Welcome to Day 3 of the Algo Futures Trading Course! In this comprehensive lesson, we dive deeper into algorithmic trading tailored for NinjaTrader users. Whether you’re a beginner or have some experience, this guide will walk you through essential concepts, tools, and strategies to elevate your futures trading game. The insights and techniques shared here are designed to empower you to trade smarter, manage risk efficiently, and harness the power of algorithmic tools to generate consistent income.

This course is brought to you by Vinny Emini, a seasoned trader and NinjaTrader expert, who shares his personal trading philosophy, practical setups, and advanced techniques that have helped him and many others succeed in the futures markets.

Table of Contents

- Step 1: Setting Up Your Trading Environment

- Step 2: Understanding Algo Bars and Contract Rollover

- Step 3: Navigating Trading Sessions and Market Timing

- Step 4: Leveraging the Time Regions Indicator

- Step 5: Managing Scheduled and Unscheduled News

- Step 6: Using the Trade Tracker to Prevent Overtrading

- Step 7: Position Sizing and Risk Management

- Step 8: Mastering Stops and Targets with the Position Manager

- Step 9: Embracing the Trading Mindset and Continuous Improvement

- Step 10: Utilizing Additional Tools for Visual and Analytical Support

- Conclusion: The Path to Becoming a Better Algo Futures Trader

Step 1: Setting Up Your Trading Environment

Before diving into strategies and trade executions, having the right setup is crucial. From hardware to software, your workspace must be optimized for focus and efficiency.

- Workspace Setup: Ensure your desk layout supports multiple monitors, a reliable keyboard, and mouse. Proper ergonomics help reduce fatigue during long trading sessions.

- Hardware: Even if you have an older machine, like an Intel i5, you can still run multiple chart layouts effectively. Vinny uses a three-chart flag layout on his laptop, demonstrating that you don’t need top-tier hardware to start trading.

- Software Installation: NinjaTrader must be installed and configured correctly. Alongside this, setting up your data feeds and AlgoBox indicators is essential to access real-time order flow and harmonic patterns.

If you haven’t completed these steps yet, pause your progress, get everything set up, and then return to continue learning.

Step 2: Understanding Algo Bars and Contract Rollover

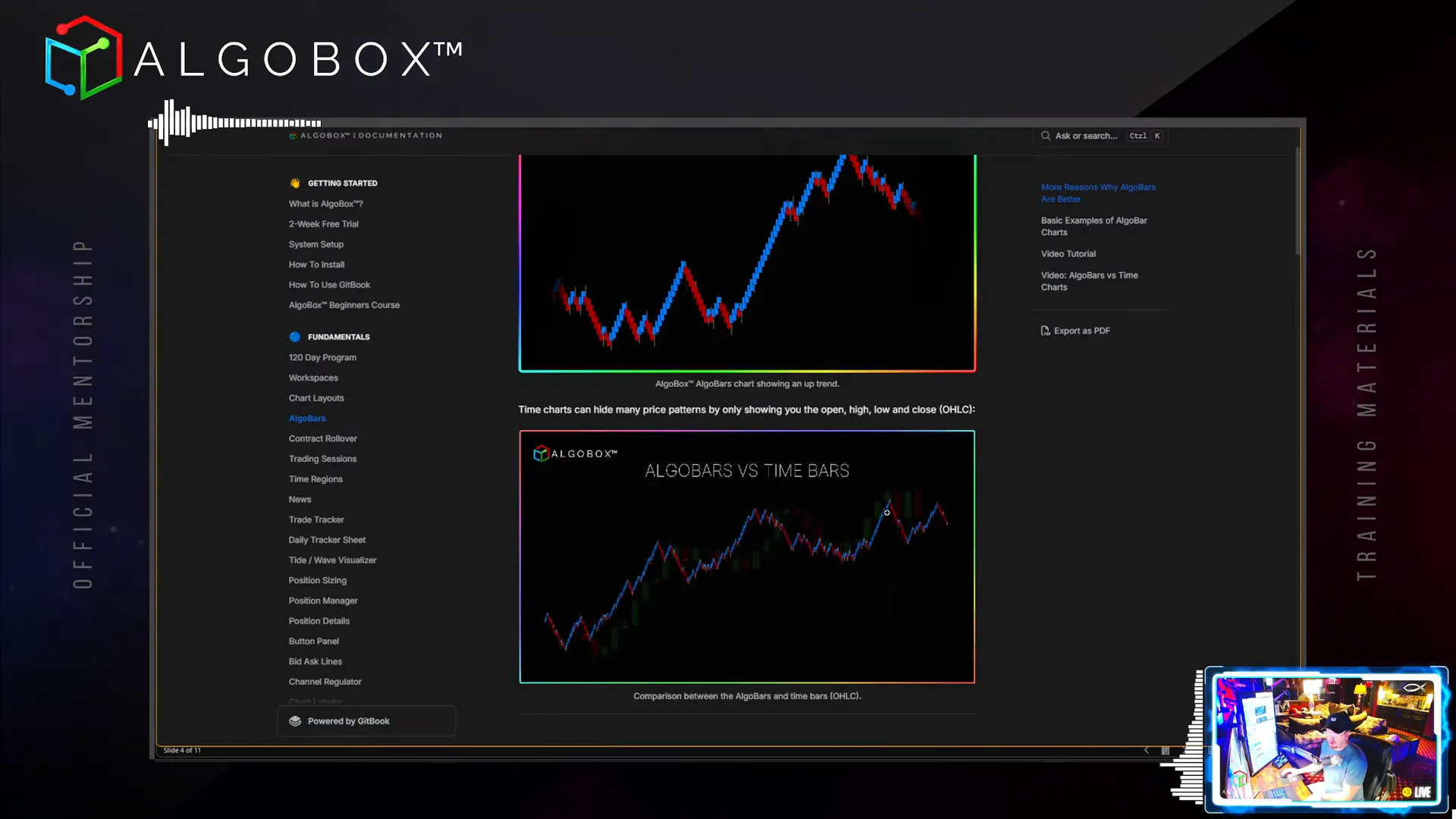

Algo bars are a core component of the trading system. Unlike traditional time bars, algo bars are based on price movement or volume, which allows you to see market patterns more clearly and trade with precision.

Vinny highlights that the system uses range bars and other algo bars instead of time bars to better capture market dynamics. For detailed setup, visit docs.algoboxpro.com.

Contract Rollover Explained

Contract rollover is a critical concept especially for futures traders. It refers to the process of moving from one expiring futures contract to the next active one. This is necessary because futures contracts have expiration dates and trading the correct contract ensures liquidity and accurate pricing.

Here’s what you need to know:

- Frequency of Rollovers: Most U.S. equity index futures roll over quarterly (four times a year). Crude oil futures roll over monthly, which means more frequent adjustments.

- Rollover Dates: These vary by instrument. For example, metals like gold and silver roll over every two months (bimonthly).

- Indicators to Help: The AlgoBox contract rollover indicator automatically marks rollover dates on your charts, helping you avoid confusion and ensure you’re trading the correct contract.

Vinny emphasizes that rollover is just a button click in NinjaTrader, often done on the Friday after the close, making the transition seamless.

Step 3: Navigating Trading Sessions and Market Timing

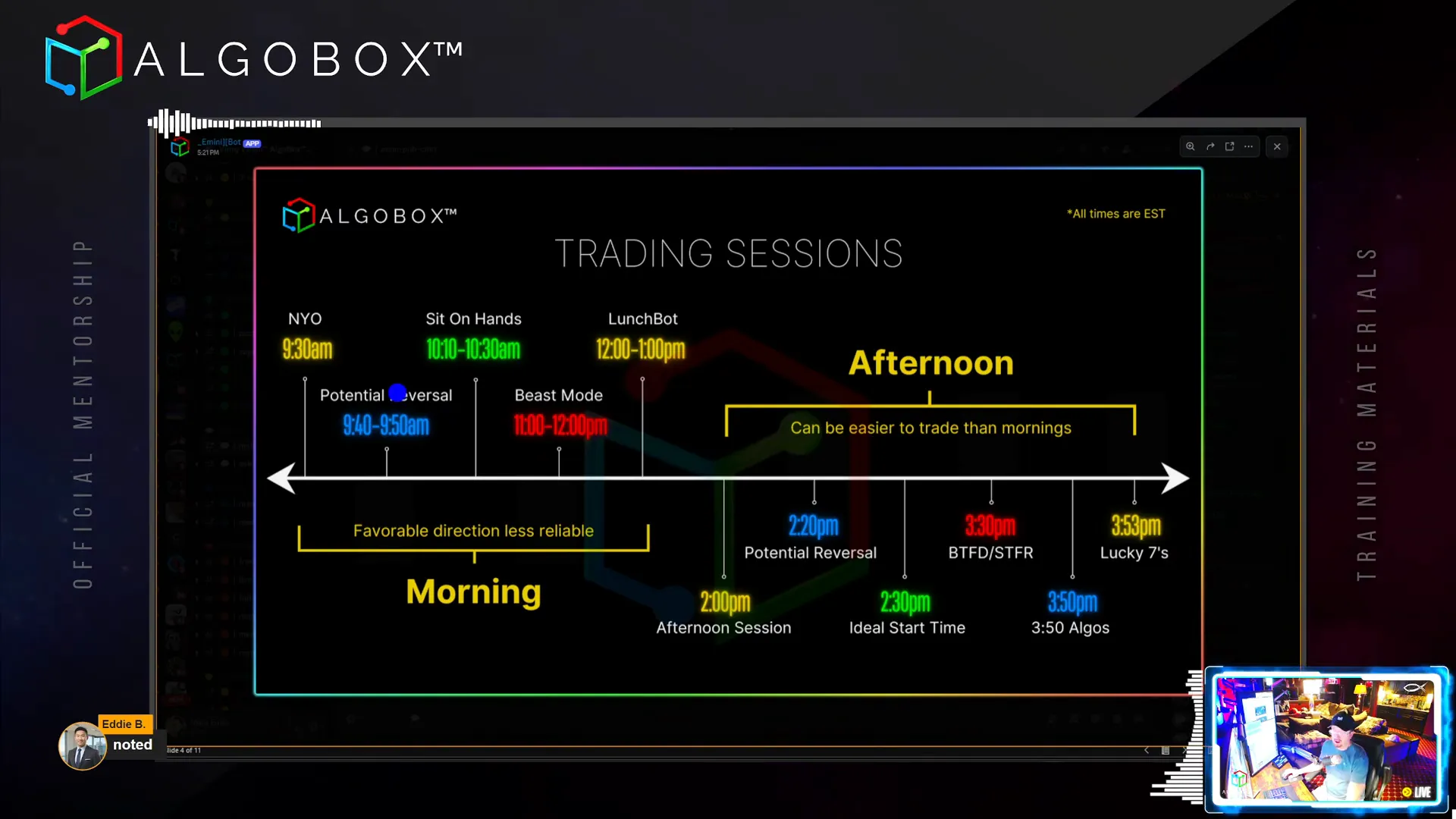

Understanding trading sessions is vital for timing your trades and knowing when the market is most active or volatile.

Vinny uses Discord commands like !sessions to access detailed schedules and insights on market behavior during different times of the day.

Key Trading Sessions

- New York Open (9:30 AM – 4:00 PM ET): High liquidity and volatility. Initial 30 minutes are often driven by “forced hands” such as 401(k) contributions and overnight orders.

- Potential Reversal Zone (9:40 – 9:50 AM): Known as the “whiskers zone,” this is a common timeframe for significant reversals. Traders like Whiskers make their living trading this window.

- Coffee Time / No Trade Zone (10:10 – 10:30 AM): A period to sit on your hands and avoid trading due to choppy market conditions and frequent fakeouts.

- Beast Mode Hour (11:00 AM – 12:00 PM): When the market often accelerates with strong trends. Vinny prepares for this session carefully.

- LunchBot Session (12:00 PM – 1:00 PM): An automated trading bot runs during this period, requiring your clock to be set to Eastern Time.

- Afternoon Session and Close: Includes key plays like BTFD (Buy The F***ing Dip) and STFR (Sell The F***ing Rip), which often occur in the last 30 minutes of trading.

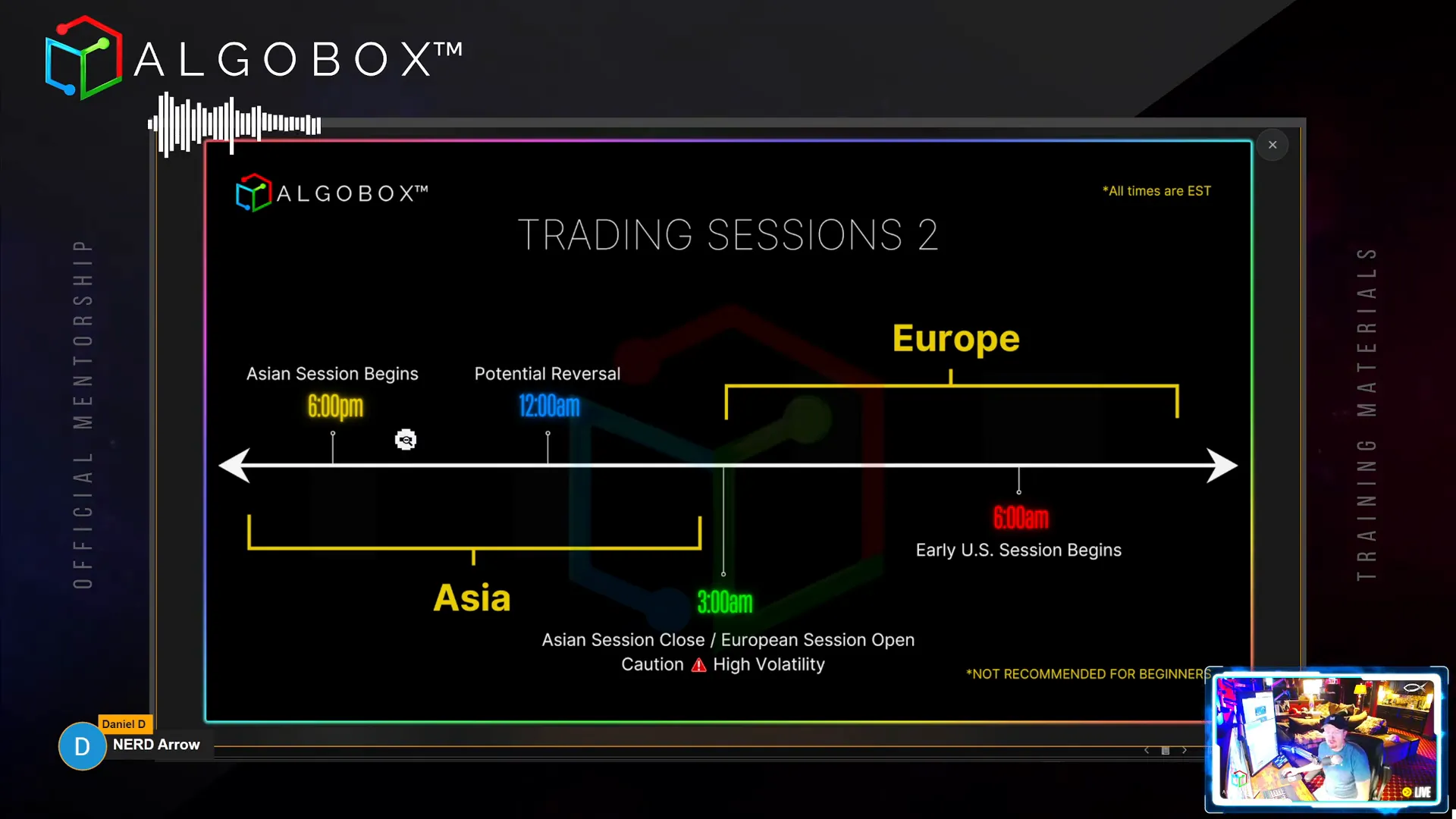

After Hours and International Sessions

Vinny also highlights the importance of understanding after-hours trading, including the Asian and European sessions, which can provide unique opportunities due to their distinct volatility patterns.

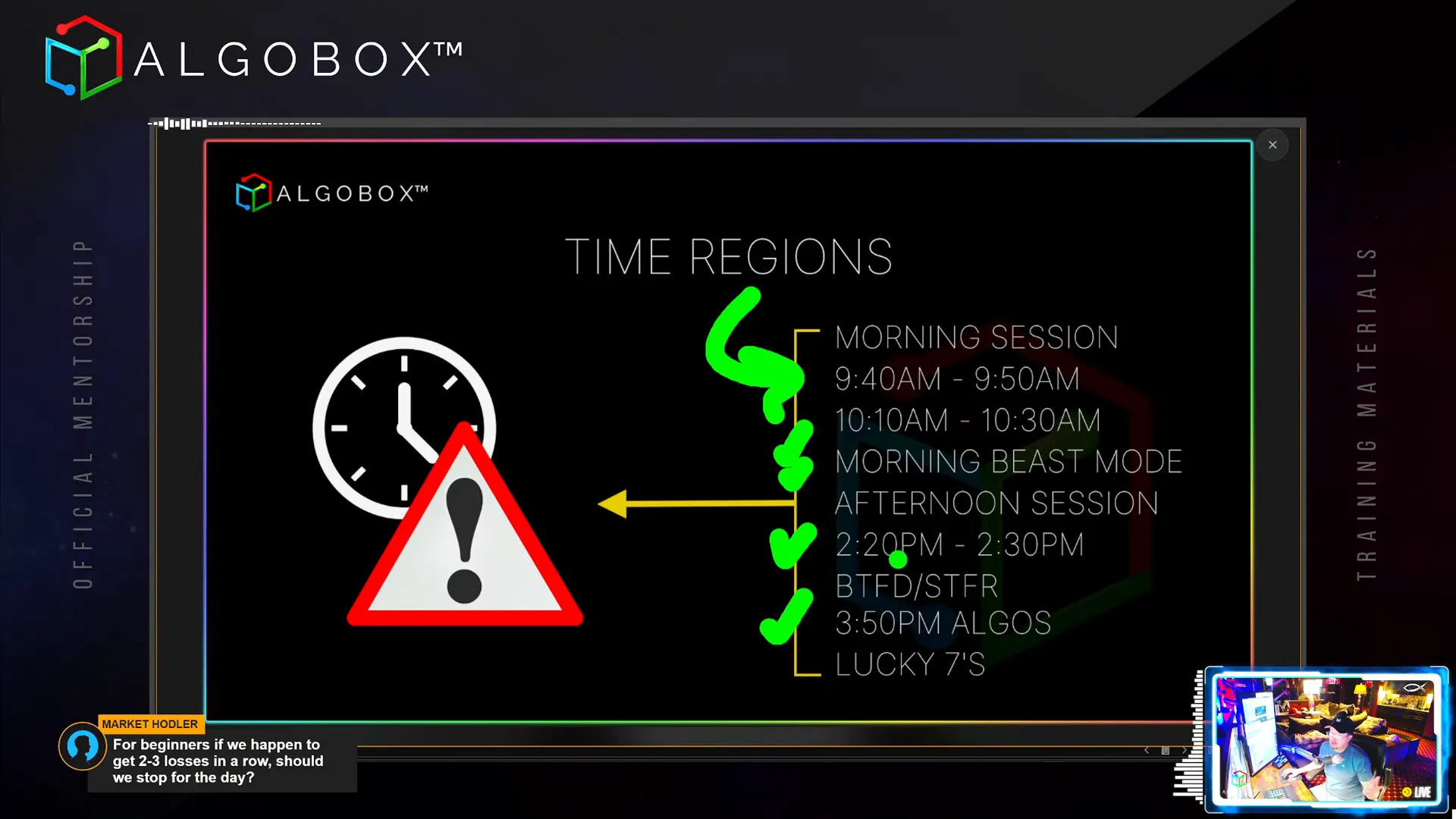

Step 4: Leveraging the Time Regions Indicator

The Time Regions Indicator is an advanced tool designed to visually alert traders to important time zones and sessions on their charts. This helps reduce reliance on memory and ensures you don’t miss critical trading windows.

- Highlights zones such as the 9:40-9:50 reversal window, the no-trade zone, Beast Mode hour, and the afternoon BTFD/STFR periods.

- Customizable colors and alert timings let you tailor the indicator to your preferences.

- Can be toggled on and off for specific sessions to avoid clutter.

This tool is essential for beginners and intermediate traders to maintain discipline and trade during optimal market conditions.

Step 5: Managing Scheduled and Unscheduled News

News events can cause significant volatility and impact your trading. Vinny categorizes news into two types:

- Scheduled News: These are pre-announced events like economic reports, earnings, and FOMC meetings.

- Unscheduled News: Sudden events like tweets or unexpected political announcements.

Key guidelines for trading around news:

- Avoid trading 2 minutes before and 3 minutes after scheduled news releases to prevent slippage and erratic price action.

- Use Discord commands like

!newsor!news tomorrowto stay updated on upcoming news. - Keep a dedicated news feed channel open to monitor real-time news flow.

Understanding how to manage news is crucial to avoid unnecessary losses and capitalize on predictable volatility.

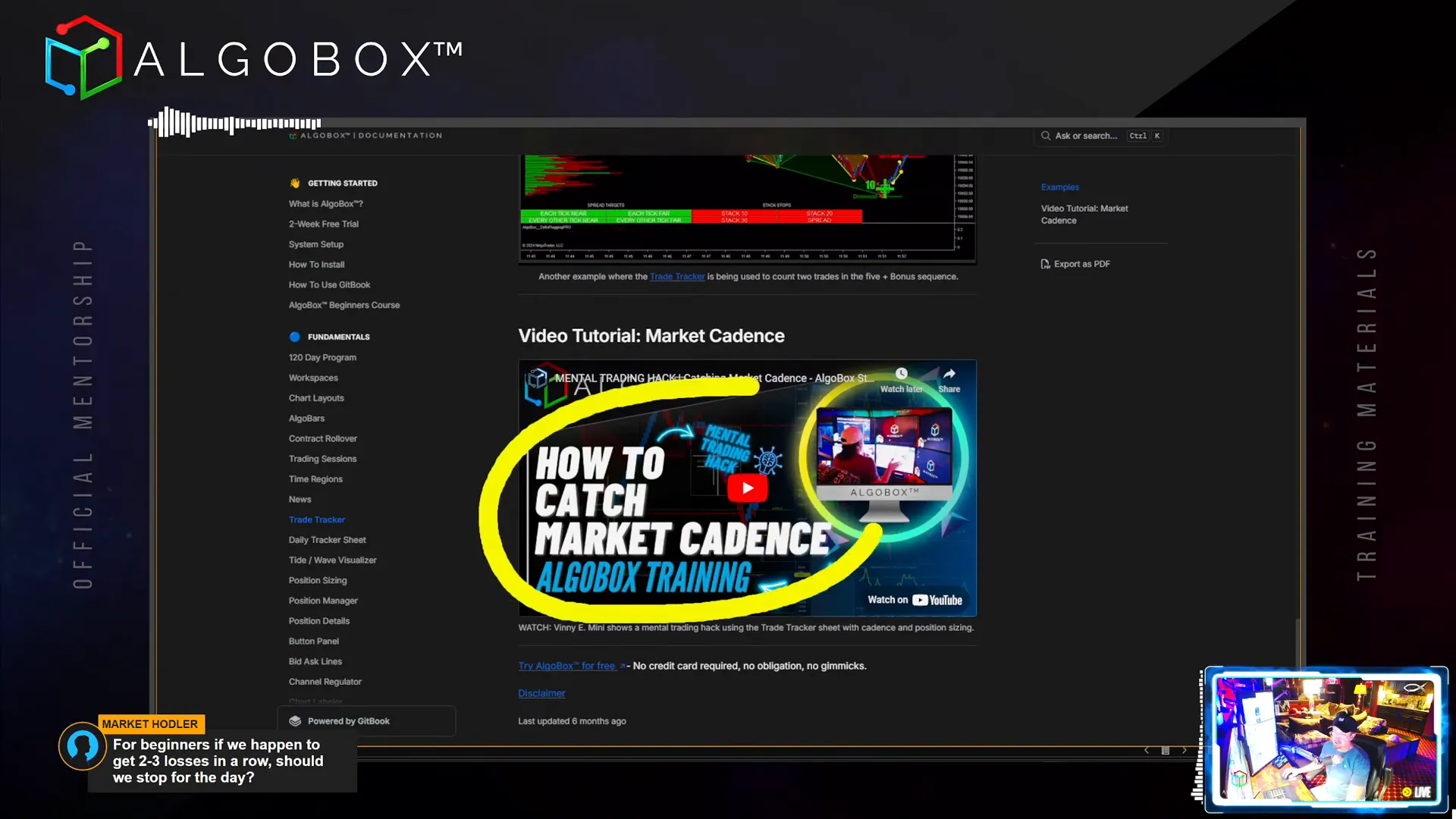

Step 6: Using the Trade Tracker to Prevent Overtrading

Overtrading is a common pitfall for many traders. To combat this, Vinny recommends using an electronic Trade Tracker tool that helps you monitor your trades visually and audibly.

- Track your trade count from “Toe in the Water” (small initial position) to “Full Plus Bonus” (max position size).

- Increase trade size gradually from trades 1 through 5, adjusting risk accordingly.

- Use sound effects as cues to reinforce discipline and prevent impulsive trades.

The Trade Tracker also features a coin flip mechanic to mark trades as winners or losers, helping maintain mental clarity and focus on the next opportunity.

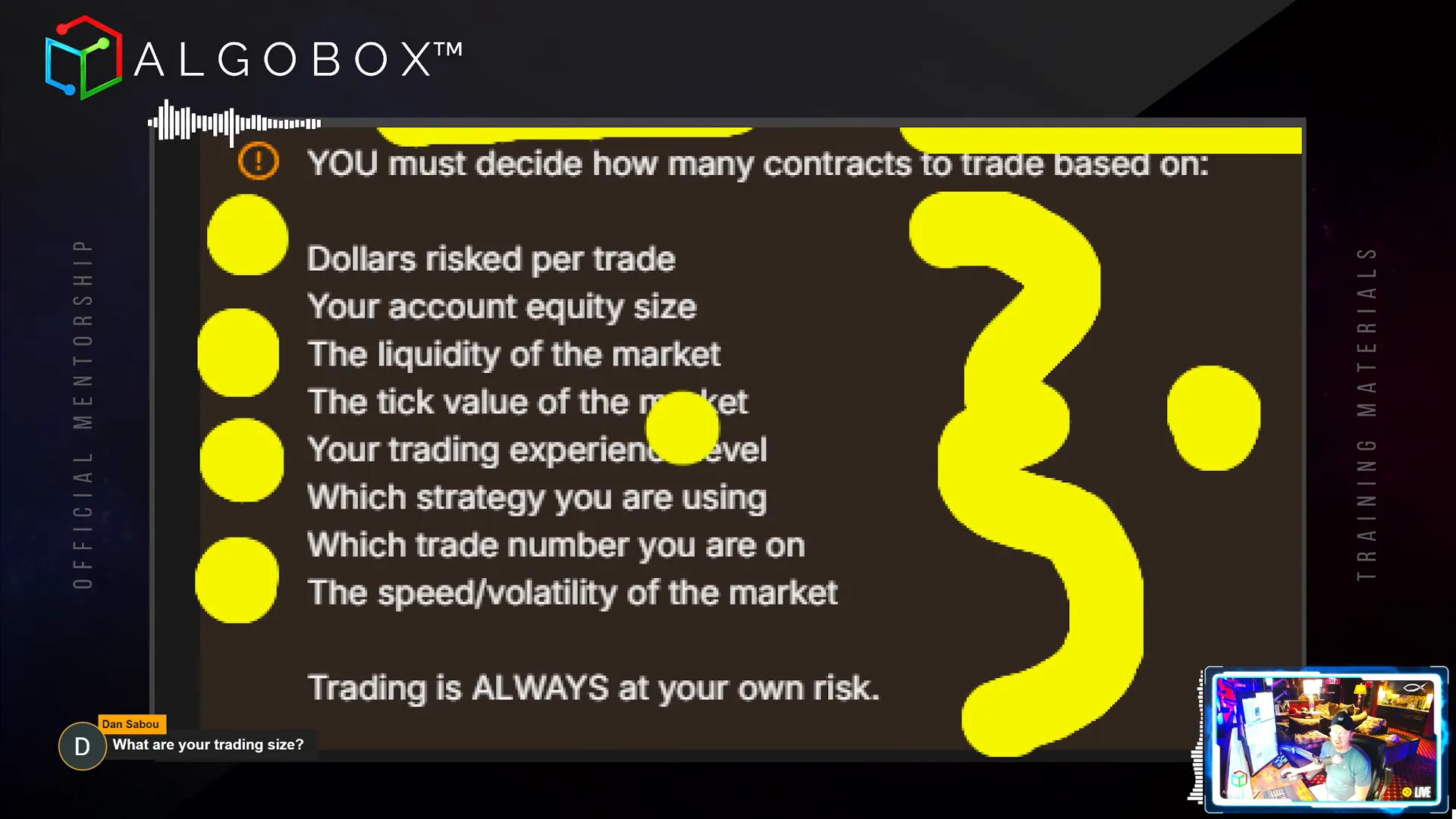

Step 7: Position Sizing and Risk Management

Proper position sizing is the backbone of successful trading. Vinny emphasizes that even multiple losses can be recouped with one well-sized winning trade if you manage your position size correctly.

- Size your trades based on dollars risked per trade, your account equity, and market liquidity.

- Adjust trade size depending on the time of day, market session, and your current P&L.

- Use incremental sizing like 1, 2, 4, 8, 10 contracts or 2, 4, 8, 16 depending on your style and risk tolerance.

- Understand the tick value of each instrument (e.g., ES, NQ, FDAX) and how it affects monetary risk.

Vinny also advises against blindly following Martingale strategies and encourages disciplined, measured sizing aligned with your trading plan.

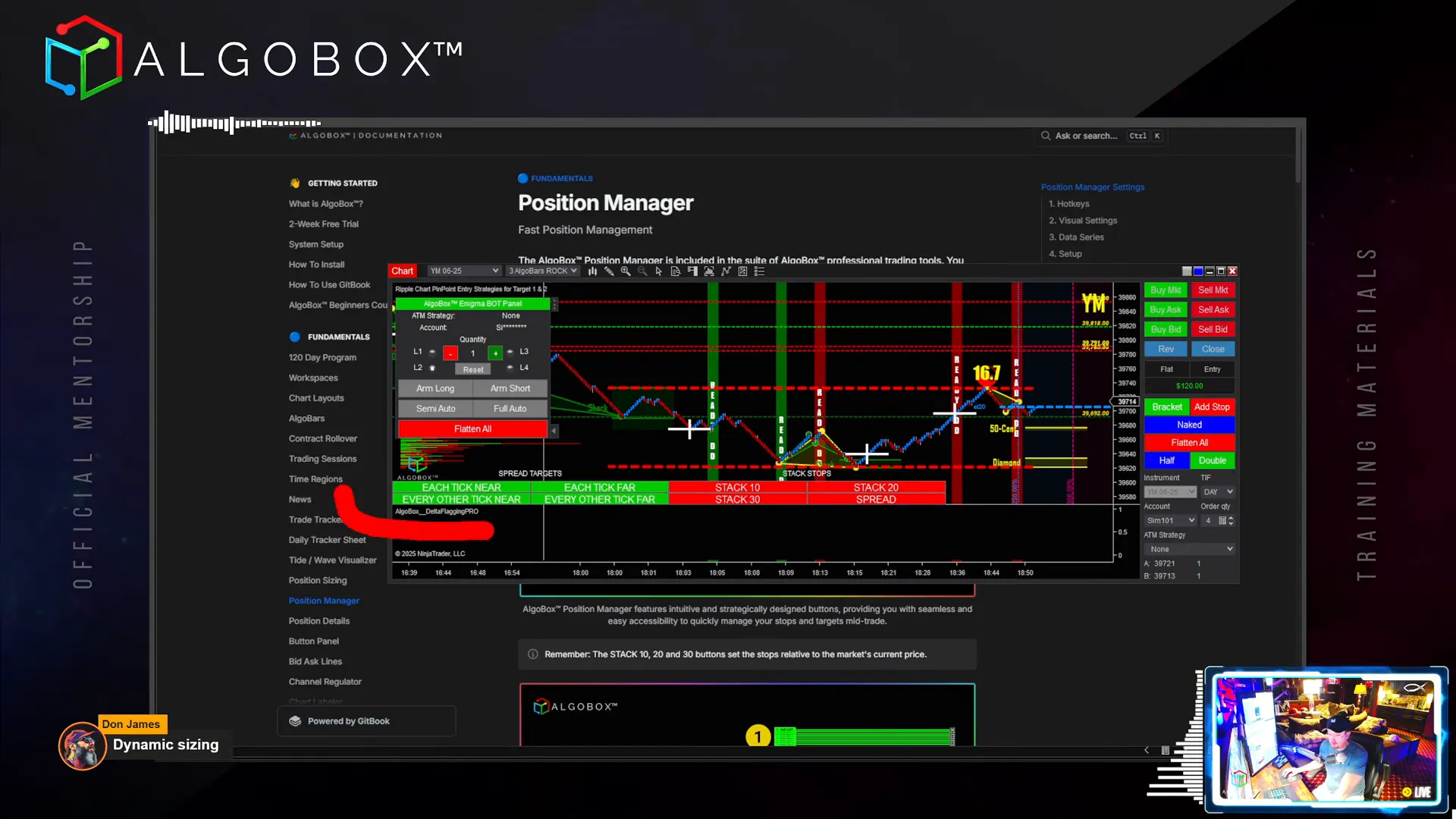

Step 8: Mastering Stops and Targets with the Position Manager

The AlgoBox Position Manager is a powerful tool that simplifies stop loss and target management with one-click buttons. This tool is especially useful in fast-moving markets and for managing multiple contracts efficiently.

- Set stops relative to the current market price, not the entry price.

- Use buttons like “Each Tick Near” (ETN), “Every Other Tick Near” (EOTN), “Stack 10,” “Stack 20,” and “Spread” to organize stops and targets.

- Customize colors and hotkeys to suit your preferences.

- Quickly flatten positions, add stops, or adjust targets without tedious manual dragging.

This tool is exclusive to AlgoBox and significantly enhances trade management efficiency.

Step 9: Embracing the Trading Mindset and Continuous Improvement

Vinny stresses that trading success is as much about mindset as it is about tools and strategies. Here are some key takeaways:

- Cadence: Learn to catch market rhythm and sequence your trades accordingly. Look for one good trade to recover from losses rather than quitting after a few losing trades.

- Discipline: Use the word “Nope” decisively to exit bad trades quickly and avoid letting losses spiral.

- Continuous Learning: Watch live streams, review recordings, and learn from traders better than yourself. Vinny recommends watching at least twelve live streams in reverse order to absorb the latest techniques.

- Replace Bad Habits: You cannot erase bad habits; you must replace them with better ones by consistently practicing correct techniques.

- Manage Mental Health: Trading is mentally demanding. Be prepared for the psychological challenges and avoid trading if mental health is compromised.

- Take Breaks: Limit trading sessions to 60-90 minutes to maintain peak concentration, then take breaks to recharge.

Trading is like riding a bull or fighting Mike Tyson—you want to get in, make your points, and get out before getting hurt.

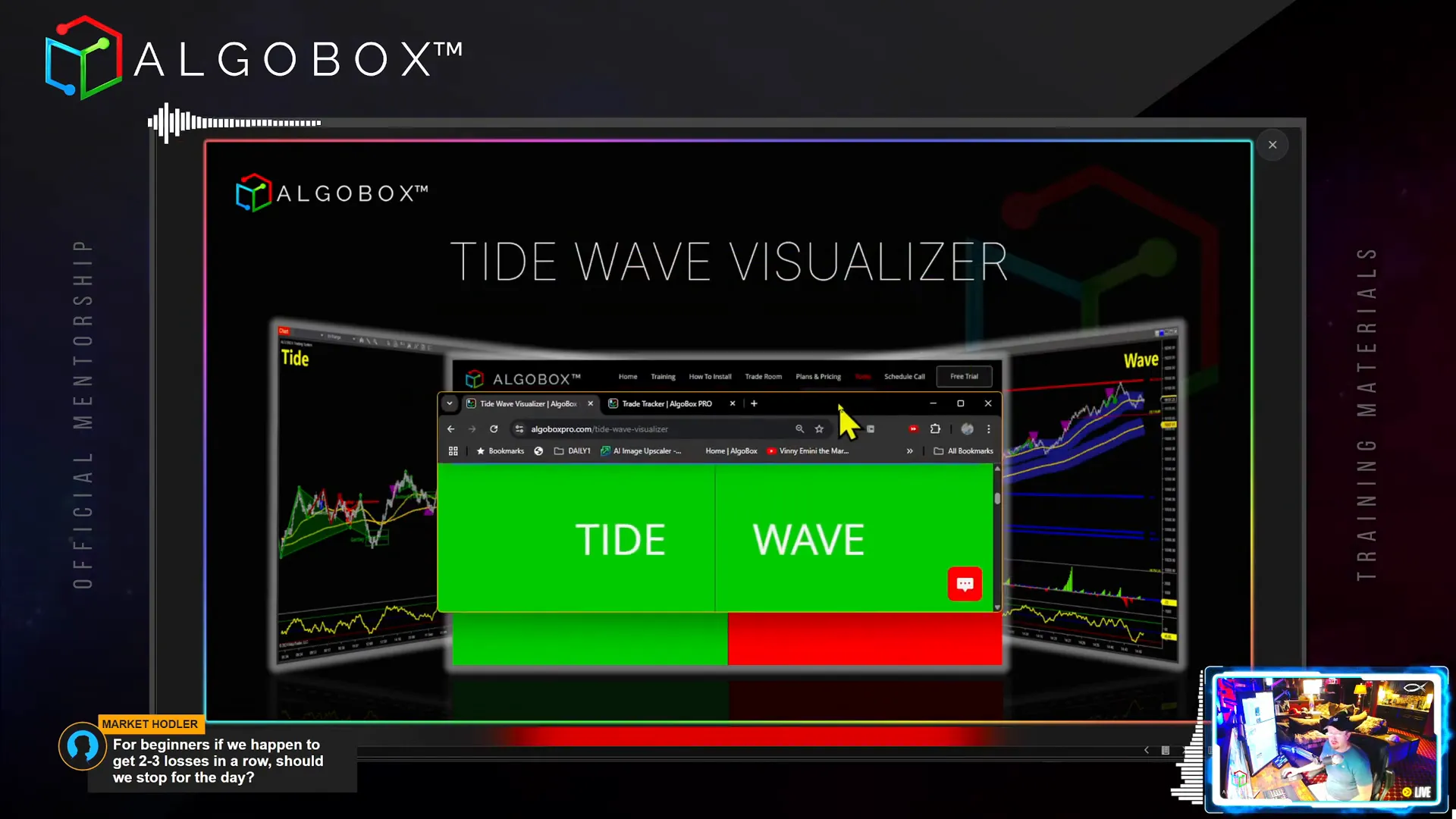

Step 10: Utilizing Additional Tools for Visual and Analytical Support

Vinny introduces several tools that complement your trading system:

- Daily Tracker Sheet: An Excel-based tool to track your daily P&L and monitor your progress over months and years.

- Tideway Visualizer: A visual indicator showing market trend strength with bright colors to remind you to trade with the trend rather than against it.

- News Indicator: Displays scheduled news events directly on your charts with customizable alerts and positioning.

These tools help maintain situational awareness and reinforce disciplined trading habits.

Conclusion: The Path to Becoming a Better Algo Futures Trader

Day 3 of the Algo Futures Trading Course is packed with actionable insights and practical tools. From setting up your workspace and understanding contract rollovers to mastering session timings, managing risk, and refining your mindset, every step is designed to elevate your trading skills.

Remember, success in trading is a combination of the right tools, disciplined execution, continuous learning, and a resilient mindset. Use the resources like AlgoBox indicators, trade trackers, and the position manager to streamline your process. Stay engaged with live streams and community discussions to keep improving.

Trading is a journey, much like riding a bull—you need to know when to get on, how to hold on, and when to get off. With persistence, practice, and the strategies outlined here, you can make that ride profitable and enjoyable.

For more resources, tools, and live trading sessions, visit algoboxpro.com and join the vibrant AlgoBox community.