Welcome to the ultimate guide on algorithmic futures trading using AlgoBox for NinjaTrader, crafted by Vinny Emini, a renowned futures trader and NinjaTrader expert. This comprehensive step-by-step tutorial is designed to help traders, from beginners to advanced, understand and leverage AlgoBox’s powerful multi-timeframe algorithmic day trading platform. Through this article, you’ll learn how to set up your trading environment, grasp AlgoBox’s core philosophy, explore its key features, and begin your journey toward trading smarter and more efficiently.

AlgoBox combines the best in algorithmic trading, order flow analysis, and harmonic structures to provide traders with a unique edge. Whether you’re new to trading or looking to sharpen your skills, this guide will walk you through everything you need to know to get started and thrive.

Table of Contents

- Step 1: Understanding AlgoBox and Its Philosophy

- Step 2: The Power of Combining Multiple Tools – Trade Nothing Alone

- Step 3: Live Streams, Community, and Mentorship

- Step 4: Essential Community Tools and The NERD Concept

- Step 5: Tracking Your Trading and Managing Risk

- Step 6: Introducing AlgoBox GPT – Your 24/7 Trading Assistant

- Step 7: Installation and Setup – Getting AlgoBox Running

- Step 8: Navigating the AlgoBox Interface and Multi-Timeframe Setup

- Step 9: Understanding AlgoBars and Range Bars

- Step 10: AlgoBox Strategies – The Two Pillars of Trading

- Step 11: Trade Management with ATM Strategies

- Step 12: Technical Support and Community Engagement

- Step 13: Data Connectivity and Broker Compatibility

- Step 14: Optimizing PC Performance and Workspaces

- Step 15: Hardware Recommendations for Efficient Trading

- Step 16: Essential Financial Tools and News Feeds

- Step 17: Educational Resources and AlgoBox YouTube Channels

- Step 18: The Flowmaster™ AudioBox – Hearing the Market

- Step 19: Comprehensive Course Syllabus and Testing Your Knowledge

- Step 20: Final Thoughts and Market Edge for Individual Traders

- Conclusion

Step 1: Understanding AlgoBox and Its Philosophy

AlgoBox is a multi-timeframe algorithmic day trading platform that blends structural analysis with real-time order flow events. The platform’s two primary filters are:

- Structural Patterns: Including wedges, trend lines, channels, and, most importantly, harmonics. Harmonics combine multiple Fibonacci levels in a series, helping anticipate new market movements.

- Real-Time Order Flow Analysis (RTOFA): Also known simply as order flow in the industry, this filter provides insights into the activity of big players and retail traders on the tape.

AlgoBox’s goal is to identify Potential Reversal Zones (PRZ) where price action is likely to pivot. Vinny argues that every trader, knowingly or not, is essentially a pullback or reversal trader, seeking optimal entry points at pivots.

AlgoBox’s system has been under development for over 15 years, with the current version 10.55 launched publicly in 2016. It’s designed to simplify algorithmic trading, making it accessible and fun, much like playing a video game such as the classic Frogger, where you aim to navigate safely through obstacles to reach your goal.

Step 2: The Power of Combining Multiple Tools – Trade Nothing Alone

The core philosophy of AlgoBox is “Trade Nothing Alone.” This means you never rely on a single indicator or signal. Instead, the system combines multiple powerful components to pinpoint high-probability trade entries.

For example, when multiple structural patterns align with several RTOFA events in one centralized location, it forms a significant area of interest. AlgoBox also detects trapped retail traders and algorithmic activity from big players, giving traders a superior edge.

The platform translates this complex data into a user-friendly, video game-like interface with audio and visual cues, helping traders react quickly and confidently.

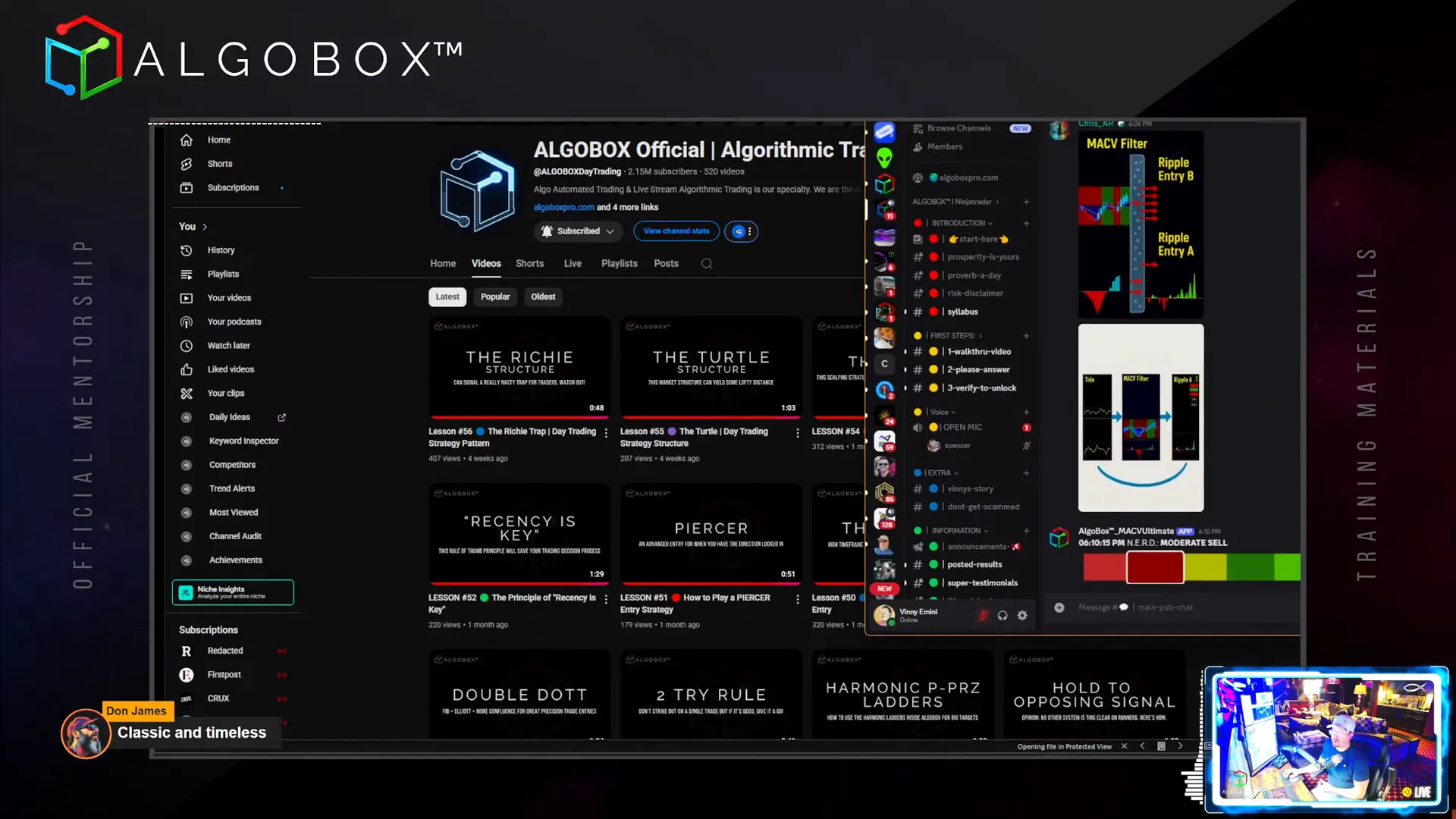

Step 3: Live Streams, Community, and Mentorship

AlgoBox offers almost daily live streams to support traders at all levels. Vinny and other experienced traders provide mentorship, answer questions, and demonstrate real-time trading strategies.

Special sessions include:

- Mentorship Mondays: Interactive algorithmic trading mentoring with live Q&A.

- Friday Sessions: Advanced-level questions and strategies.

Live streams showcase the power of AlgoBox’s tools in action, reinforcing learning with hands-on examples.

Step 4: Essential Community Tools and The NERD Concept

The AlgoBox community provides a suite of free tools to enhance your trading experience, even if you’re not an AlgoBox user. One of the flagship tools is the MacV Ultimate Tool, a directional bias filter across multiple instruments.

At the heart of this is the NERD – an acronym representing four correlated futures instruments:

- N – Nasdaq

- E – ES (E-mini S&P 500)

- R – RTY (Russell 2000)

- D – Dow (YM)

These instruments typically move in tandem, so trading in the direction of the NERD increases the odds of success by aligning with broader market trends.

Another helpful tool is the Tide Wave Visualizer, which displays high timeframe bias using color-coded blobs, allowing traders to quickly gauge market direction at a glance.

Step 5: Tracking Your Trading and Managing Risk

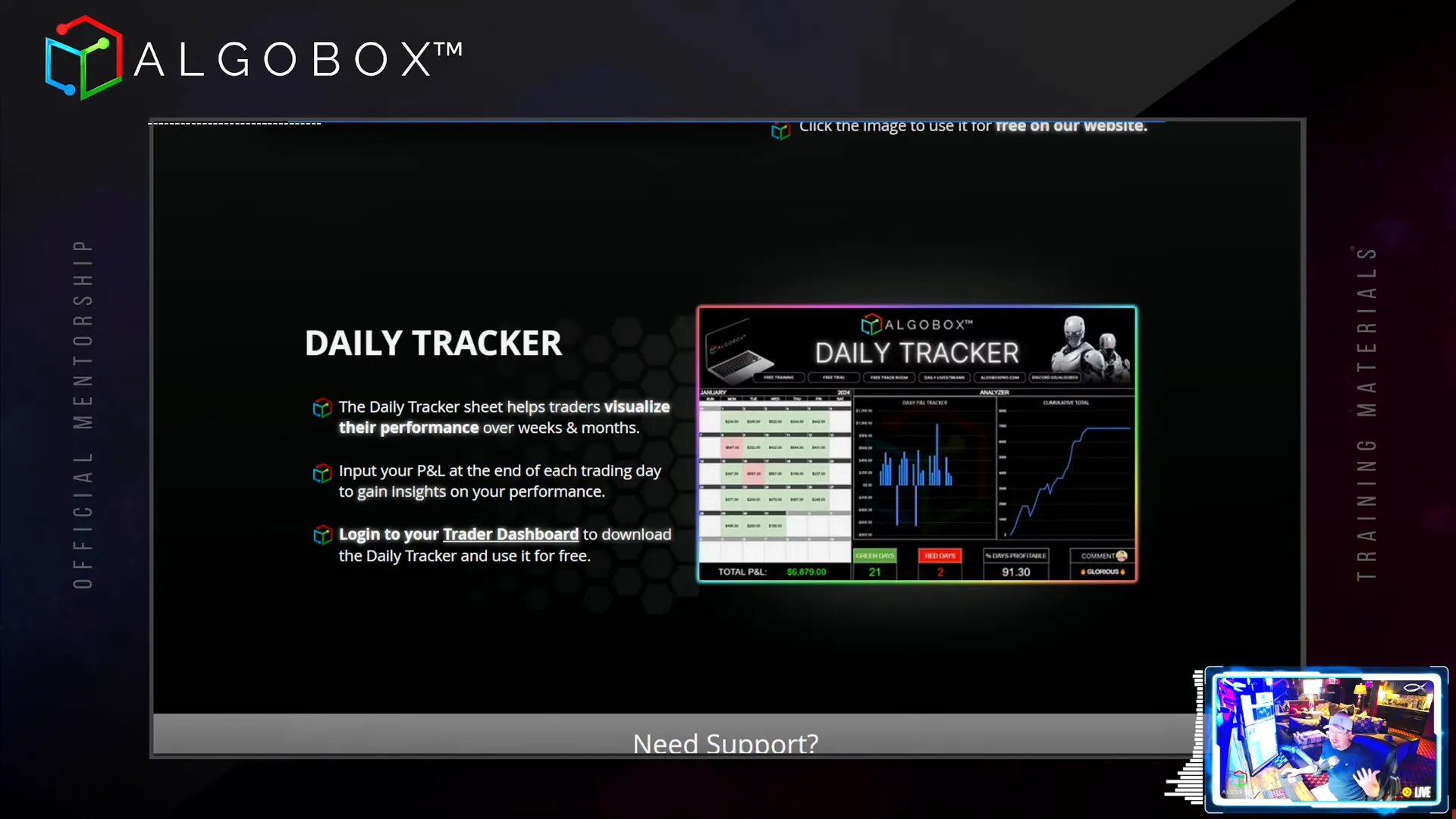

AlgoBox encourages disciplined trading with tools like the Trade Tracker, which helps manage risk and control trading time to avoid overtrading. The tracker is available in both electronic and printable formats, allowing traders to monitor daily performance effectively.

Tracking progress promotes accountability and continuous improvement—key traits of successful traders.

Step 6: Introducing AlgoBox GPT – Your 24/7 Trading Assistant

AlgoBox GPT is a groundbreaking AI-powered assistant trained on all AlgoBox documentation and training materials. It’s like having Vinny’s brain available anytime to answer your questions in detail.

Whether you want to revisit complex strategies like the Double Dot strategy or clarify setup nuances, AlgoBox GPT provides bullet-point explanations and step-by-step guidance.

This AI assistant integrates with the AlgoBox Discord, offering a seamless way to get help without needing to open support tickets or calls.

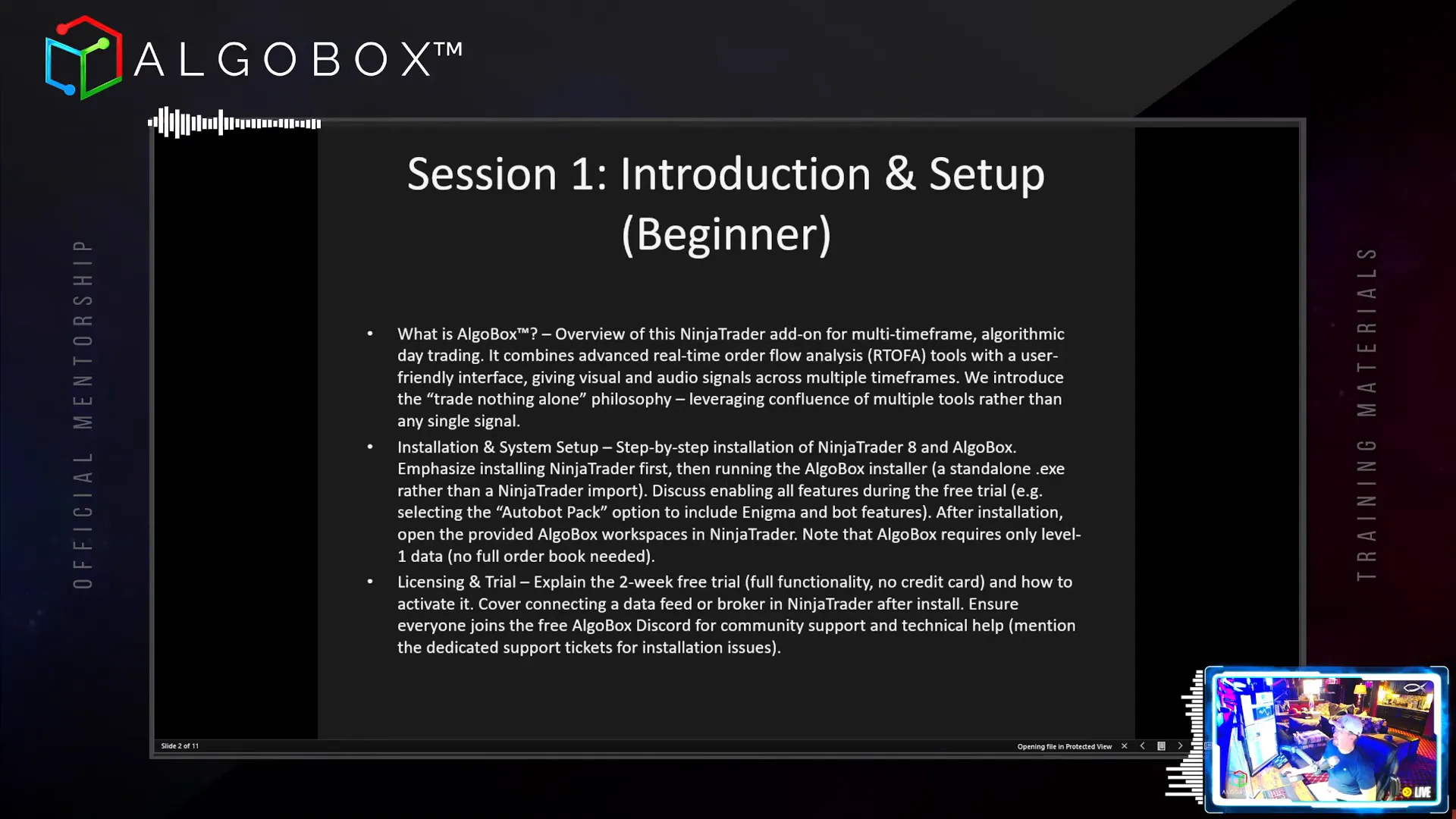

Step 7: Installation and Setup – Getting AlgoBox Running

Before you start, make sure you have NinjaTrader 8 installed, as AlgoBox is an add-on to this platform. NinjaTrader is free to use, and you only need the top of book (Level 1) data feed for AlgoBox to function effectively.

Here’s a quick overview of the installation process:

- Download NinjaTrader from the official website and create an account.

- Install NinjaTrader following on-screen instructions, including allowing it through your firewall.

- Download the AlgoBox installer zip file from the AlgoBox website.

- Unzip the file and run the executable installer.

- Uninstall any previous versions of AlgoBox before installing the new one.

- During installation, select the option to unlock all features, especially if you’re on the two-week free trial.

- After installation, launch NinjaTrader and authorize the AlgoBox add-on when prompted.

- Connect your market data feeds to NinjaTrader.

- Open the default AlgoBox workspace to start using the platform.

It’s important to note that you do not need NinjaTrader’s Order Flow Plus or lifetime license for AlgoBox; the free version suffices.

Step 8: Navigating the AlgoBox Interface and Multi-Timeframe Setup

Upon launching AlgoBox, you’ll find five charts arranged in a layout designed to provide a comprehensive market view across multiple time frames:

- Tide Chart: Represents the highest timeframe, akin to the ocean’s tide.

- Wave Chart: A mid-level timeframe, like the waves on a beach.

- Primary Filter Chart: The central chart that filters signals before execution.

- Big Ripple Chart: Larger timeframe entry chart.

- Small Ripple Chart: Smaller timeframe entry chart.

This setup follows the famous Alexander Elder’s advice on using multiple timeframes to filter trades and confirm bias.

The system assigns bias colors (green for long, red for short, orange for neutral) to help traders quickly interpret market direction. Entries are made only when multiple bias filters align, such as the NERD and the directional filter matching in color.

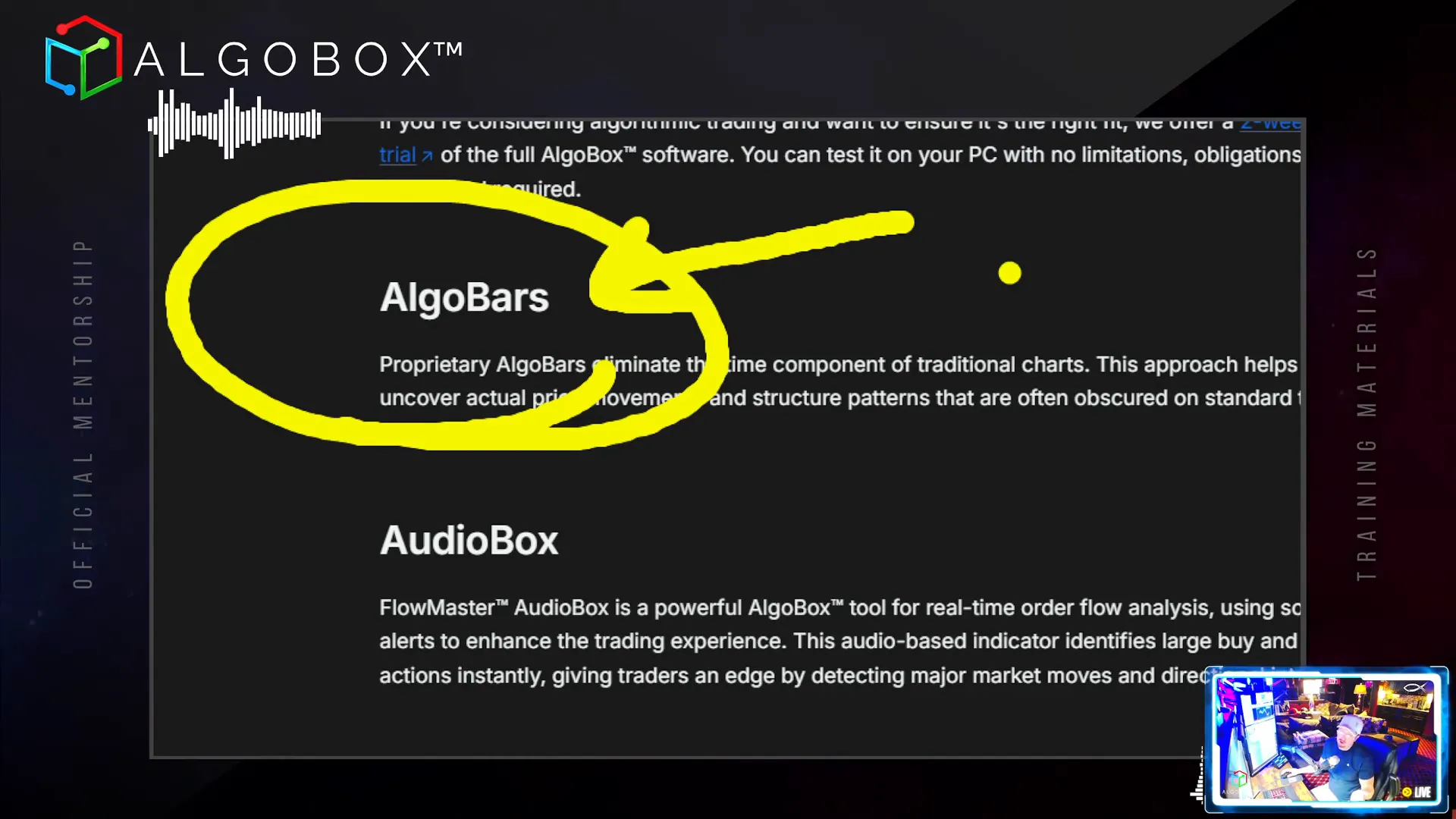

Step 9: Understanding AlgoBars and Range Bars

AlgoBox does not use traditional time-based bars. Instead, it employs two innovative bar types:

- AlgoBars: These bars reveal patterns within minute and second bars, capturing fractal market behavior. There are two types within AlgoBars – normal bars and shift/engulfing bars with tails.

- Range Bars: These bars maintain a fixed tick range from top to bottom, such as a 10-tick range bar, making price movement measurement precise and consistent.

Understanding tick values is crucial for futures trading. For example, the Nasdaq, ES, RTY, and Dow futures have a tick value of $5 per tick. Gold and crude oil have a $10 tick value, while the ES is $12.50. Knowing these values helps calculate profit and loss per trade accurately.

Step 10: AlgoBox Strategies – The Two Pillars of Trading

All AlgoBox trades are based on the combination of two pillars:

- Structure: Chart patterns such as channels, wedges, and harmonics.

- Order Flow Events (RTOFA): Directionally biased order flow signals indicating the activity of big players and retail traps.

Vinny emphasizes the importance of combining multiple signals rather than trading on a single indicator. The system’s cheat sheets list various entry setups, including readyDD, titanic zone, and super bands, each combining structure and order flow for high-probability trades.

AlgoBox is home to the Enigma, a proprietary combination of RTOFA and structural elements, including unique Z-axis depth analysis, which identifies key market setups.

Step 11: Trade Management with ATM Strategies

AlgoBox integrates with NinjaTrader’s Automatic Trade Management (ATM) strategies, which automate trade exits by setting stops, targets, trailing stops, and one-cancels-other (OCO) orders.

Traders can preprogram big and small ATM strategies to match the chart’s timeframe and risk level, allowing for efficient and disciplined trade management.

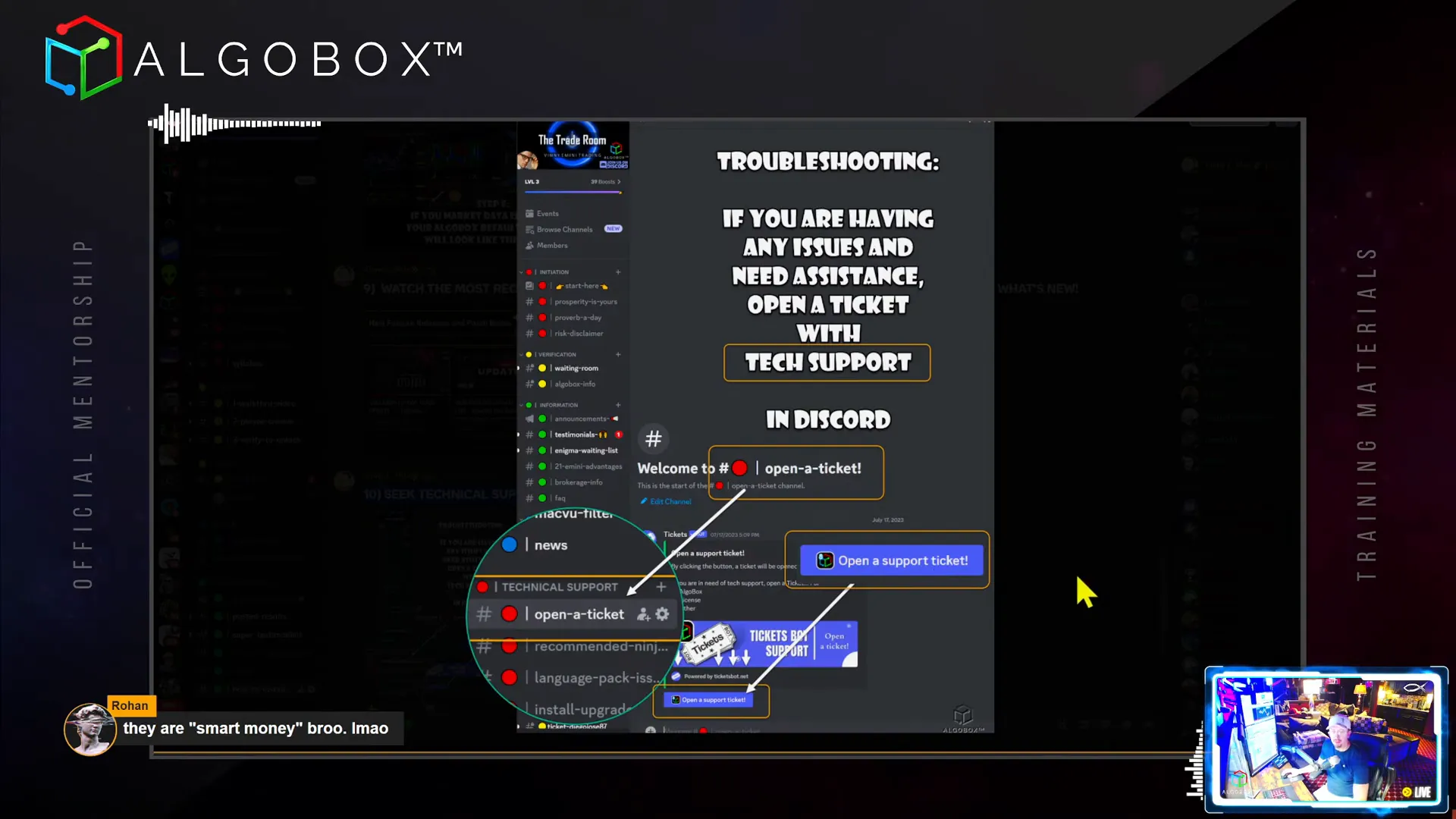

Step 12: Technical Support and Community Engagement

AlgoBox offers excellent technical support through Discord, where users can open private support tickets, share screenshots, and even allow remote assistance via TeamViewer under strict security protocols.

Before opening a ticket, users are encouraged to ask questions publicly or consult AlgoBox GPT, the AI assistant embedded in the Discord community.

Community members and moderators actively help answer questions, fostering a collaborative learning environment.

Step 13: Data Connectivity and Broker Compatibility

AlgoBox requires a data feed connected to NinjaTrader, typically linked to your broker or trader funding program. The main data source is the Chicago Mercantile Exchange (CME), providing essential market data in three columns: time, quantity, and price.

Only Level 1 (top of book) data is necessary, making the setup cost-effective. AlgoBox is compatible with most brokers and trader funding programs, including Apex, which supports up to 20 accounts with fast trade execution.

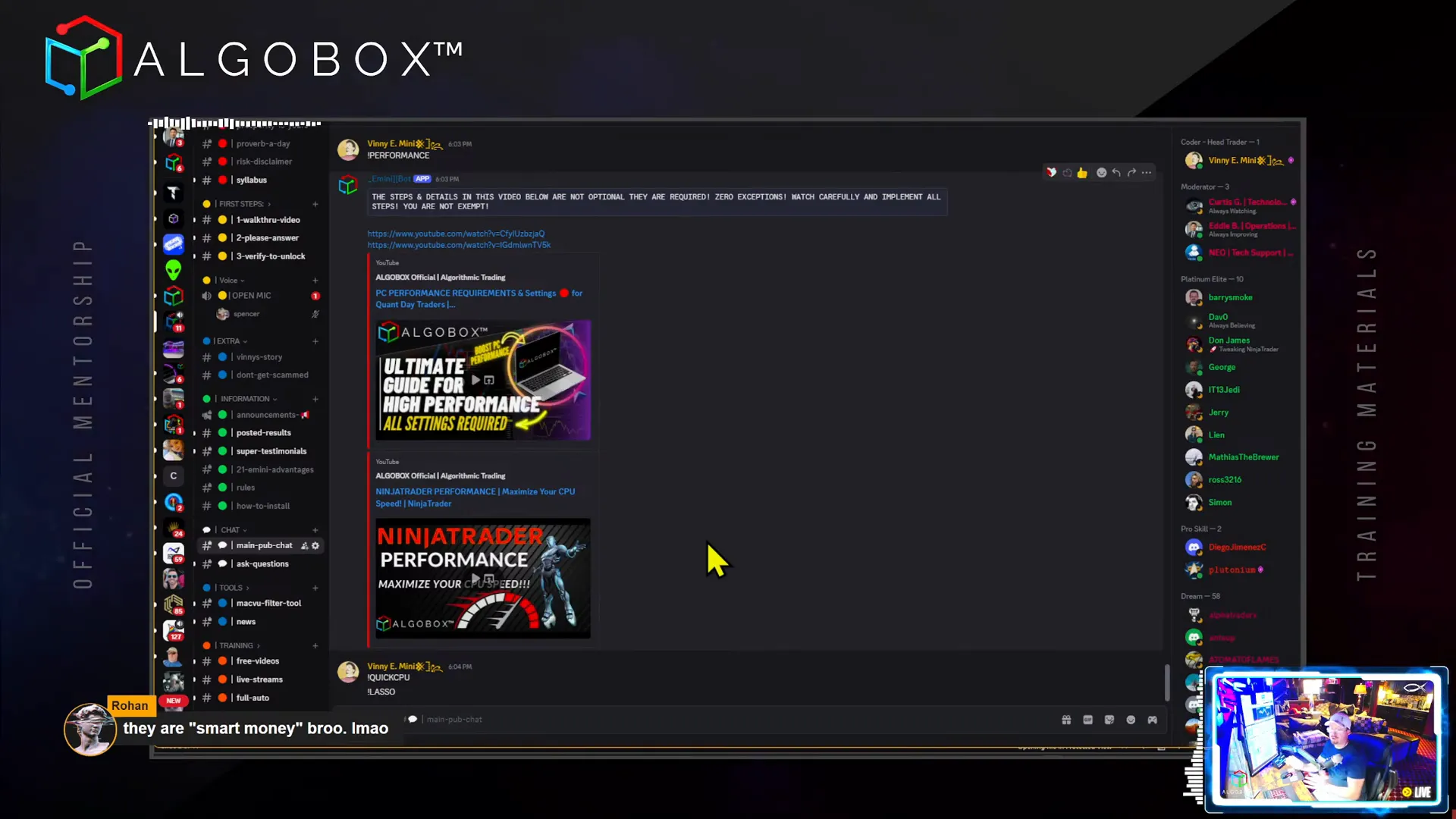

Step 14: Optimizing PC Performance and Workspaces

For smooth operation, AlgoBox recommends running on a Windows PC with at least an Intel i5 processor. Users should follow performance tuning guides shared within the community to optimize their systems.

Multiple workspaces are available, such as the 20-chart layout for deep analysis or the 12-chart flag layout for streamlined trading. Avoid running multiple workspaces simultaneously if your PC struggles with performance.

Saving personalized workspaces under unique names is advised to prevent overwriting during updates.

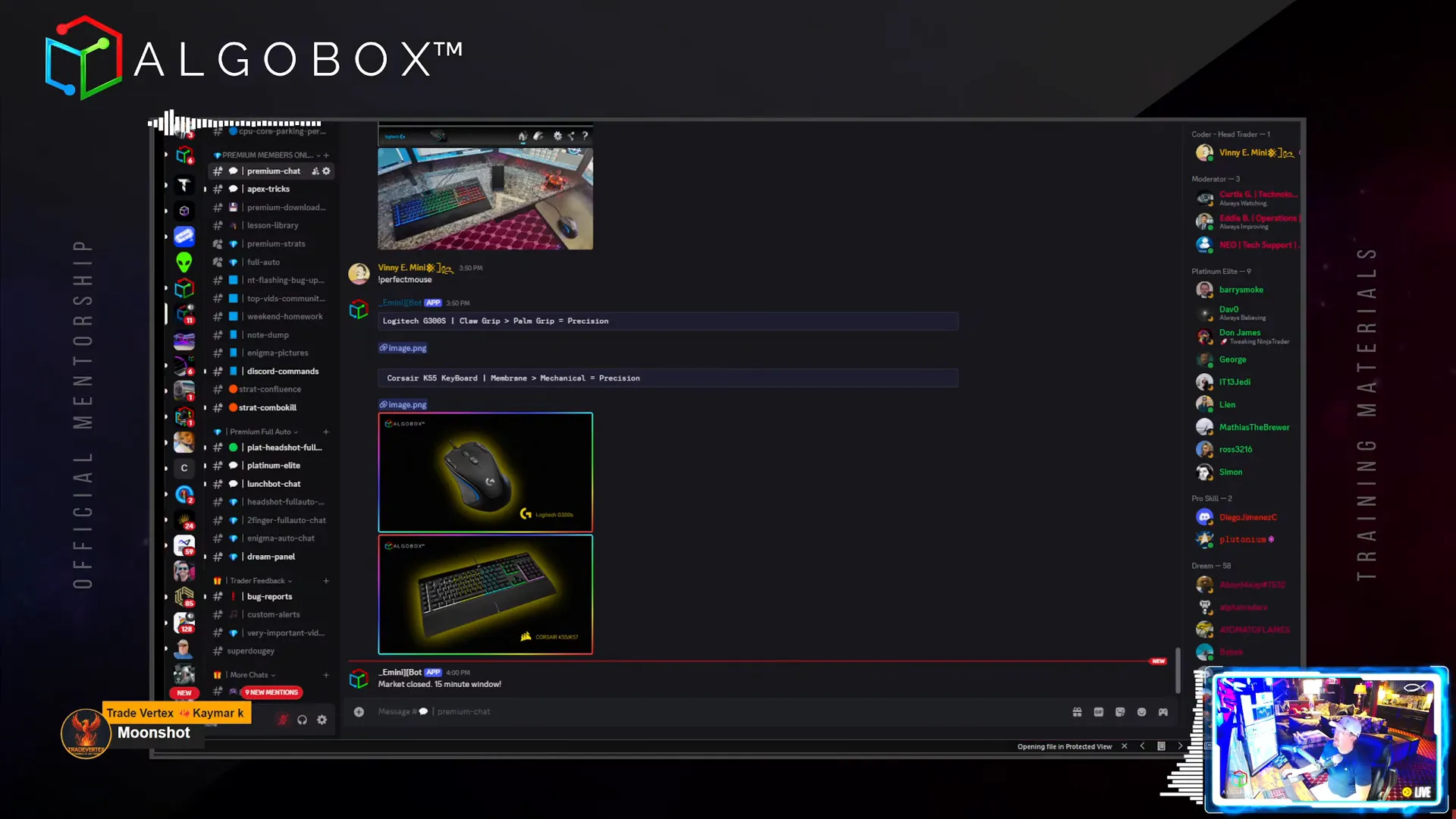

Step 15: Hardware Recommendations for Efficient Trading

Vinny recommends specific hardware for efficient trading, including the Logitech G300S mouse, praised for its ambidextrous design and programmable buttons, and the Corsair K55 keyboard, a wired membrane keyboard preferred for its reliability and quiet operation.

These peripherals allow traders to assign hotkeys and manage trades swiftly, which is essential when trading multiple contracts or rapid decision-making.

Step 16: Essential Financial Tools and News Feeds

Staying informed is critical. Traders should use tools like Financial Juice for real-time news and audio feeds, and follow Trump Socials (Truth Social) for market-moving social media updates.

Additionally, screenshot utilities like Snagit or the free alternative ShareX are invaluable for capturing trade setups and reviewing market activity.

Step 17: Educational Resources and AlgoBox YouTube Channels

Vinny Emini hosts two YouTube channels to support AlgoBox traders:

- Vinny Emini Channel: Focuses on live streams, mentorship, and in-depth training sessions.

- AlgoBox Official Channel: Provides quick tutorials and strategy breakdowns.

Subscribing and enabling notifications on both channels ensures you never miss critical updates, live trading sessions, or giveaways such as the “Champ Lamp of Power.”

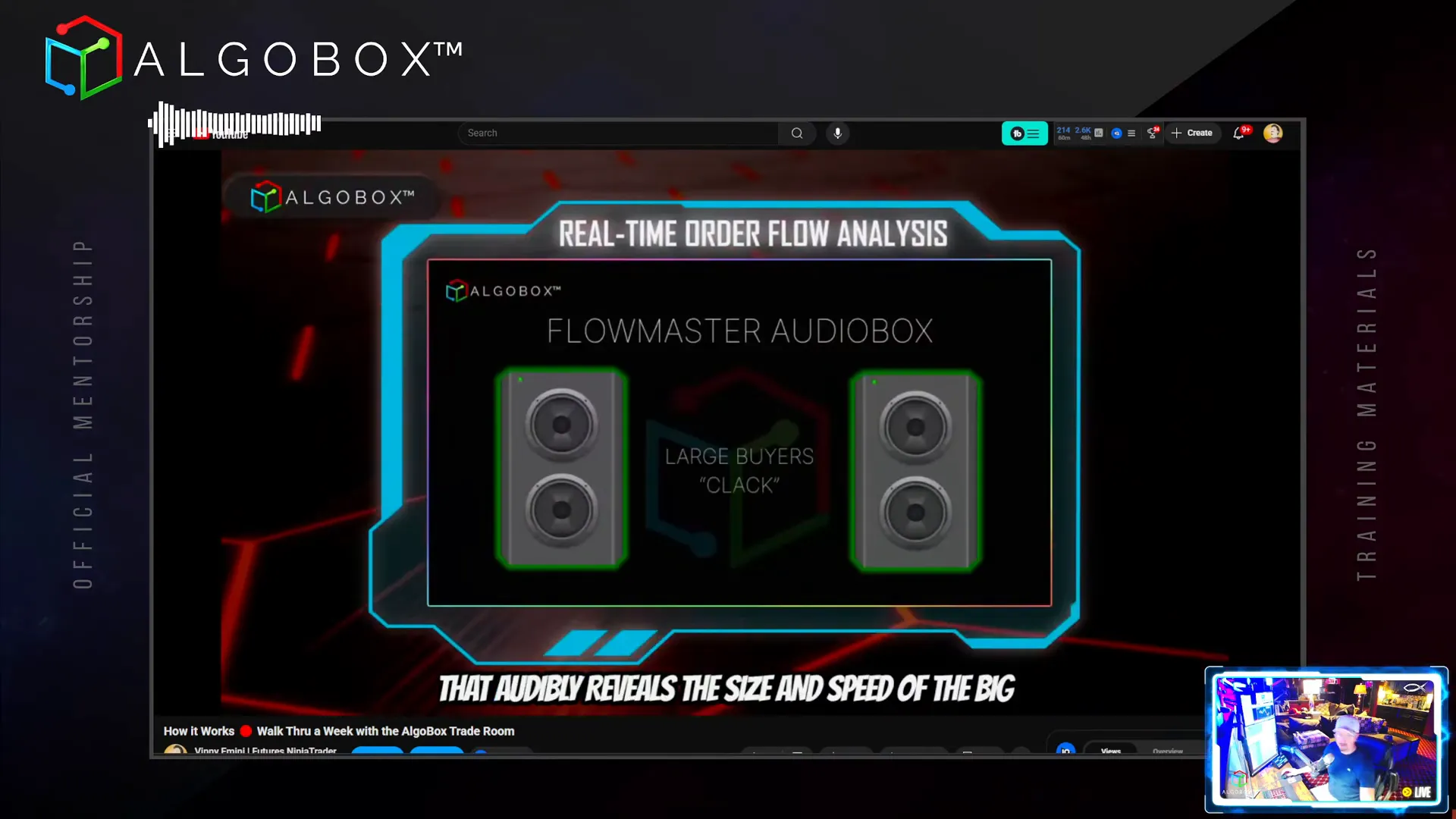

Step 18: The Flowmaster™ AudioBox – Hearing the Market

The Flowmaster™ AudioBox is a standout feature that translates order flow data into distinct audio cues:

- A higher-pitched “clack” signals big buyers entering the market.

- A lower-pitched “boom” indicates institutional-sized sellers.

This auditory feedback allows traders to “hear” the tape, similar to pit trading, enhancing situational awareness and reaction time.

Step 19: Comprehensive Course Syllabus and Testing Your Knowledge

The AlgoBox curriculum is structured with a detailed syllabus covering entry and exit strategies, tools, and settings. It includes tests and quizzes via the AlgoBox Academy to help traders assess their knowledge and progress.

By the end of the training, you’ll be familiar with core strategies like the Headshot, Double Dot, Moonshot, and more, empowering you to trade with confidence and precision.

Step 20: Final Thoughts and Market Edge for Individual Traders

Vinny concludes by highlighting a significant shift in market dynamics: the individual trader now holds a technological edge over institutions. Thanks to decentralized processing power, advanced front-end tools, and fast internet connections, small traders can see and react to market movements faster than ever.

AlgoBox embodies this edge by combining algorithmic precision, dynamic structures, and real-time order flow, giving traders a “cheat code” to navigate the markets like a pro gamer.

Conclusion

Starting your journey with AlgoBox and NinjaTrader opens a world of algorithmic trading designed to simplify complexity and sharpen your trading edge. By mastering the combination of structural analysis and real-time order flow, using innovative tools like AlgoBars, Flowmaster™ AudioBox, and the Enigma system, you can trade with confidence and precision.

With comprehensive support through live streams, community tools, AI assistance, and technical support, AlgoBox empowers traders to evolve from beginners to skilled algorithmic traders swiftly.

Remember, the key is to practice consistently, use the available resources, and embrace the philosophy of trading nothing alone. This approach maximizes your chances of success in the fast-paced futures markets.

Get started today by downloading the free two-week trial, connecting your NinjaTrader platform, and exploring the powerful AlgoBox features. Your path to smarter, algorithmic futures trading begins here.