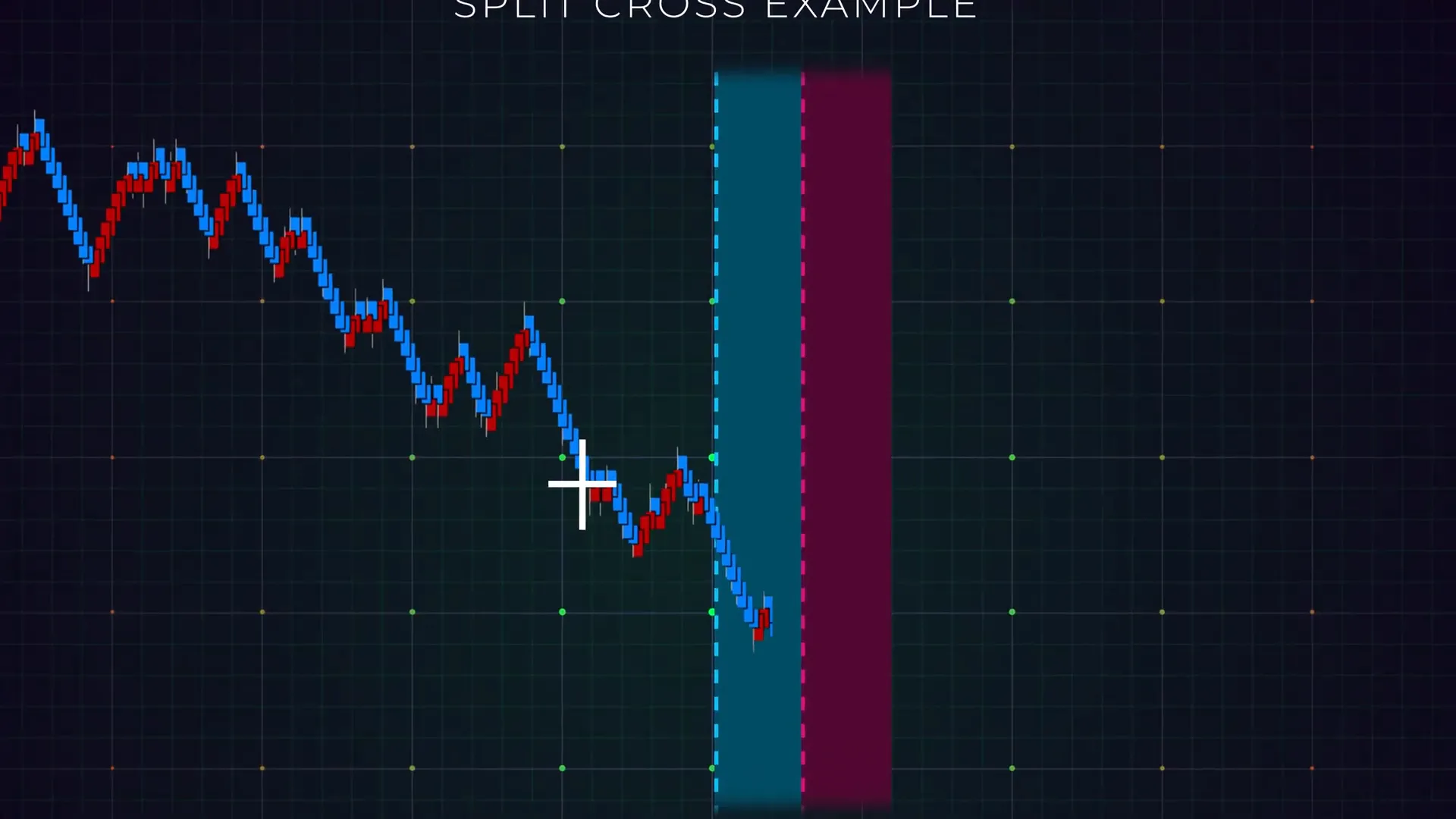

To trade SCR you must be able to identify the sequence quickly and accurately. I look for the following sequence of events:

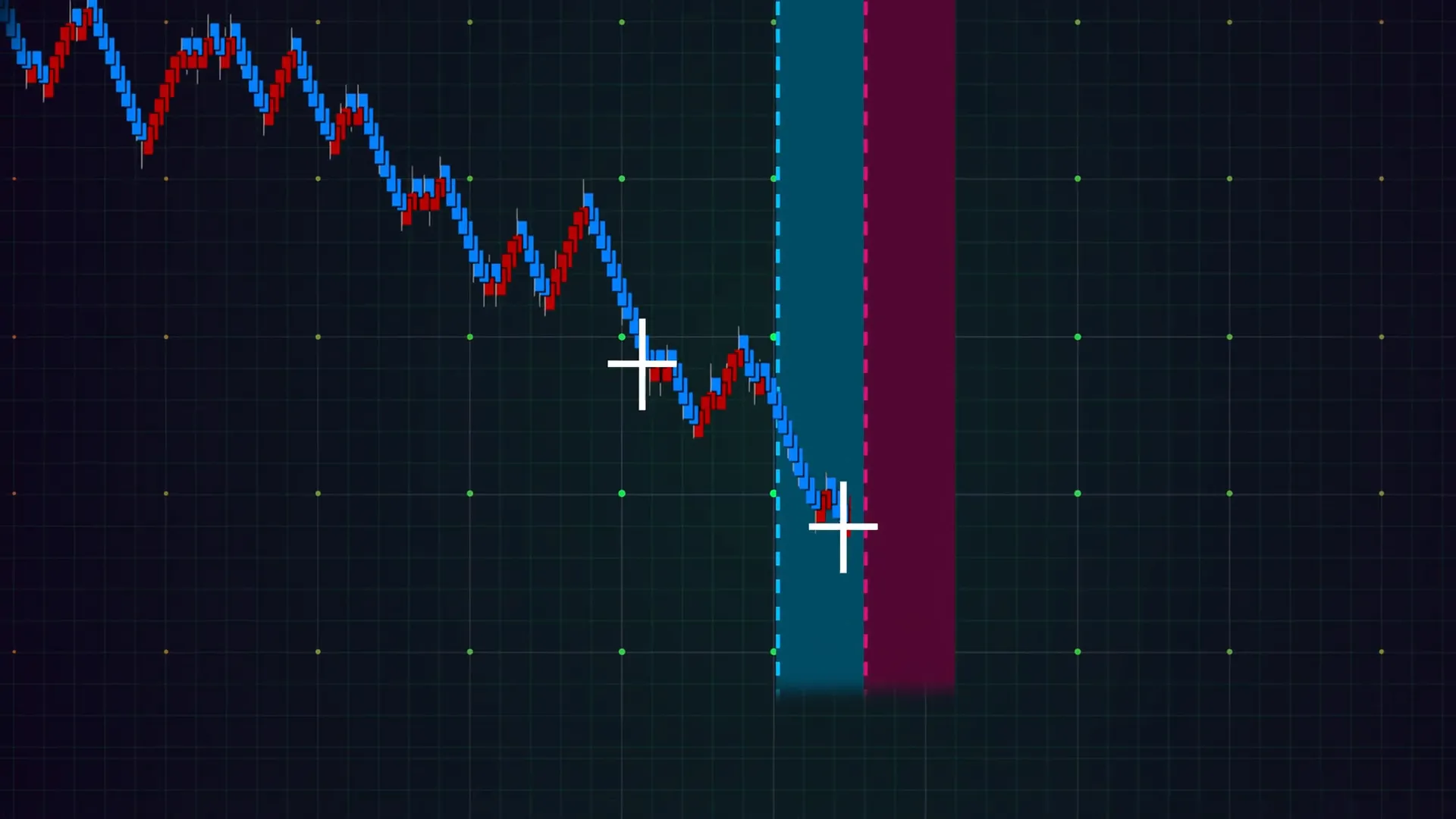

- Strong impulse leg — price has been moving decisively in one direction.

- A white Flowmaster cross appears — indicating a surge in order flow consistent with the direction of the impulse.

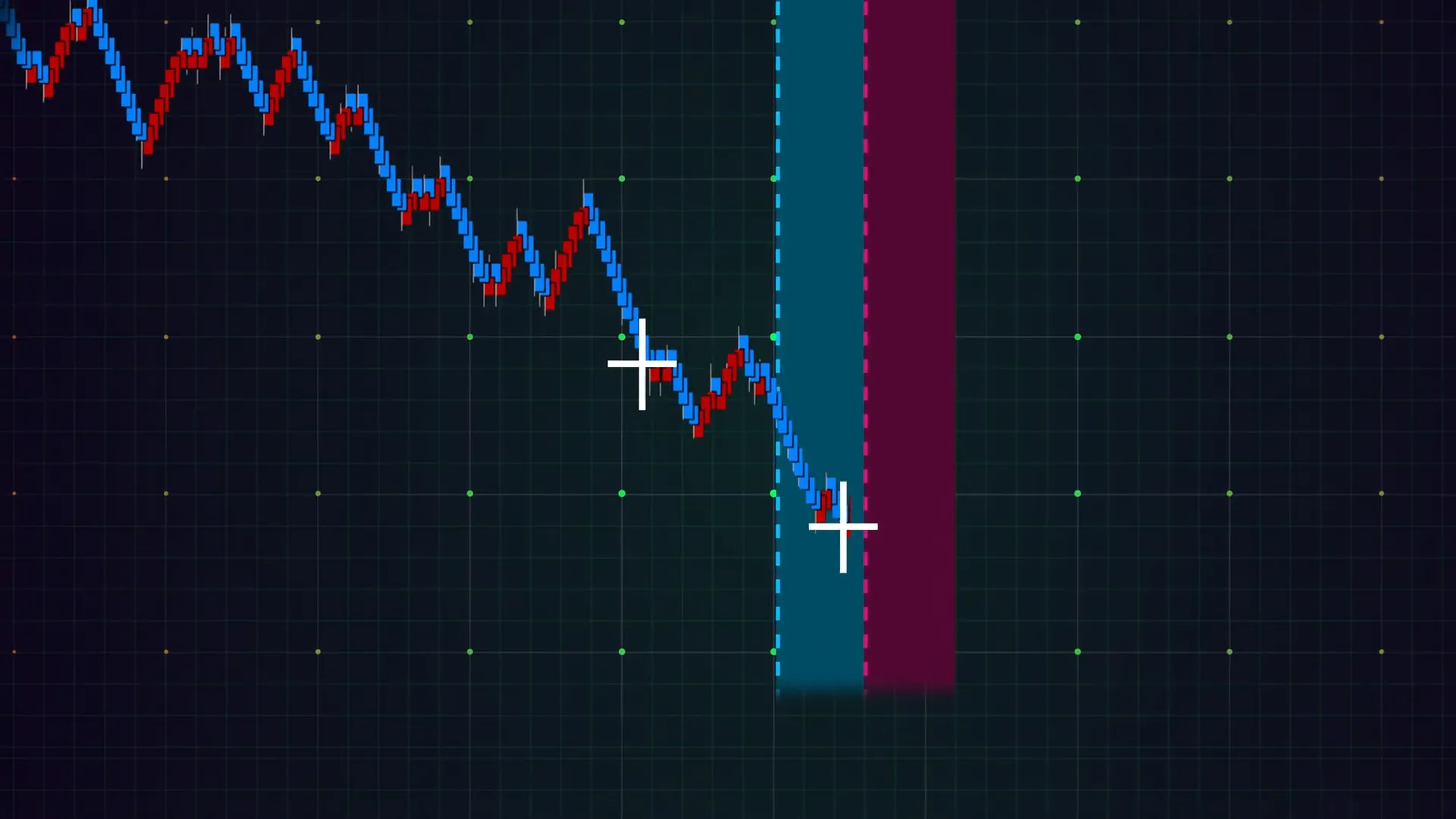

- Price continues the move; retail participants chase; after some time and price extension, a second white Flowmaster cross appears in the same leg but spaced out from the first.

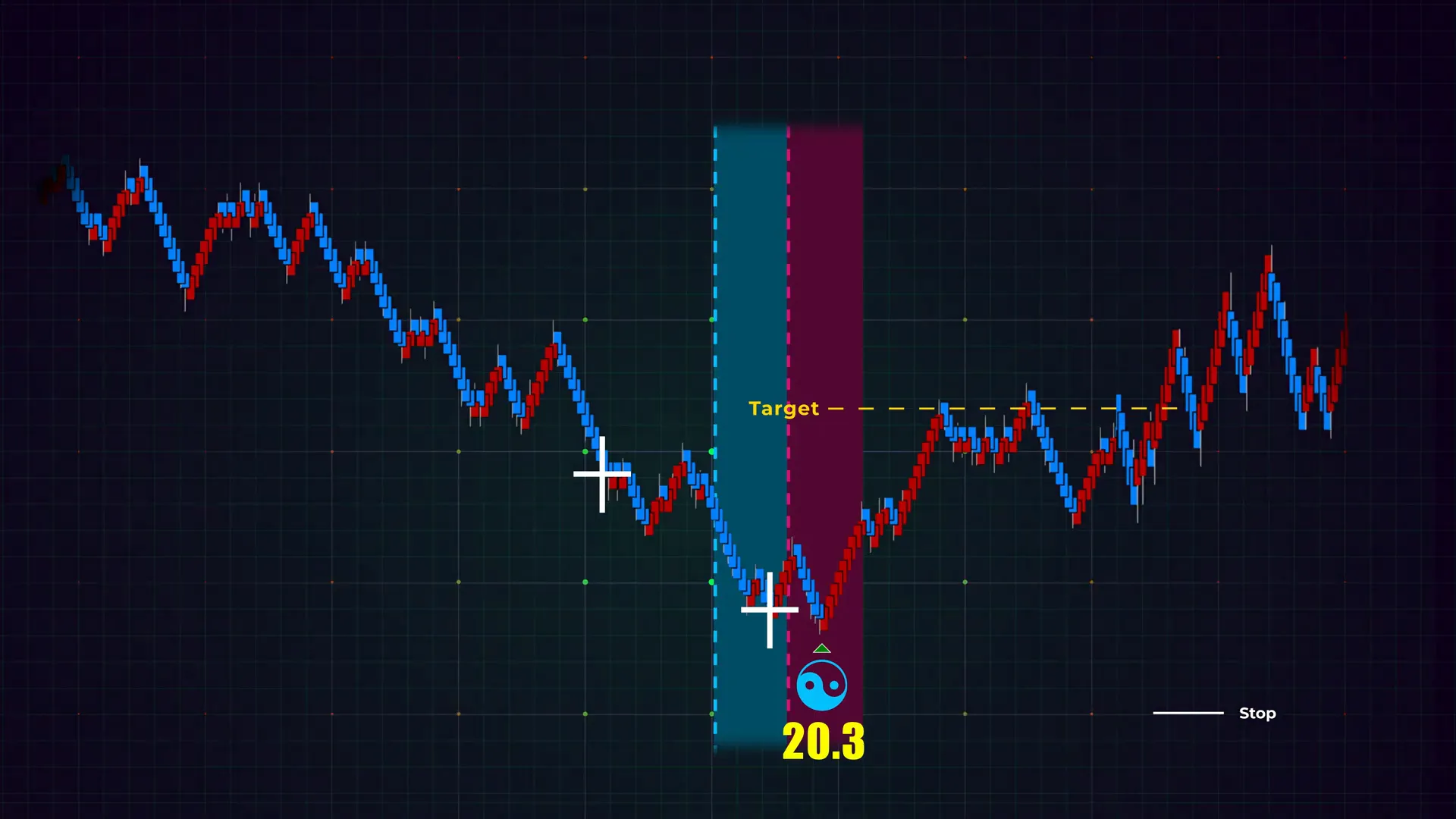

- Retail attempts often extend momentum, but at a key timing and location in the same zone, an opposite direction AlgoBox signal appears — typically a blue Enigma. The Enigma in the opposite direction provides the confirmation I need to consider an entry.

I often describe this visually: two white crosses separated across a stretched leg (the “split”), followed by a blue Enigma (the reversal clue). When this aligns with structural resistance or support, the probability of a short‑term reversal increases.

Crucially: SCR alone is not a trigger. It’s the coupling of the split cross pattern with the Enigma and supporting structural context that creates a tradable setup.

Step 4: Entry, stop and target rules

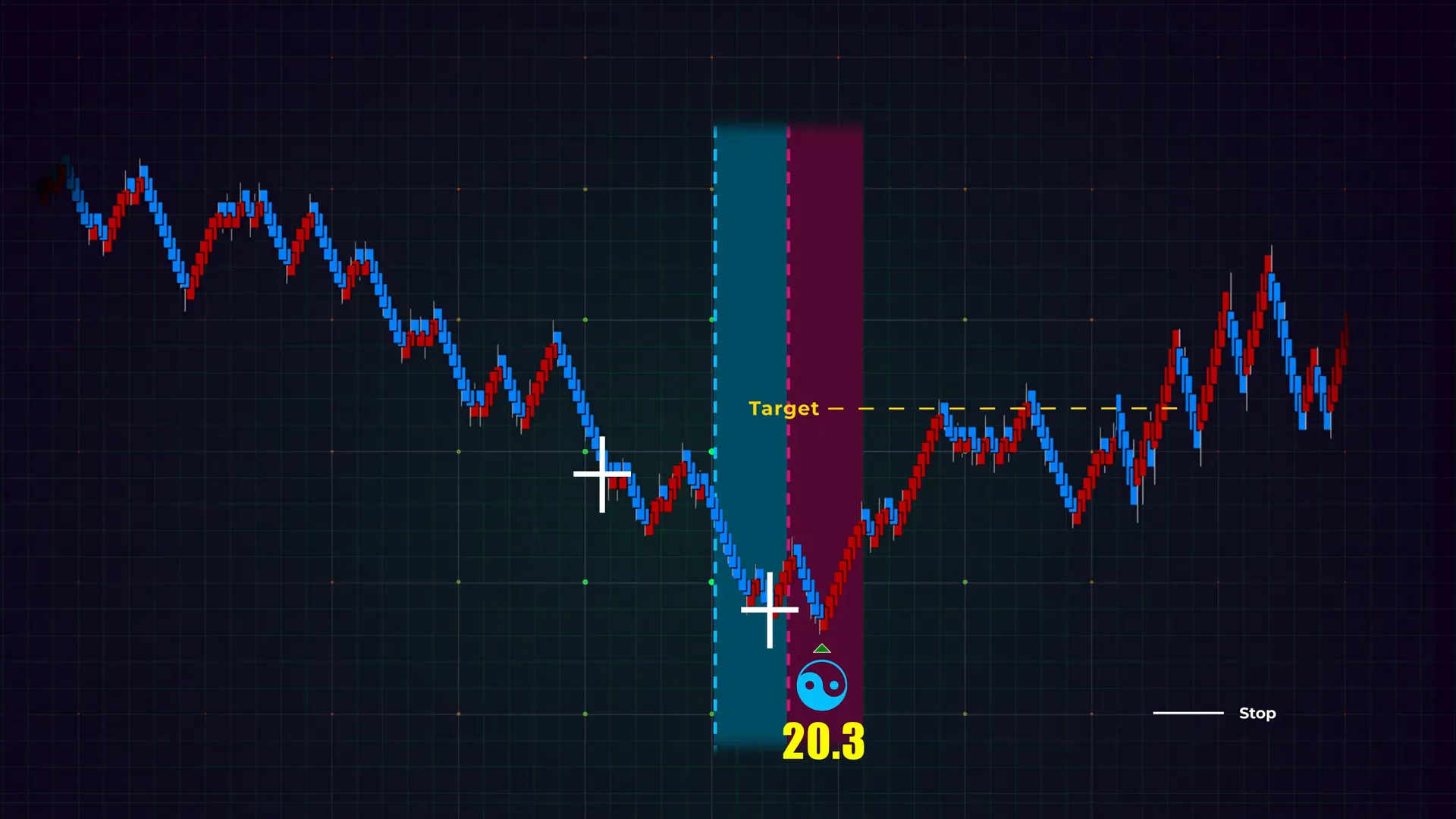

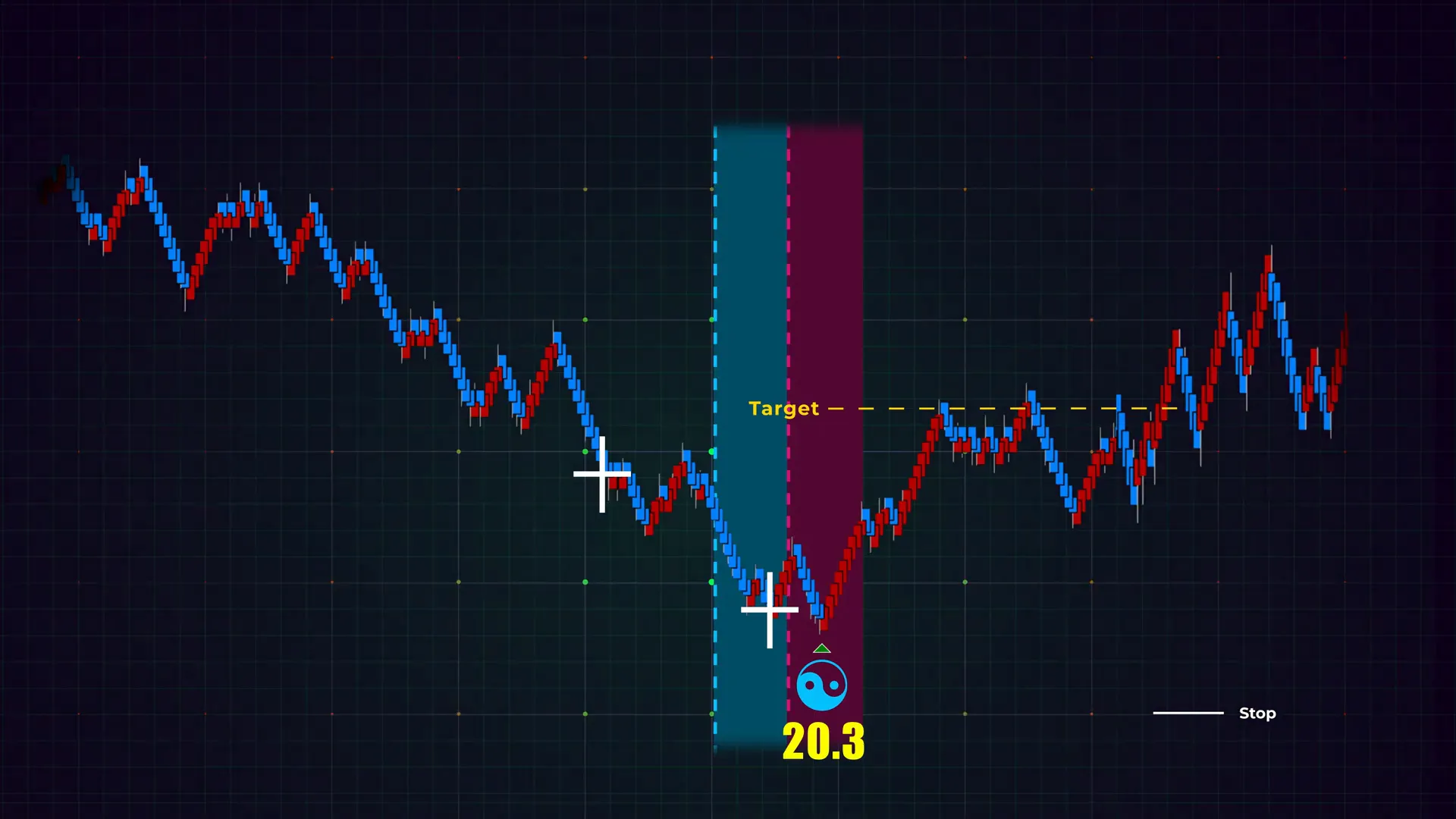

Once I see the SCR pattern and the confirming AlgoBox signal (the Enigma), I rely on a straightforward set of rules for entries, stops and targets. Rules reduce emotional decisions and keep my risk consistent.

Entry

- Primary entry is considered when the Enigma forms opposite to the retail direction in the same split cross zone.

- I prefer to enter on a break of the Enigma marker in the direction of the Enigma’s bias or on a retest of the Enigma zone if price pulls back.

- If price action is choppy or structure is unclear, I avoid entering even with an Enigma; SCR is an observational clue that needs confluence.

Stop placement

- My customary stop sits behind the Enigma marker. That means the Enigma provides a logical place to put a protective stop that’s tied to the signal’s integrity.

- Depending on volatility and instrument, I adjust stop size with ATR or tick-based measures, but the Enigma provides the structural anchor for risk management.

- I avoid moving stops to break even prematurely; instead I trail stops once the trade has achieved a predefined target.

Targets

- The Enigma has a projected line I often use as the primary target. That projected line is a useful reference because it’s derived from AlgoBox’s probabilistic projection.

- Secondary targets are placed at nearby levels of structure, S/R, or prior swing lows/highs depending on context.

- I rarely over‑extend risk for marginal targets; if the Enigma target is hit, I will either scale out or tighten stops to lock profit.

Here’s the succinct trade plan I use for SCR setups:

- Confirm split cross (two white Flowmaster crosses separated in an impulse leg).

- Wait for a blue Enigma or opposite direction AlgoBox confirmation in the same zone.

- Enter on Enigma confirmation or retest.

- Protect with stop behind the Enigma marker.

- Target the Enigma’s projected line and nearby structural levels for scaling out.

Step 5: Confluence and filters to strengthen the signal

SCR is a clue, not a standalone ticket to profit. I never take SCR in isolation. To improve win rate and reduce false signals, I require confluence from at least one — and preferably multiple — of the following:

- Structural alignment: The split cross should occur near a level that makes sense: a prior swing high/low, trendline, value area edge, or session boundary.

- Order flow confirmation: Look at volume profile shifts, footprints, or delta divergence. If the Flowmaster cross coincides with absorbing footprints or a visible change in buying/selling aggression, the signal strengthens.

- Session context: Is the move occurring during a news event, open auction, or low liquidity period? I give different weight to SCR depending on session structure.

- Momentum and volatility: A calm, choppy market will create more false SCRs. I prefer clear impulse legs with healthy volatility where the split cross pattern stands out.

- Time of day: Certain times are more prone to retail chase — late sessions or momentum exhaustion periods — which can make SCR more probable. But beware of thin liquidity at off hours.

When several of these filters align — for example, SCR at a prior resistance with an Enigma and a footprint showing absorption — I increase my position size slightly (within risk limits) because the trade has stronger edge.

Step 6: Practical execution and simulated practice

Mastery of SCR comes from repetition and disciplined simulation. I recommend the following practice routine using NinjaTrader Market Replay or any robust replay environment:

- Load a range of instruments you intend to trade (e.g., ES, NQ, CL). Watch how SCR looks across futures and FX; it can present differently.

- Use a slower playback speed at first (0.25–0.5x) and focus on spotting the two white Flowmaster crosses and measuring their spacing.

- Mark the first cross and the second cross, then note how price behaves between them. Ask: Was the second cross late retail involvement?

- When an Enigma forms opposite the retail direction, run through your entry/stops/targets as if trading live. Track whether your stop would have been hit and whether the Enigma target would have been achieved.

- Keep a trade journal that logs each example: context, signal, entry, stop, outcome, and lessons.

- Gradually speed up replay to real‑time as you gain confidence, but continue journaling for accountability.

Practice helps you internalize key timing observations such as how long retail momentum typically lasts after the second cross, and where the Enigma tends to form in relation to the split cross zone.

Step 7: Advanced nuances and common pitfalls

With experience you’ll notice subtle patterns and edge cases. Here are the advanced nuances I emphasize to students and to myself when reviewing trades.

How far apart do the crosses need to be?

There’s no fixed tick count that defines “farther apart,” because it depends on the instrument and the impulse strength. Instead I use relative measures:

- If the second cross appears after a clear retracement or continuation of the impulse for a notable distance (for example, a swing that retraces less than 50% but extends the prior leg), that’s sufficient spacing.

- On low tick instruments you can use time (e.g., the crosses separated by several bars) as an indicator of spacing.

- Key rule: the two crosses should feel like separate retail bait moments, not a rapid double‑cross pattern.

Why do retail traders get baited?

Retail traders often chase momentum because human psychology rewards “not missing out.” The market structure can intentionally expose liquidity (stop clusters, limit orders) and larger participants use that hunger to source liquidity. The SCR pattern is a way of detecting when retail impatience and liquidity seeking are likely to be exhausted.

Handling false signals

- False SCRs occur when the second cross is simply noise or when an Enigma forms but lacks supporting structure. Reduce false signals by requiring at least one additional filter (structural level or order flow confirmation).

- Don’t average into a trade purely because SCR looks good; wait for the Enigma confirmation or a price action trigger aligned with your rules.

- If you get a stop hit on an SCR trade, analyze whether you traded prematurely or if your stop placement was too tight relative to volatility.

Retail momentum lasting longer

One nuance I repeat to students: “The retail momentum tends to last a bit longer.” That means patience matters. After the second cross you may see an additional push that invalidates a premature entry. The Enigma typically appears at “king timing” — a moment where accumulated pressures shift. Trade small and wait for confirmation or structure when in doubt.

Step 8: Building a pre‑trade and trade routine

Consistency comes from routine. Here’s the checklist I follow for every potential SCR trade. You should customize this to your own preferences and instrument, but use it as a starting point:

- Market context: Check major economic releases, session bias and overnight levels.

- Instrument selection: Choose futures or FX instruments with sufficient liquidity and reasonable tick size for your account.

- Identify impulse leg: Confirm a recent strong directional move where SCR could form.

- Spot the first Flowmaster cross and mentally mark the zone.

- Watch for the second white Flowmaster cross spaced out in the same leg.

- Look for structural confluence: prior highs, lows, range extremes or S/R clusters.

- Wait for a blue Enigma or order flow reversal signal in the same zone.

- Execute entry per rule, place stop behind Enigma marker, and set Enigma projected line as target.

- Manage the trade: scale out, trail stops or take full profit as predefined.

- Journal the trade with screenshots and a note about what the trade taught you.

Having the checklist reduces impulsive entries and helps you learn from every setup.

Step 9: Example trade walkthrough

Let me walk you through a typical SCR example so you can visualize the whole process. I’ll narrate the timeline as if we were watching a replay together.

- Impulse leg development: Price starts a strong bullish impulse. I note the move and prepare for any reversal clues. The first white Flowmaster cross appears at [01:02], indicating significant order flow activity and a potential thirst for liquidity.

- First cross reaction: Price continues higher after the first cross. Retail notices and buying accelerates as momentum traders chase the breakout. I do not take action yet; the first cross is simply the initial clue.

- Second white cross appears: Later in the same impulse leg, a second white Flowmaster cross forms. It is spaced out from the first, and I mentally label this pair as a possible split cross. Retail is now deeply involved and late to the party. At this point I expect retail momentum to possibly continue for a while, so I’m patient.

- King timing — Enigma forms: As price moves within the same zone, a blue Enigma appears opposite the retail direction at a critical timing. This is the confirming AlgoBox signal that aligns with the split cross observation. The Enigma highlights a probable short‑term reversal zone and projects a target line.

- Entry trigger: I enter on a break below the Enigma marker (if shorting) or on an agreed retest area. The Enigma essentially becomes my signal to commit.

- Risk management: I place my stop behind the Enigma marker to give the trade structural logic. The Enigma projected line serves as my initial target. If price reaches the projected line, I scale out or trail to lock profits.

- Outcome: In this example, the Enigma target is reached, and the stop would have been honored had the trade gone against me. The high probability of success for this trade came from the SCR observation combined with the Enigma confirmation and the presence of structural resistance.

This is the precise sequence I teach in the AlgoBox bootcamp: spot the split cross, wait for the Enigma, trade with structure‑based stops and Enigma targets. Practice this sequence repeatedly until it becomes reflexive.

Step 10: How to continue learning (trials, bootcamps, live sessions)

If you want to accelerate learning, I recommend structured practice plus mentorship. I offer a two week trial for AlgoBox and an eight‑session bootcamp that walks you through not just SCR, but all the core AlgoBox strategies along with live trade examples and Q&A.

Live sessions are invaluable because you see the trade decision process in real time: how I judge spacing between crosses, why I accept or reject certain Enigmas, and how I size positions relative to account risk. The trial gives you hands‑on access to the indicators so you can replicate the exact setups I demonstrate.

Whether you use the trial or practice independently, the key to mastery is consistent replay work, journaling and disciplined adherence to the entry/stop/target rules.

Common trading scenarios and how I handle them

Below are several real-world scenarios you’ll encounter while looking for SCR setups, with my approach for each.

Scenario A — SCR forms but the Enigma is weak or absent

If I see the split cross but no Enigma, I treat SCR as a watchlist item. I won’t enter until I have additional confirmation such as a footprint reversal, price rejection wick, or a breakout of a micro‑structure level. Patience is critical — not every SCR becomes tradable.

Scenario B — SCR forms during a major news release

When news spikes volatility, SCR signals are less reliable because price can violently overshoot and invalidate the Enigma quickly. My rule: avoid new SCR trades within a defined window around high‑impact releases unless the signal is reinforced by institutional order flow and substantial structural context.

Scenario C — SCR on low liquidity instruments

Low liquidity exaggerates moves and creates false crosses. I recommend only trading SCR on instruments with consistent liquidity for your account (e.g., major futures contracts) and to adjust ticks/ATR stops to account for erratic spikes.

Scenario D — Broken Enigma then reformation

Sometimes price pierces the Enigma marker and then re‑forms it. In that case I evaluate whether the break was a false chop or an actual invalidation. If the Enigma fully invalidates (structure flips and higher timeframes disagree), I step aside. If it’s a false breakout and price returns to the Enigma zone with clean structure, I may re‑enter according to my rules.

Performance management and psychology

Trading SCR is part technical and part psychological. Watching setups fail can erode confidence if you don’t manage expectations. Here’s how I manage both performance and mindset:

- Small, repeatable risk: I risk a fixed percentage per trade and accept that a string of losses is possible. The goal is to trade the edge, not chase a single trade.

- Journaling: I log every signal, entry, exit and a short note about my emotional state. Over time this reveals behavioral biases and technical blind spots.

- Review cadence: I review trades weekly, focusing on setups that produced unexpected outcomes. That’s where learning accelerates.

- Acceptance of variance: No strategy wins every time. SCR improves the probability, but I prepare mentally for normal drawdowns.

Checklist: When to accept an SCR trade (my personal rules)

- Impulse leg is clean and directional with recent momentum.

- Two white Flowmaster crosses appear in the same leg with sufficient spacing.

- An Enigma forms opposite to the retail direction in the same zone.

- There is at least one additional filter: structural resistance/support, footprint absorption, or session context alignment.

- Risk–reward is acceptable based on Enigma projected line and my stop placement.

- Trade size scaled to risk tolerance and account rules.

FAQ

Q: What indicators are essential for SCR?

A: The primary indicator is the Flowmaster cross to spot order flow surges. The Enigma signal is the preferred confirmation indicator because it offers a directional bias and projected target. I also use structural overlays (prior highs/lows), footprint or volume profile for order flow confirmation, and ATR for volatility‑based stop sizing.

Q: Which markets and timeframes work best?

A: SCR is designed for liquid futures and forex instruments where order flow data is robust. I commonly trade ES, NQ and other high‑volume contracts on intraday timeframes (1‑minute to 5‑minute charts) because the splits and Enigmas appear clearly. That said, SCR can be adapted to slightly higher timeframes; you just need to scale spacing and stops accordingly.

Q: How do I size my position on SCR trades?

A: I size using a fixed percentage of account risk per trade, often 0.5%–1% depending on my confidence and the number of simultaneous trades. Position size is derived from stop distance and dollar risk. If I see multiple confirming factors (structure, Enigma, footprint), I may increase size slightly within predefined risk limits.

Q: Is SCR a scalping strategy or a swing strategy?

A: SCR is primarily an intraday, short‑term reversal strategy. Targets are usually short to medium intraday moves (often single‑digit to low‑double digit ticks on futures depending on instrument). It’s not intended for holding through large trend reversals unless additional structure supports a longer hold.

Q: How long should I practice before trading SCR live?

A: That depends on your background, consistency, and psychological readiness. I recommend at least 2 weeks of focused Market Replay practice with daily journaling, but many traders will need several months to achieve reliable edge. Use simulated accounts, track performance and only go live after consistent positive expectancy in simulation.

Q: How does SCR handle trend trades?

A: SCR is a reversal observation, so in strong trending environments I use it conservatively. If the broader trend is powerful and institutional order flow supports continuation, SCR may produce only modest pullbacks before trend resumes. I either trade SCR as a counter‑trend scalp with tight risk or skip SCR during strong trend bias unless the Enigma and higher timeframe structure indicate a meaningful reversal.

Conclusion

The Split Cross Reversal is one of those patterns that rewards careful observation, disciplined confirmation and repetition. It’s not a magic bullet, but when combined with the Flowmaster cross, Enigma confirmation and structural filters, it becomes a practical short‑term reversal tool for the AlgoBox toolkit. My advice: practice in NinjaTrader’s Market Replay, keep a meticulous journal, and apply strict risk management. Over time you’ll internalize the spacing between crosses, learn the “king timing” when the Enigma forms, and develop the instincts necessary to trade SCR confidently.

If you want guided learning, start with the two‑week AlgoBox trial and join the eight‑session bootcamp. Those live sessions show how I apply SCR and other AlgoBox strategies in real time and give you a framework to build consistent edge. Subscribe to live training and keep practicing — I’ll see you in the next session.

This article was created from the video SPLIT CROSS REVERSAL Strategy 🟪 NinjaTrader Futures | AlgoBox Training with the help of AI.